Tag: Donald J. Trump

-

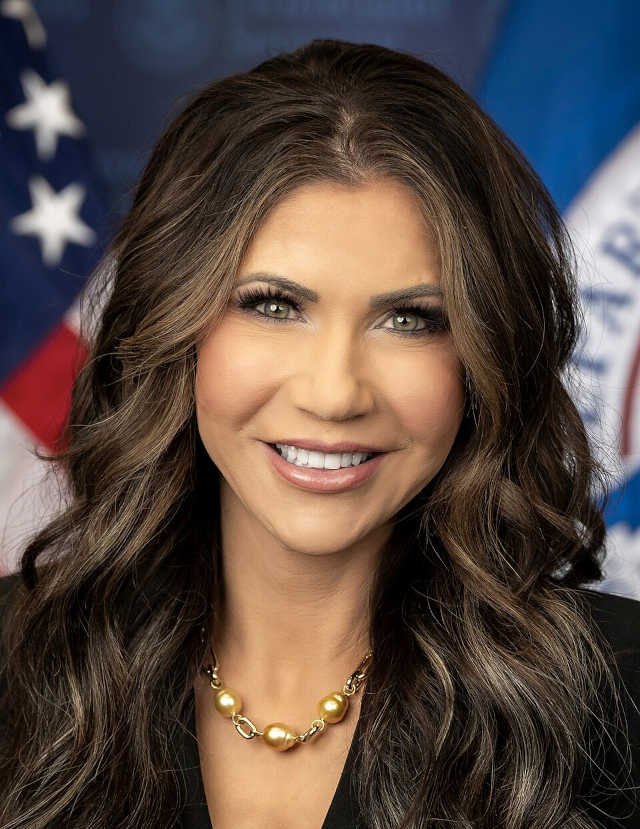

Kristi Noem Fired: DHS Fact-Check & Multi-Source Analysis

President Trump fired DHS Secretary Kristi Noem on March 5, 2026 — but accounts of why differ sharply depending on the source. We analyzed eight outlets across the political spectrum to separate confirmed facts from contested claims, identify what all sides agree on, and surface what nearly every publication left out.

-

Trump’s 2026 State of the Union: Full Transcript Breakdown and Fact-Check — Economy, Iran Strike, Hostages, and Medals of Honor

President Trump delivered his first State of the Union of his second term on Feb. 24, 2026, claiming sweeping first-year wins on the economy, border, and foreign policy — while two Medals of Honor and a Legion of Merit were awarded live on the House floor.

-

Trump Signs National Angel Family Day Proclamation, Touts 21,000 Arrests Under Laken Riley Act

President Trump hosted Angel Families at the White House on Feb. 23, 2026, signing a proclamation establishing National Angel Family Day. Family members of Americans killed by undocumented immigrants testified, and Trump highlighted results of the Laken Riley Act.

-

Psychological Analysis of Authoritarian Communication: Trump’s Supreme Court Tariff Response (February 2026)

A structured psychological analysis of Trump’s response to the Supreme Court’s tariff ruling reveals consistent patterns of grandiose self-presentation, binary moral framing, defeat-reframing, and institutional delegitimization — mapped against known authoritarian leadership influence profiles.

-

Trump Defiant After Supreme Court Strikes Down IEEPA Tariffs: “We Have Alternatives”

President Trump responded defiantly to the Supreme Court’s 6-3 ruling striking down his IEEPA tariffs, calling it “deeply disappointing” while announcing an immediate 10% global tariff under Section 122. He left unanswered whether $175 billion in collected revenue would be refunded.

-

Trump at Coosa Steel in Rome, Georgia (Feb. 19, 2026): Full Breakdown and Fact-Check

President Trump visited Coosa Steel in Rome, Georgia on February 19, 2026, celebrating the plant’s revival as proof that his tariff policies are working. We break down every claim he made — and fact-check the biggest ones against the data.

-

Trump Speaks to Reporters on Air Force One — February 16, 2026

President Donald Trump held an impromptu press gaggle aboard Air Force One on President’s Day, February 16, 2026, covering a sweeping range of topics including upcoming Iran nuclear talks in Geneva, a potential government shutdown, Cuba diplomacy, the Ukraine peace process, his new “Board of Peace,” Taiwan arms sales, the Epstein files, and sharp criticism…

-

Trump Fort Bragg Speech: Fact-Checking Military Claims, Iran Strikes, and Maduro Capture (Feb 2026)

President Trump addressed military families at Fort Bragg on February 13, 2026, making major claims about military recruitment records, Iran nuclear strikes, Venezuela operations, and NATO spending. We fact-check the $1,776 military payments, Operation Midnight Hammer details, Maduro capture timeline, and economic assertions using government sources and independent reporting.

-

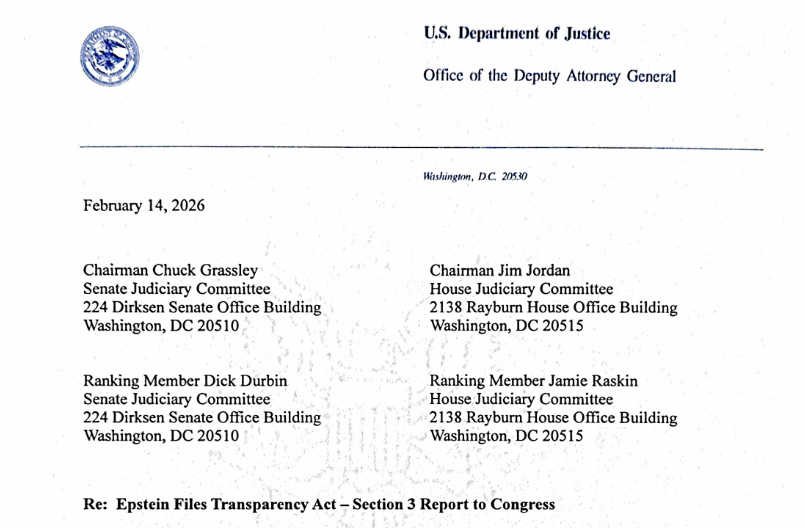

Epstein Files Transparency Act — Section 3 Report to Congress

The U.S. Department of Justice informed Congress that it released extensive records related to Jeffrey Epstein and Ghislaine Maxwell under the Epstein Files Transparency Act, withheld only privileged materials, redacted victim-sensitive content, and provided a comprehensive list of government officials and politically exposed persons named in the files.

-

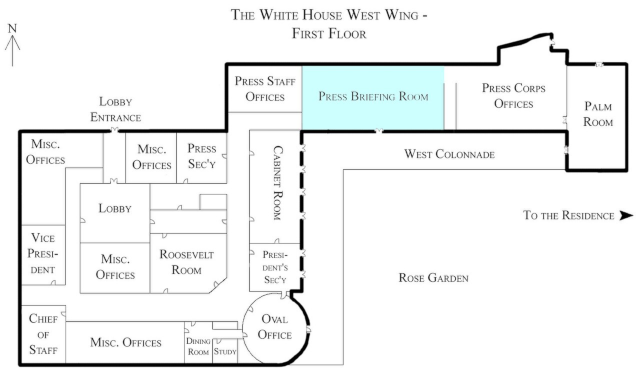

White House Briefing: Trump Accounts Launch, $1.3T Deregulation, Immigration Stats Defended – February 10, 2026

Press Secretary Karoline Leavitt outlined Trump’s week ahead including Netanyahu meeting and historic EPA deregulation projected to save $1.3 trillion. She defended immigration statistics, announced Trump Accounts offering $1,000 government seed money for children.

-

Trump Signs Government Funding Bill: Crime Claims, Drug Pricing, and Immigration Enforcement Fact-Checked

President Trump signed the Consolidated Appropriations Act on February 3, 2026, reopening the government with claimed spending cuts and prescription drug reforms. The ceremony featured dramatic claims about crime reductions and border security, though many statistics are unverifiable or contradict available data.