Tag: Featured

-

Kansas minimum wage hike would harm the most vulnerable workers

A bill to raise the minimum wage in Kansas will harm the most vulnerable workers, and make it more difficult for low-skill workers to get started in the labor market.

-

Hate crimes should not be enhanced in Kansas

A bill in Kansas proposes to toughen penalties for hate crimes, thereby judging people on their thoughts and beliefs rather on their actions.

-

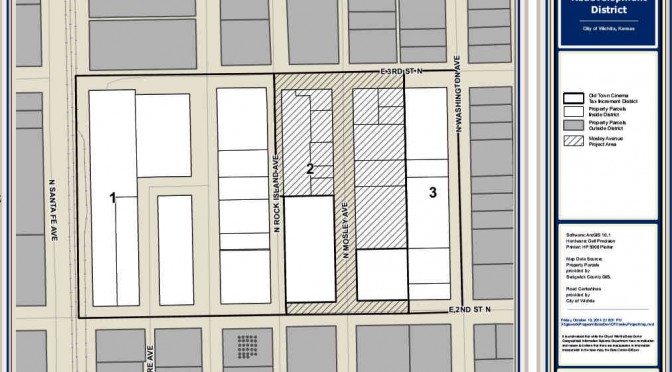

Wichita drops taxpayer protection clause

To protect itself against self-defeating appeals of property valuation in tax increment financing districts, the City of Wichita once included a protective clause in developer agreements. But this consideration is not present in two proposed agreements.

-

WichitaLiberty.TV: Rodney Wren

Rodney Wren is a debate and forensics coach. I asked him what can we do to improve the political process, particularly regarding candidate debates and the two major political parties?

-

Government intervention may produce unwanted incentives

A Kansas economic development incentive program has the potential to alter hiring practices for reasons not related to applicants’ job qualifications.

-

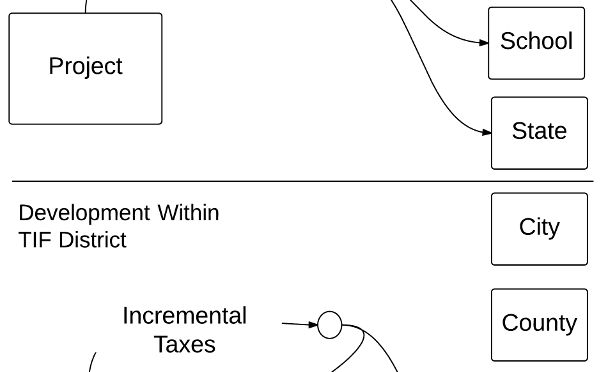

Tax increment financing (TIF) resources

Resources on tax increment financing (TIF) districts.

-

Wichita TIF projects: some background

Tax increment financing disrupts the usual flow of tax dollars, routing funds away from cash-strapped cities, counties, and schools back to the TIF-financed development. TIF creates distortions in the way cities develop, and researchers find that the use of TIF means lower economic growth.

-

Wichita loan agreement subject to interpretation

In 2009 the City of Wichita entered into an ambiguous agreement to grant a forgivable loan, and then failed to follow its own agreement. Worse yet, there has been no improvement to similar contracts. Such agreements empower the city to grant favor at its discretion.

-

Kansas school finance case based on inadequate standards

The just-released Gannon school finance decision in Kansas concludes that not long ago Kansas schools were functioning adequately. But data on Kansas school standards says something else.

-

Clawbacks illustrate difficulty of economic development

Politicians and government officials like clawbacks in economic development incentive agreements. But do these provisions have any negative aspects?

-

Year in Review: 2014

Here is a sampling of stories from Voice for Liberty in 2014.

-

Economic development in Sedgwick County

The issue of awarding an economic development incentive reveals much as to why the Wichita-area economy has not grown.