Tag: Featured

-

Wichita Mayor Carl Brewer on citizen engagement

Wichita Mayor Carl Brewer and the city council are proud of their citizen engagement efforts. Should they be proud?

-

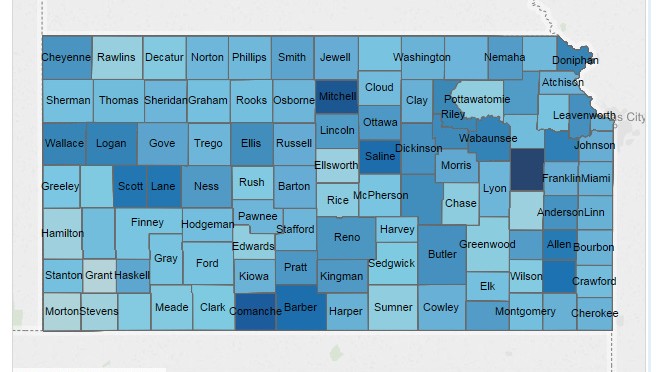

Kansas property tax data, the interactive visualization

Here is an interactive visualization that holds property tax data for Kansas counties from 1997 to 2013.

-

Newspaper editorialists with an ideology? Not in Kansas, surely.

Caution, Kansas newspaper editorialists. Your ideology is showing.

-

For Wichita Eagle, no immediate Kansas budget solution

The Wichita Eagle shows how its adherence to ideology misinforms Kansans and limits their exposure to practical solutions for governance.

-

Voter privacy a subject ready for debate

Campaign methods used in the recent election may spark debate on the information government makes available about voters and their voting behavior.

-

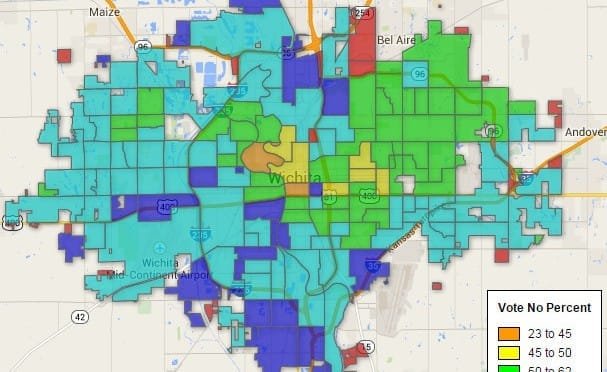

Wichita sales tax election map

Here’s a map I created of the “No” vote percentage by precinct.

-

In election coverage, The Wichita Eagle has fallen short

Citizens want to trust their hometown newspaper as a reliable source of information. The Wichita Eagle has not only fallen short of this goal, it seems to have abandoned it.

-

Wichita Downtown Development Corporation campaigns for higher taxes, paid for by taxes

Campaign activity by the Wichita Downtown Development Corporation appears to be contrary to several opinions issued by Kansas Attorneys General regarding the use of public funds in elections.

-

Fact-checking Yes Wichita: Water pipe(s)

The “Yes Wichita” campaign group makes a Facebook post with false information to Wichita voters. Will Wichita Mayor Carl Brewer send a mailer to Wichitans warning them of this misleading information?

-

Wichita to consider tax exemptions

A Wichita company asks for property and sales tax exemptions on the same day Wichita voters decide whether to increase the sales tax, including the tax on groceries.

-

WichitaLiberty.TV: Dave Trabert of Kansas Policy Institute on the Kansas budget

In this episode of WichitaLiberty.TV: Dave Trabert of Kansas Policy Institute talks about KPI’s recent policy brief “A Five-Year Budget Plan for the State of Kansas: How to balance the budget and have healthy ending balances without tax increases or service reductions.”

-

Fact-checking Yes Wichita: Tax rates

The claim that the mill levy has not been raised for a long time is commonly made by the city and “Yes Wichita” supporters. It’s useful to take a look at actual numbers to see what has happened.