Tag: Economics

-

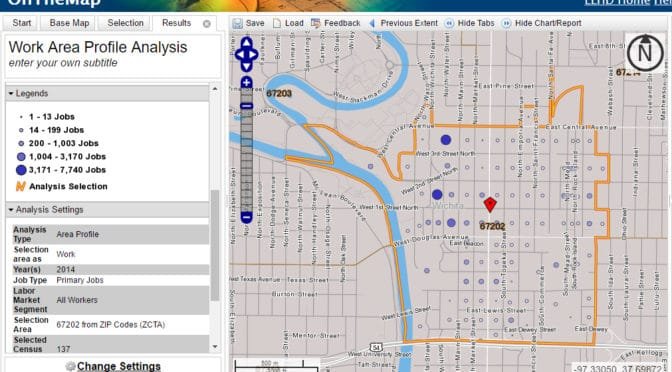

Census data for downtown Wichita workers

Is the presentation of the number of workers in downtown Wichita an innocent mistake, mere incompetence, or a willful lie?

-

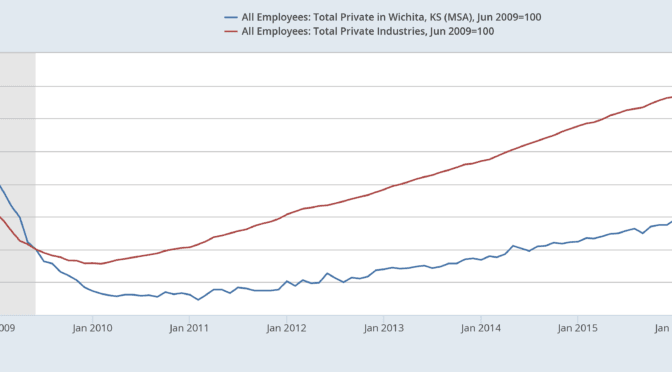

Wichita post-recession job growth

Wichita has recovered from recessions, but after the most recent, the city is falling further behind.

-

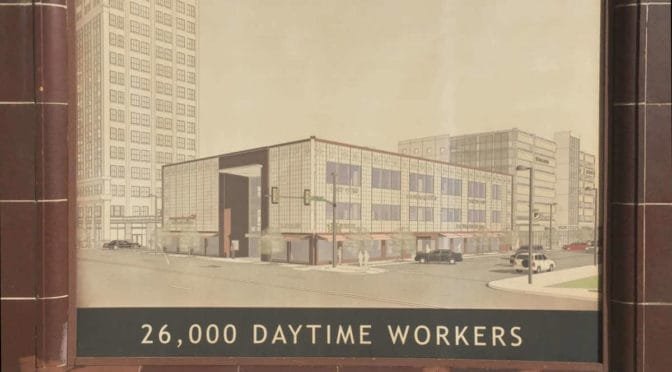

Downtown Wichita jobs, sort of

The claim of 26,000 workers in downtown Wichita is based on misuse of data so blatant it can be described only as malpractice.

-

Rich States, Poor States, 2107 edition

In Rich States, Poor States, Kansas improves its middle-of-the-pack performance, but continues with a mediocre forward-looking forecast.

-

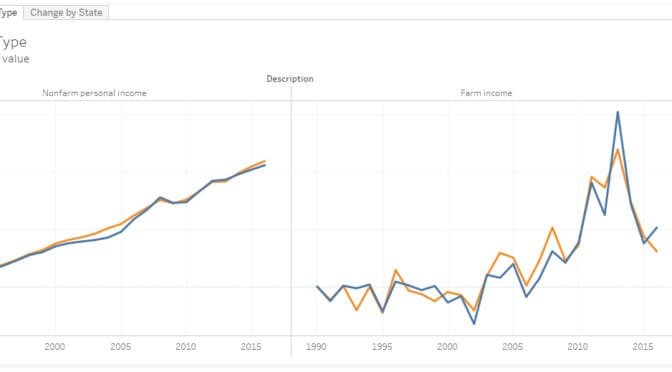

Kansas farm income

Comparing farm and non-farm income in Kansas and the Plains states.

-

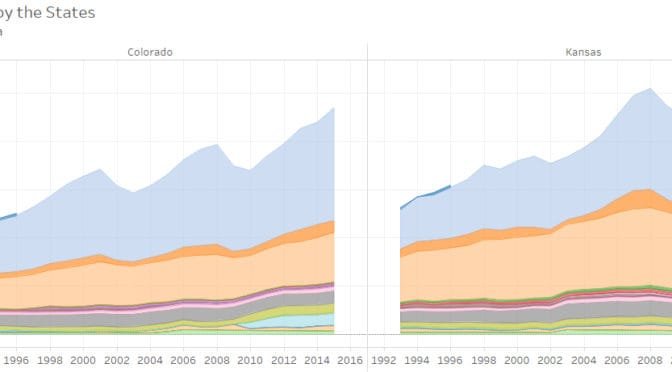

Tax collections by the states

An interactive visualization of tax collections by state governments.

-

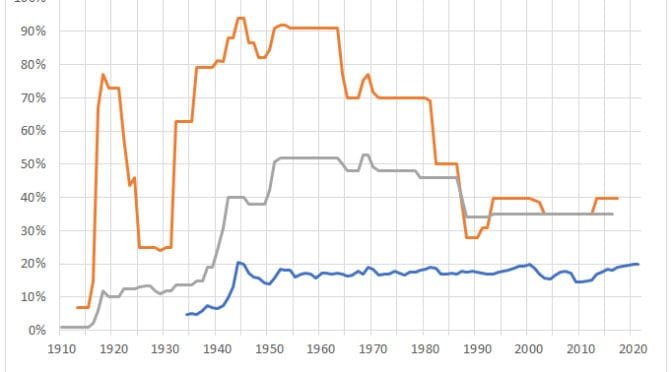

Tax rates and taxes paid

Is there a relationship between marginal tax rates and tax dollars collected?

-

Personal income in the states

An interactive visualization of income growth and change in the states, by major sector.

-

WichitaLiberty.TV: The regulatory and administrative state

Fred L. Smith, Jr. is the founder of the Competitive Enterprise Institute. He explains the problems with excessive regulation and a large administrative state.

-

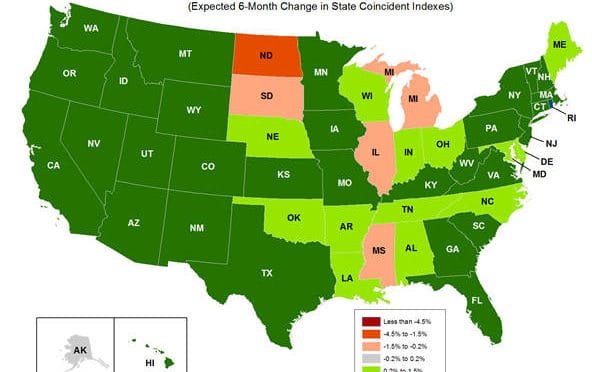

Economic indicators for the states

An index of past economic activity for each state, and another index looking forward.

-

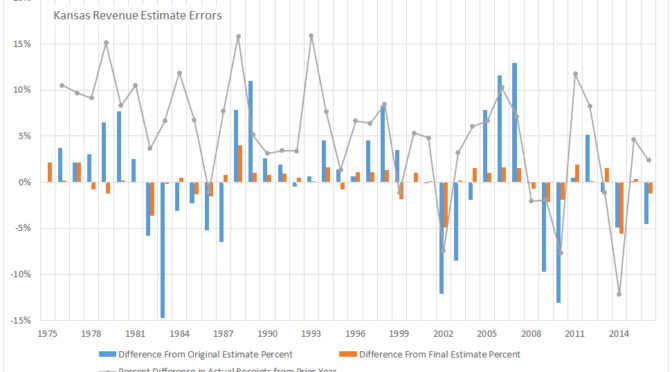

Kansas revenue estimates

Kansas revenue estimates are frequently in the news and have become a political issue. Here’s a look at them over the past decades.

-

Kansas manufacturing and oil not recovering

While total employment in Kansas is growing, two industries are the exception.