Tag: Economics

-

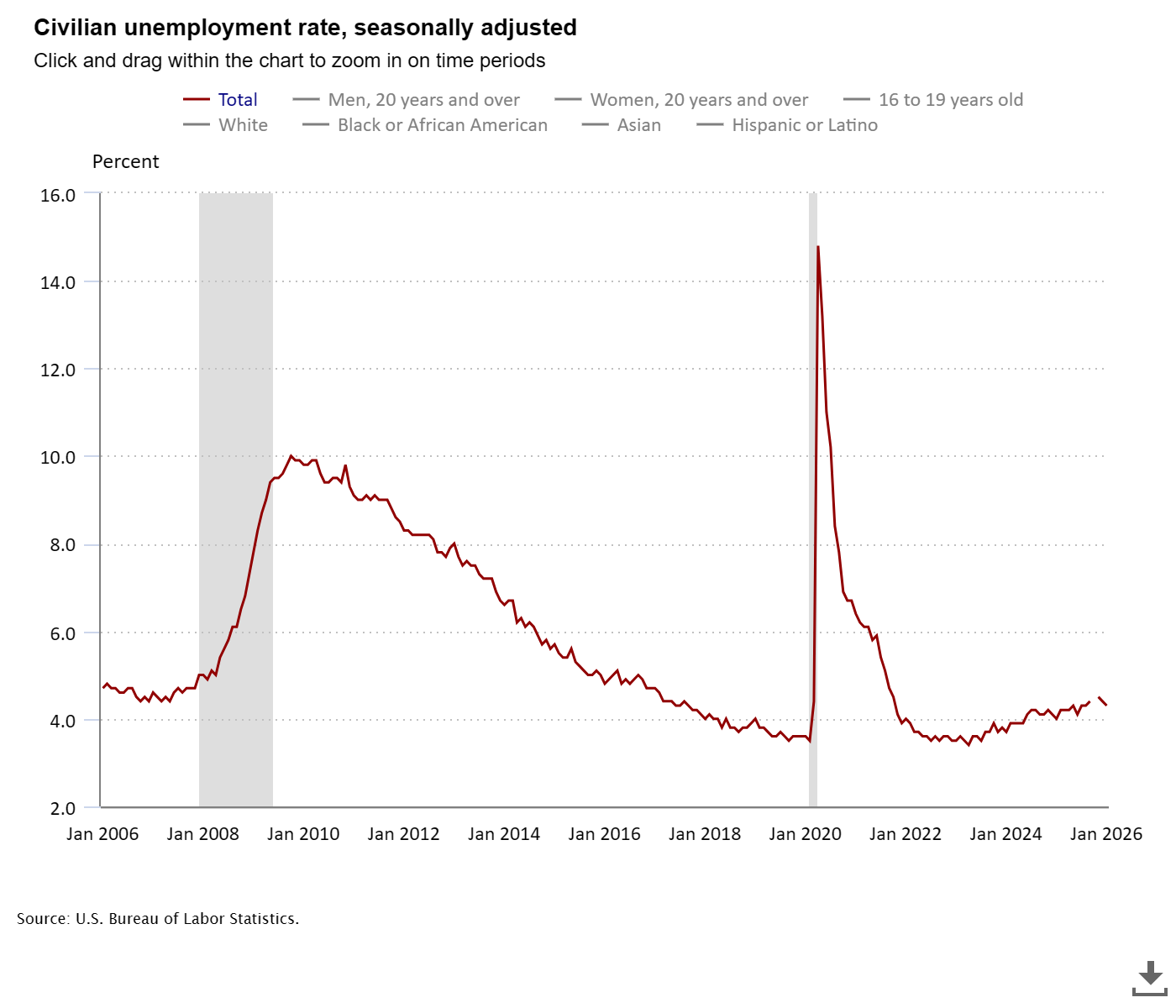

January 2026 Jobs Report: 130K Jobs Added, But Massive Revisions Reveal 2025 Was Far Weaker Than Reported

The U.S. added 130,000 jobs in January 2026 while the unemployment rate held steady at 4.3%. Health care, social assistance, and construction led gains, while federal government and financial activities cut jobs. Benchmark revisions sharply reduced 2025 job growth totals.

-

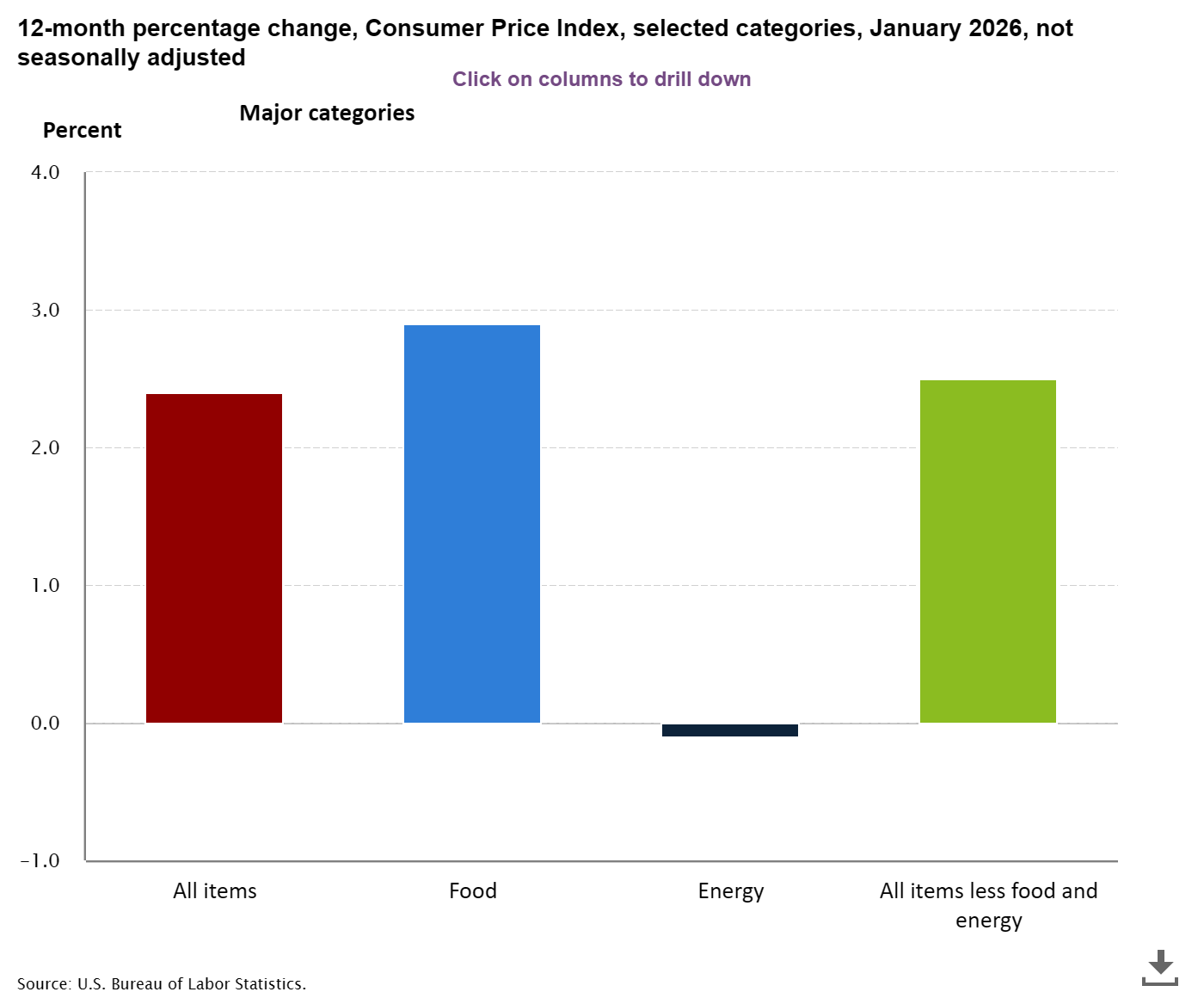

January 2026 Inflation Report: CPI Drops to 2.4% as Price Pressures Ease

The Consumer Price Index for January 2026 shows inflation continuing its gradual decline to 2.4% annually, down from 2.7% in December. While energy prices provided relief with gasoline down 3.2% for the month, housing costs and services inflation remain persistent challenges for American households.

-

There Are No Good Reasons to Subsidize Stadiums. Governments Keep Doing It.

Despite decades of economic evidence showing that publicly funded sports stadiums fail to deliver promised benefits, governments continue to spend billions subsidizing wealthy team owners, often at the expense of taxpayers and public trust.

-

Donald J. Trump: “My Tariffs Have Brought America Back”

President Donald Trump argues that his sweeping tariffs have produced extraordinary economic growth, low inflation, booming investment, and enhanced national security, proving critics wrong.

-

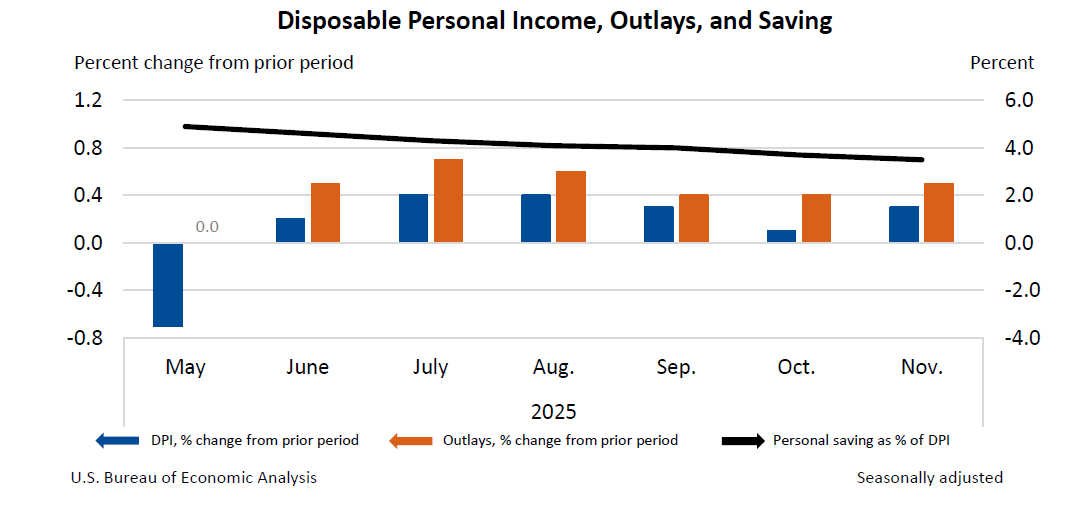

U.S. Income Rises, Spending Outpaces Saving in Late 2025, BEA Reports

New BEA data show U.S. personal income rose in October and November 2025, but consumer spending increased more rapidly. Inflation stayed moderate while the personal saving rate fell, signaling continued consumer-driven growth with rising financial pressure on households.

-

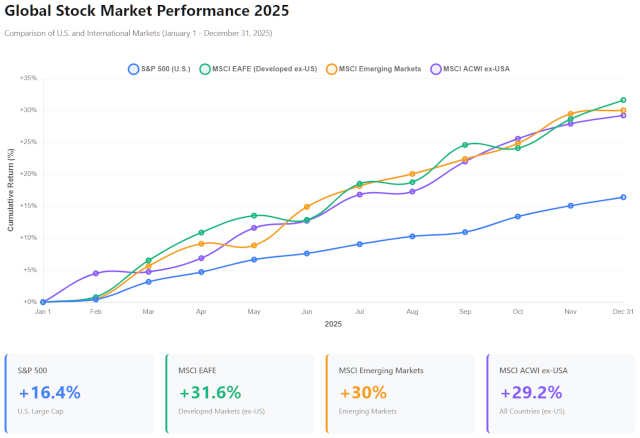

Market Performance in 2025: U.S and World

U.S. stock markets had outperformed the world, until 2025.

-

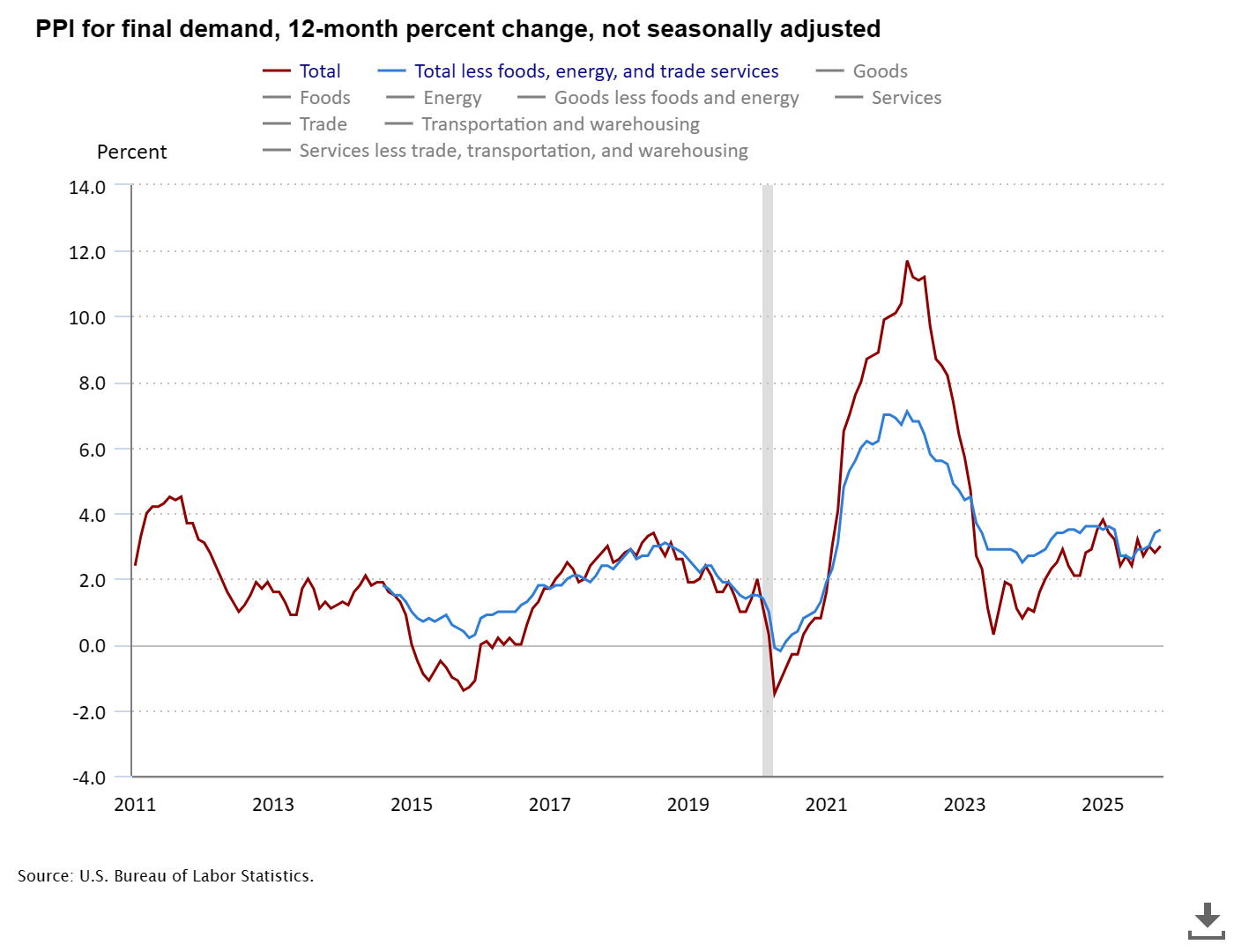

Producer Price Indexes — November 2025

The Producer Price Index for final demand increased 0.2 percent in November 2025, driven primarily by a 0.9 percent rise in final demand goods (especially a 10.5 percent jump in gasoline prices), while final demand services remained unchanged.

-

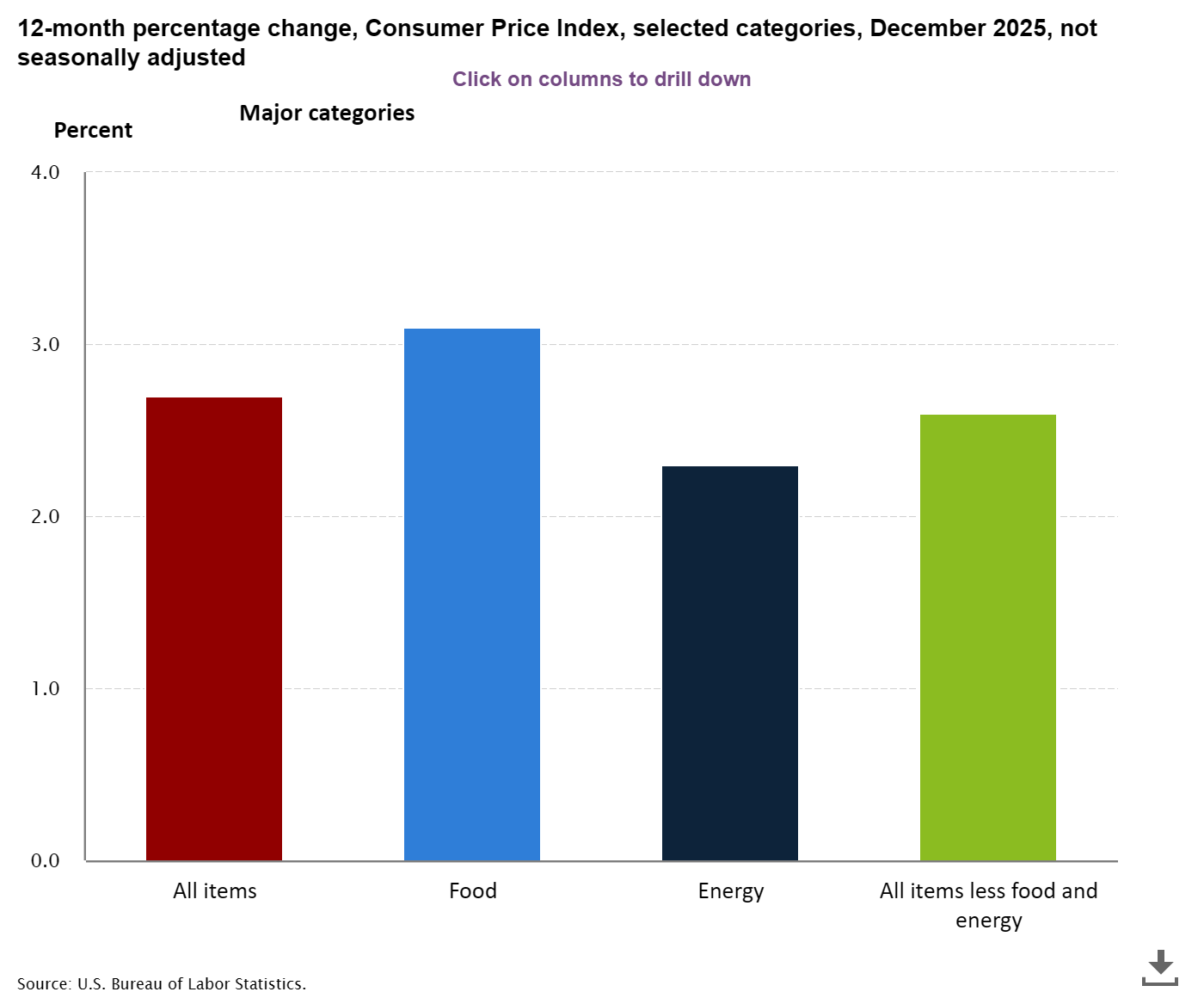

December 2025 CPI Report Explained: Inflation Holds at 2.7% as Housing and Food Costs Rise

The December 2025 Consumer Price Index reveals inflation holding steady at 2.7% year-over-year, with monthly prices rising 0.3%. Housing remains the primary driver at 3.2% annual growth, while food prices climbed 3.1%. Core inflation stayed at 2.6%, suggesting underlying price pressures remain elevated above the Federal Reserve’s target.

-

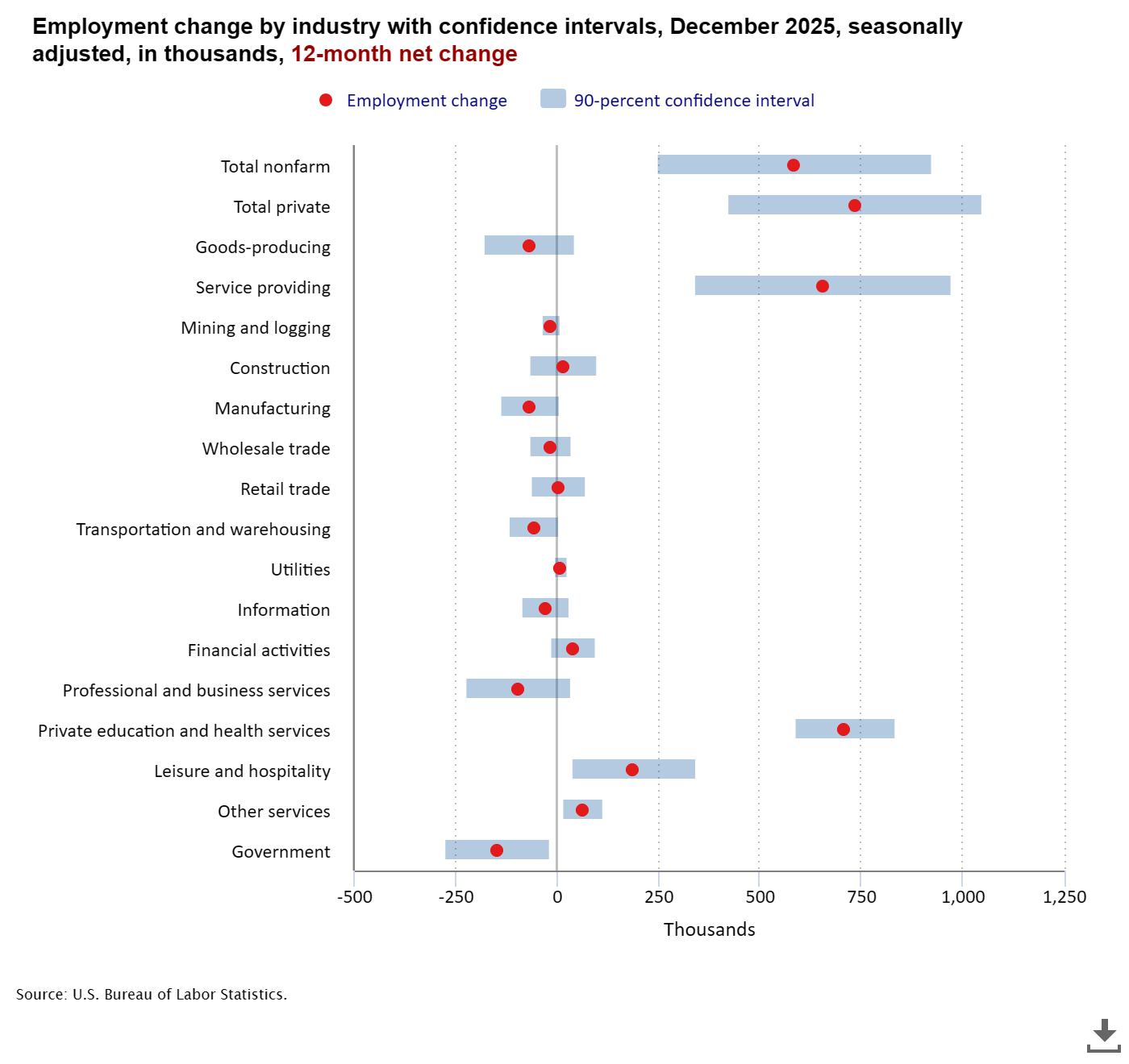

Fact-Check: December 2025 Jobs Report – What the Data Really Shows vs. Administration Claims

The December 2025 jobs report shows 50,000 jobs added and 4.4% unemployment, but administration claims of “blockbuster growth” contradict economist consensus. Our analysis examines five major news sources to separate fact from spin on employment data.

-

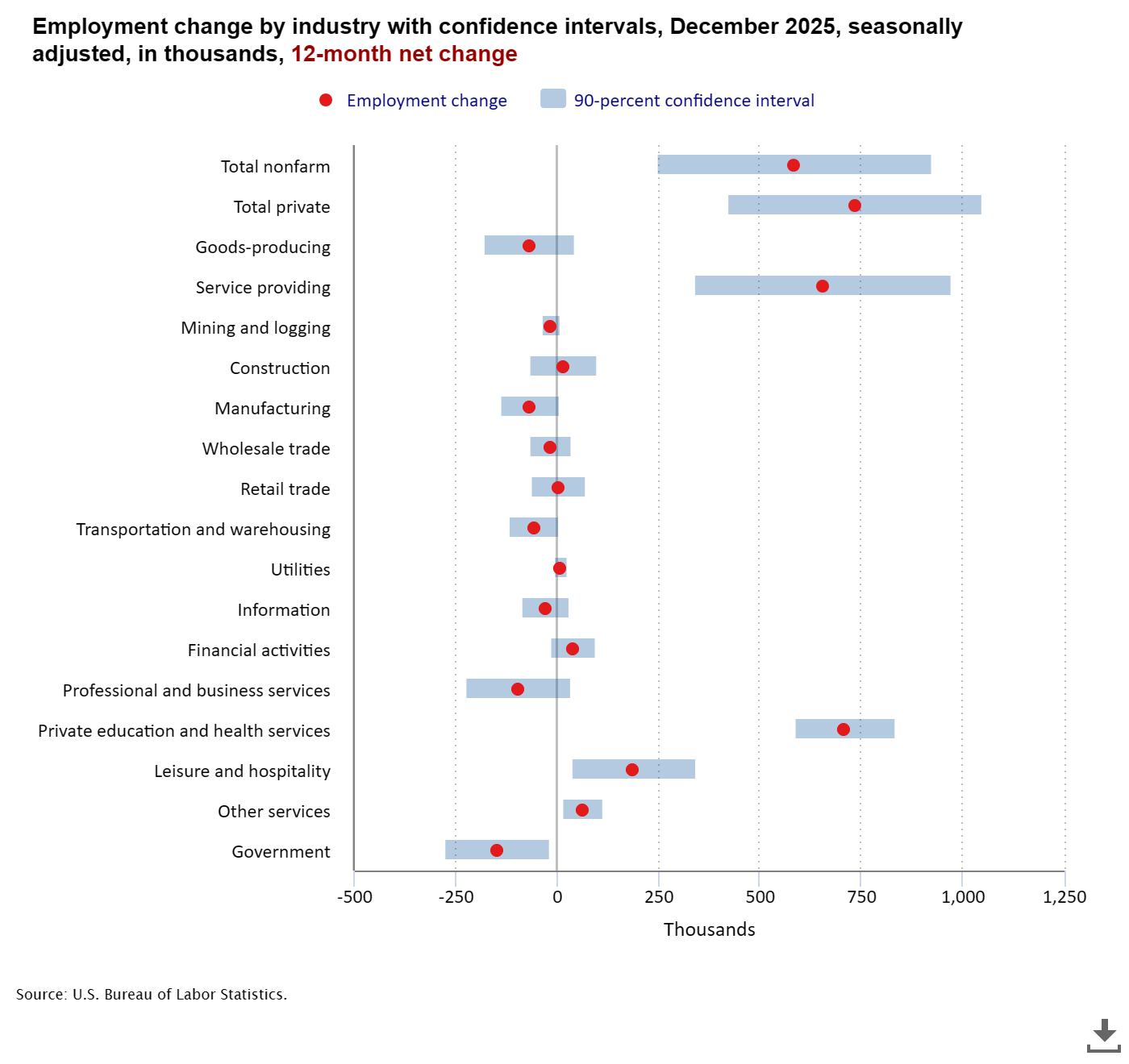

December 2025 Jobs Report: Only 50K Jobs Added as Labor Market Cools Dramatically from 2024

The December 2025 employment report reveals a significantly weakened labor market with only 50,000 jobs added and unemployment steady at 4.4 percent. The year saw just 584,000 total jobs created compared to 2 million in 2024, marking the slowest growth since the pandemic recovery.

-

State Job Openings and Labor Turnover — October 2025

The October 2025 state-level labor market data shows modest changes in job openings, hires, and separations across most states, with Alaska, Wyoming, and Montana seeing the most significant increases in job openings rates, while national rates remained largely unchanged despite complications from a federal government shutdown.

-

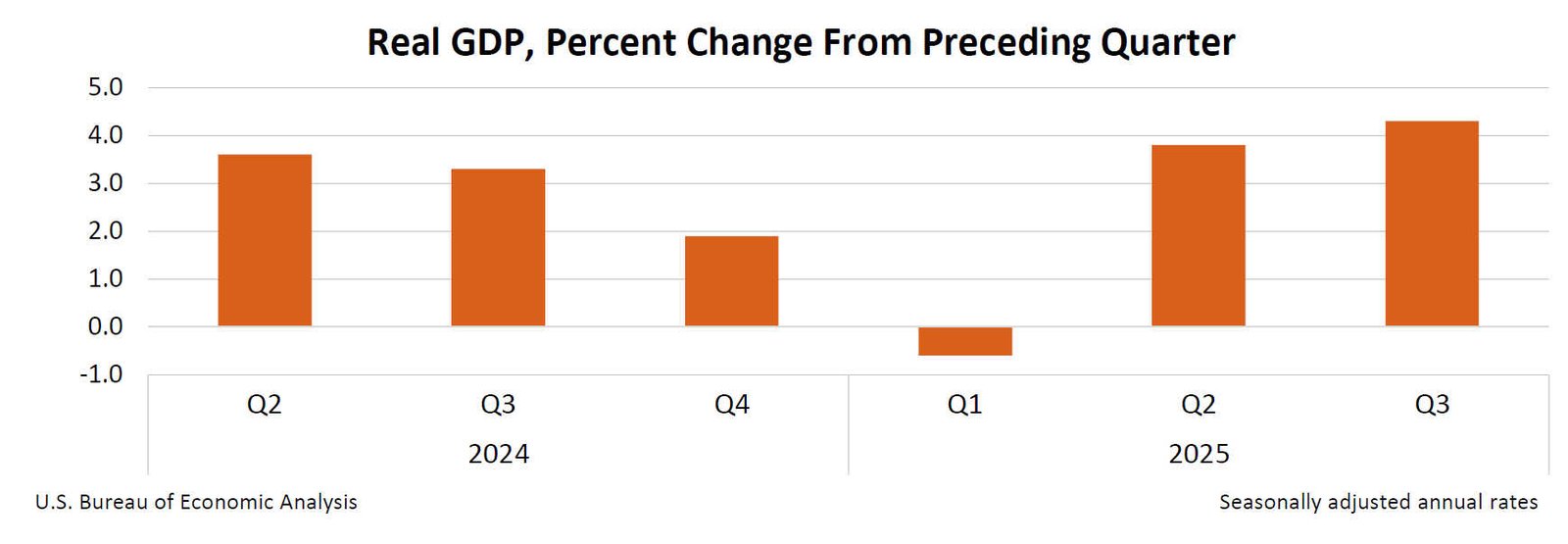

Gross Domestic Product, 3rd Quarter 2025 (Initial Estimate) and Corporate Profits (Preliminary)

The U.S. economy grew at an annual rate of 4.3 percent in the third quarter of 2025, driven by increases in consumer spending, exports, and government spending, while corporate profits rose 166.1 billion dollars compared to the second quarter.