Tag: Featured

-

WichitaLiberty.TV: Unknown stories of economic development, Uber, Fact-checking Yes Wichita

In this episode of WichitaLiberty.TV: Wichita economic development, one more untold story. The arrival of Uber is a pivotal moment for Wichita. Fact-checking Yes Wichita on paved streets.

-

To pay for a Wichita water supply, there are alternatives

Supporters of a proposed Wichita sales tax contend there is only one alternative for paying for a new water supply, and it is presented as unwise.

-

For proposed Wichita sales tax, claims of transparency

Claims of valuing and promoting government transparency by the City of Wichita are contradicted by its taxpayer-funded surrogates.

-

Fact-checking Yes Wichita: Sales tax cost per household

The cost of the proposed Wichita sales tax to households is a matter of dispute. I present my figures, and suggest that “Yes Wichita” do the same.

-

Fact-checking Yes Wichita: Boeing incentives

The claim that the “city never gave Boeing incentives” will come as news to the Wichita city officials who dished out over $600 million in subsidies and incentives to the company.

-

Using your smartphone for political activism

Your smartphone is a valuable tool for activism. Here are two ways to get involved.

-

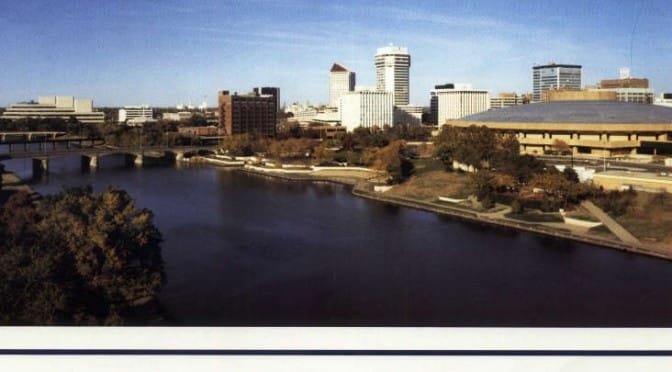

Wichita economic development, one more untold story

Readers of the Wichita Eagle might be excused for not understanding the economic realities of a proposed tax giveaway to a local development.

-

Arrival of Uber a pivotal moment for Wichita

Now that Uber has started service in Wichita, the city faces a decision. Will Wichita move into the future by embracing Uber, or remain stuck in the past?

-

Fact-checking Yes Wichita: Arithmetic

A group promoting the proposed Wichita sales tax makes an arithmetic error, which gives us a chance to ask a question: Is this error an indication of Yes Wichita and the city’s attitude towards, and concern for, factual information?

-

WichitaLiberty.TV: Wichita’s blatant waste, Transforming Wichita, and how you can help

Let’s ask that Wichita trim its blatant waste of tax dollars before asking for more. We’ll look back at a program called Transforming Wichita. Then: We need to hold campaigns accountable. I’ll give you examples why, and tell how you can help.

-

Fact-checking Yes Wichita: NetApp incentives

In making the case that economic development incentives are necessary and successful in creating jobs, a Wichita campaign overlooks the really big picture.

-

Fact-checking Yes Wichita: Paved streets

Will the proposed Wichita sales tax result in more paved streets? It depends on what you mean by “pave.”