Tag: Featured

-

Wichita Eagle, where are you?

The Wichita Eagle avoids reporting and editorializing on an issue that is saving Wichita over one hundred million dollars. We wonder why.

-

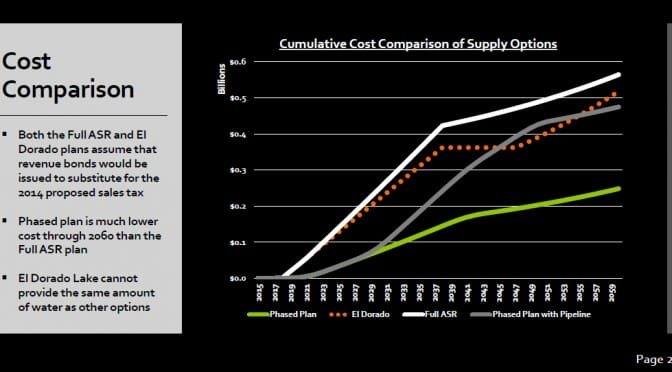

In Wichita, the phased approach to water supply can save a bundle

In 2014 the City of Wichita recommended voters spend $250 million on a new water supply. But since voters rejected the tax to support that spending, the cost of providing adequate water has dropped, and dropped a lot.

-

Sales tax revenue and the Kansas highway fund

The effect of a proposed bill to end transfer of Kansas sales tax revenue to the highway fund is distorted by promoters of taxation and spending.

-

Kansas and Colorado, compared

News that a Wichita-based company is moving to Colorado sparked a round of Kansas-bashing, most not based on facts.

-

At Pachyderm: Police Chief Gordon Ramsay

The Wichita Pachyderm Club featured Wichita Police Chief Gordon Ramsay speaking on the topic “There’s a New Chef in Town.”

-

Math quiz on Kansas spending

The average Kansan is misinformed regarding Kansas school spending, and Kansas news media are to blame, writes Paul Waggoner of Hutchinson

-

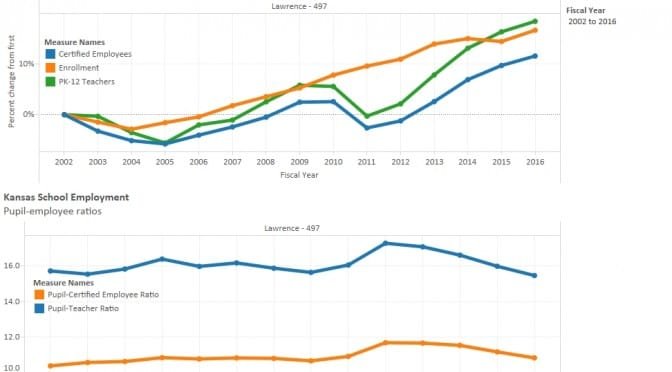

Lawrence school funding and employment

A Kansas school board president complains about funding, but the district has been able to grow employment faster than enrollment.

-

Wichita TIF district disbands; taxpayers on the hook

A real estate development in College Hill was not successful. What does this mean for city taxpayers?

-

Kansas Supreme Court judicial selection

Kansas progressives and Democrats oppose a judicial selection system that is used by U.S. Presidents, both Democrats and Republicans.

-

Power of Kansas cities to take property may be expanded

A bill working its way through the Kansas Legislature will give cities additional means to seize property.

-

In Kansas, doctors may “learn” just by doing their jobs

A proposed bill in Kansas should make us question the rationale of continuing medical education requirements for physicians.

-

Kansas teachers union opposes bill that empowers teachers

Kansas National Education Association, the state’s teachers union, opposes a bill that empowers teachers.