Tag: Economics

-

How do school choice programs affect budgets and performance of school districts?

Opponents of school choice programs argue the programs harm school districts, both financially and in their ability to serve their remaining students. Evidence does not support this position.

-

On Kansas tax experiment, we do know what doesn’t work: High taxes

Those who criticize lower Kansas tax rates tax rates as an experiment that may not work should be aware that we know with certainty what hasn’t worked in Kansas.

-

In Kansas, PEAK has a leak

A Kansas economic development incentive program is pitched as being self-funded, but is probably a drain on the state treasure nonetheless.

-

Government intervention may produce unwanted incentives

A Kansas economic development incentive program has the potential to alter hiring practices for reasons not related to applicants’ job qualifications.

-

Tax increment financing (TIF) resources

Resources on tax increment financing (TIF) districts.

-

Clawbacks illustrate difficulty of economic development

Politicians and government officials like clawbacks in economic development incentive agreements. But do these provisions have any negative aspects?

-

Year in Review: 2014

Here is a sampling of stories from Voice for Liberty in 2014.

-

Kansas is not an entrepreneurial state

The performance of Kansas in entrepreneurial activity is not high, compared to other states.

-

Myth: Markets promote greed and selfishness

Markets make it possible for the most altruistic, as well as the most selfish, to advance their purposes in peace, writes Tom G. Palmer.

-

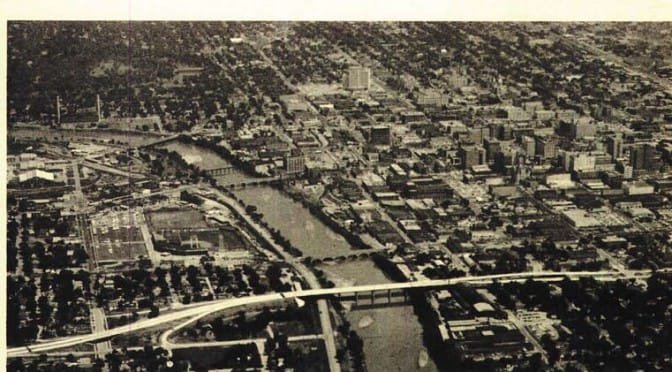

Economic development in Wichita: Looking beyond the immediate

Decisions on economic development initiatives in Wichita are made based on “stage one” thinking, failing to look beyond what is immediate and obvious.

-

Corporate income tax rates in U.S. do not help our economy

Over the past two decades most large industrial countries have reduced their corporate income tax rates. Two countries, however, stand out from this trend: France and The United States.

-

Evaluating economic development incentives

The evaluation of economic development incentives requires thinking at the margin, not the entirety.