Kansas legislators are struggling to balance the state’s budget. In 2012 the legislature passed a tax cut, although it was unevenly applied. But in the intervening years, the legislature has not taken serious steps to cut state spending to match. Legislators failed to consider bills to streamline and outsource government functions, although the bills had passed in a previous session. The legislature has also failed to consider budgetary process reform as explained below in an article from May 2012.

Leaders in the Kansas legislature and executive branch tell us the only way to balance the Kansas budget this year is by raising more revenue through taxation. That may be true, as reforming spending and budgeting takes time to accomplish. We had the time. But our legislature and executive branch squandered that opportunity. Now, they ask you for more tax revenue.

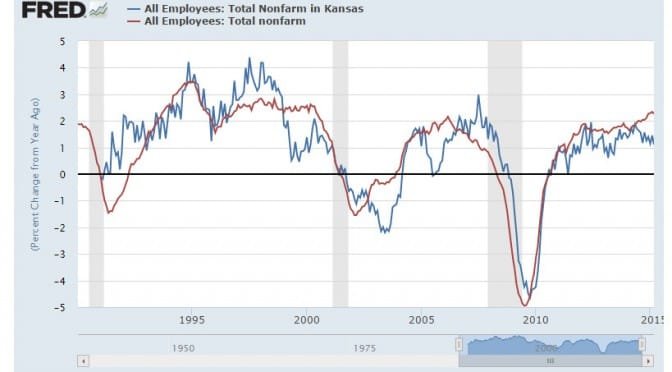

This year Kansas made a leap forward in reducing income tax rates. The next step for Kansas is to reduce its spending, both to match the reduced revenue that is forecast, but also to improve the efficiency of Kansas government and leave more money in the hands of the private sector. Specifically, Kansas needs to improve its budgeting process and streamline state government.

In Kansas, like in many states, the budgeting process starts with the previous year’s spending. That is then adjusted for factors like inflation, caseloads, and policy changes that necessitate more (or rarely, less) spending. The result is that debates are waged over the increment in spending. Rarely is the base looked at to see if the spending is efficient, effective, or needed.

There are several approaches Kansas could take to improve on this process. One is zero-based budgeting. In this approach, an agency’s budget set to zero. Then, every spending proposal must have a rationale or justification for it to be added to the budget.

Zero-based budgeting can be successful, but, according to the recent paper Zero-base Budgeting in the States from National Conference of State Legislatures, it requires a large commitment from the parties involved. It also can take a lot of time and resources. Kansas could start the process with just a few agencies, and each agency could go through the process periodically, say once every five or six years. Some states have abandoned the zero-based budgeting process.

In its State Budget Reform Toolkit, American Legislative Exchange Council advocates a system called priority-based budgeting. This process starts with deciding on the core functions of state government. That, of course, can be a battle, as people have different ideas on what government should be doing.

ALEC reports that “In 2003, Washington state actually implemented priority based budgeting to close a budget deficit of $2.4 billion without raising taxes.”

The spending cuts Kansas needs to balance the budget are not large. Kansas Policy Institute has calculated that a one-time cut of 6.5 percent next year would be sufficient to bring the budget to balance.

The problem that Kansas will face in reducing state spending and streamlining its government is that there are those who are opposed. Streamlining often means eliminating programs that aren’t needed, aren’t performing as expected, or are very costly. These programs, however, all have constituencies that benefit from them — the concept of concentrated benefits and dispersed costs that public choice economics has taught us. These constituencies will be sure to let everyone know how harmful it will be to them if a program is scaled back or ended.

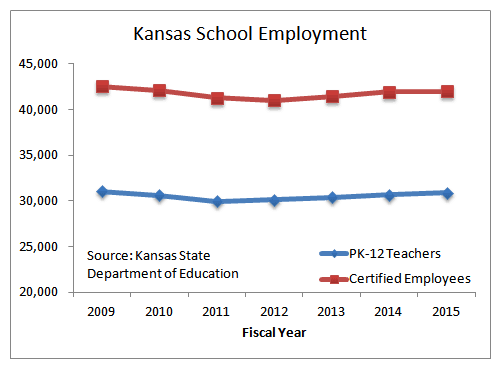

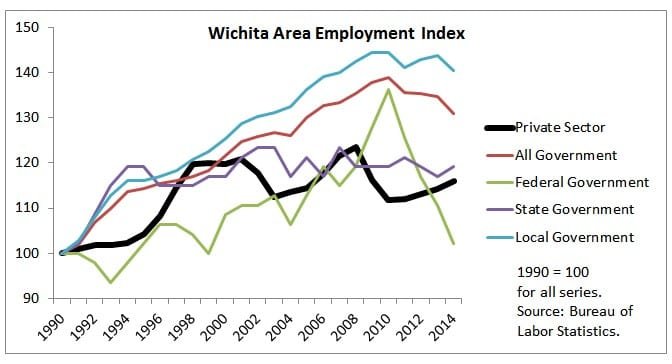

Streamlining also means that there may be fewer state employees. Some will say that the loss of state employees means a loss for the economy, as the state workers will no longer be receiving a paycheck and spending it. This reasoning, however, ignores the source of state workers’ pay: the taxpayers of Kansas. With fewer state employees, taxpayers will have more money to spend or invest. The problem is that it is easier to focus on the employees that may lose their jobs, as they are highly visible and they have vocal advocacy groups to watch out for them. This is an example of the seen and unseen, as explained by Henry Hazlitt.

City documents give some detail regarding the amounts of property tax to be forgiven on an annual basis, for a period of up to ten years. In the past, city documents have often mentioned other incentive programs that will benefit the company, but that information is missing. Other sources mention two state programs — PEAK and HPIP — the company may benefit from, but amounts are not available.

City documents give some detail regarding the amounts of property tax to be forgiven on an annual basis, for a period of up to ten years. In the past, city documents have often mentioned other incentive programs that will benefit the company, but that information is missing. Other sources mention two state programs — PEAK and HPIP — the company may benefit from, but amounts are not available.