Tag: Featured

-

With new tax exemptions, what is the message Wichita sends to existing landlords?

As the City of Wichita prepares to grant special tax status to another new industrial building, existing landlords must be wondering why they struggle to stay in business when city hall sets up subsidized competitors with new buildings and a large cost advantage.

-

Wichita: We have incentives. Lots of incentives.

Wichita government leaders complain that Wichita can’t compete in economic development with other cities and states because the budget for incentives is too small. But when making this argument, these officials don’t include all incentives that are available.

-

Another Friday lunch, and even more lights are on

When Wichita city leaders tell us that the budget and spending have been cut to the bone, that everything that can be done to save money has already been done, remember my Friday trips to downtown for lunch.

-

WichitaLiberty.TV: Government accounting, Government ownership of infrastructure, and Wichita commercial property taxes

Government leaders tell us they want to run government like a business. But does government actually do this, even when accounting for its money? Then, is it best for government to own all the infrastructure? Finally, taxes on Wichita commercial property are high, compared to the rest of the nation.

-

Questions for the next Wichita city attorney: Number 4

Wichita’s city attorney is retiring, and the city will select a replacement. There are a few questions that we ought to ask of candidates, such as: Can the city disregard charter ordinances when they inconvenience the council’s cronies?

-

A lesson for Wichita in economic development

When a prominent Wichita business executive and civic leader asked for tax relief, his reasoning allows us to more fully understand the city’s economic development efforts and nature of the people city hall trusts to lead these endeavors.

-

In Wichita, ‘free markets’ cited in case for economic development incentives

A prominent Wichita business uses free markets to justify its request for economic development incentives. A gullible city council buys the argument.

-

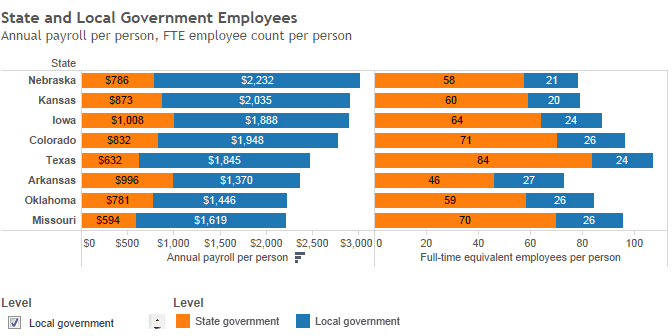

Government employee costs in the states

The states vary widely in levels of state government and local government employees and payroll costs, calculated on a per-person basis. Kansas ranks high in these costs, nationally and among nearby states.

-

Daily Signal launched today

Today The Heritage Foundation launches The Daily Signal, a news, analysis, and commentary outlet.

-

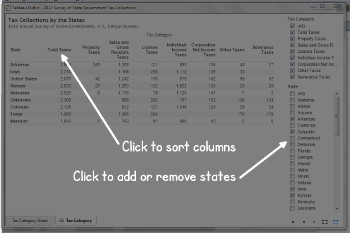

Tax collections by the states

Kansas state government collects more tax revenue than most surrounding states. Additionally, severance taxes are a minor contribution to collections, even in Texas.

-

Kansas City Star’s dishonest portrayal of renewable energy mandate

The Star touts economic gains to the wind industry but ignores the reality that those gains come at the expense of everyone else in the form of higher taxes, higher electricity prices and other unseen economic consequences, writes Dave Trabert of Kansas Policy Institute.

-

Wichita property taxes compared

An ongoing study reveals that generally, property taxes on commercial and industrial property in Wichita are high. In particular, taxes on commercial property in Wichita are among the highest in the nation.