Tag: Featured

-

Simple tasks for Kansas Legislature

In this excerpt from WichitaLiberty.TV: There are things simple and noncontroversial that the Kansas Legislature should do in its upcoming session.

-

Empowering and engaging Wichitans, or not

Does the City of Wichita really want to “empower and engage citizens by providing information necessary to keep them informed on the actions their government is taking?”

-

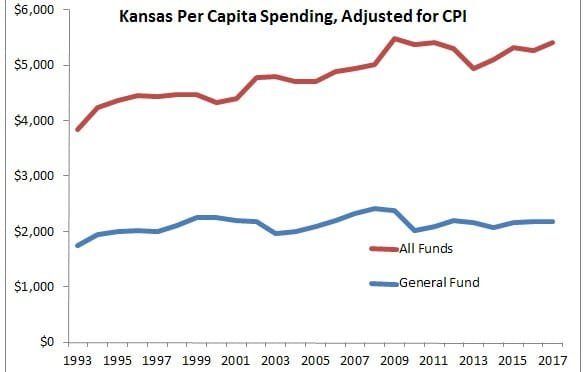

Spending and taxing in Kansas

Difficulty balancing the Kansas budget is different from, and has not caused, widespread spending cuts.

-

WichitaLiberty.TV: Goals for the Kansas Legislature, school choice in Kansas

In this episode of WichitaLiberty.TV: There are worthy goals the Kansas Legislature should tackle, and the need for school choice in Kansas.

-

After years of low standards, Kansas schools adopt truthful standards

In a refreshing change, Kansas schools have adopted realistic standards for students, but only after many years of evaluating students using low standards.

-

Kansas schools and other states

A joint statement released by Kansas Association of School Boards, United School Administrators of Kansas, Kansas School Superintendents’ Association, and Kansas National Education Association makes claims about Kansas public schools that aren’t factual.

-

Must it be public schools?

A joint statement released by Kansas Association of School Boards, United School Administrators of Kansas, Kansas School Superintendents’ Association, and Kansas National Education Association exposes the attitudes of the Kansas public school establishment.

-

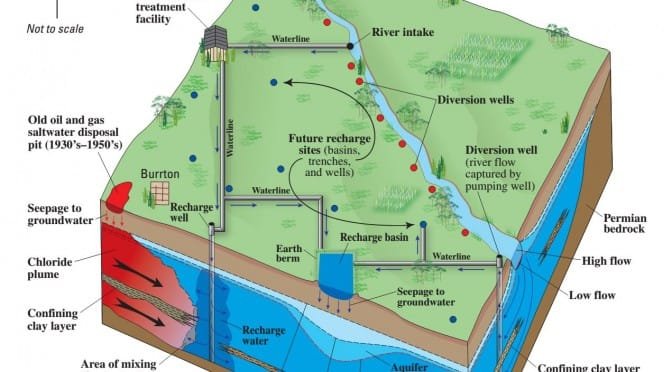

Wichita water statistics update

The Wichita ASR water project produced little water in December. There were 31 days when river flow was adequate.

-

Kansas Attorney General Derek Schmidt

Kansas AG Derek Schmidt addressed cases in the Kansas and U.S. Supreme Courts in a talk at the Wichita Pachyderm Club.

-

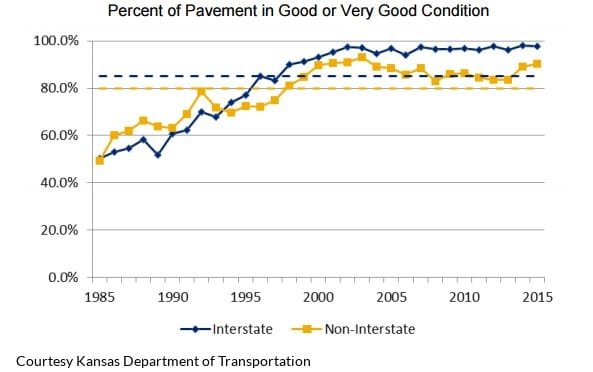

Kansas highway conditions

Has continually “robbing the bank of KDOT” harmed Kansas highways?

-

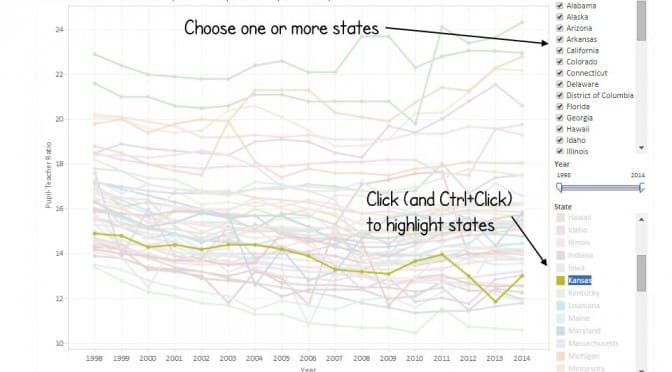

Pupil-teacher ratios in the states

Kansas ranks near the top of the states in having a low pupil-teacher ratio.