Tag: Featured

-

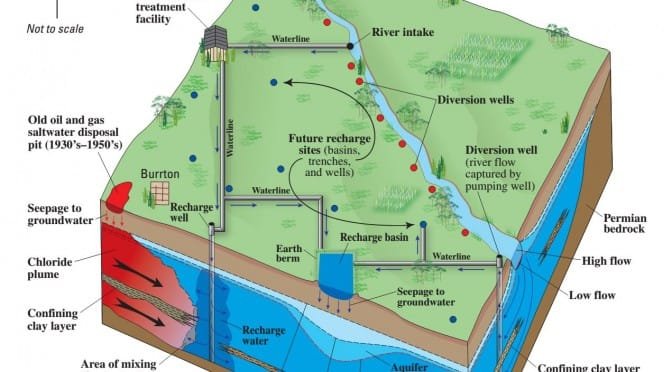

Wichita water statistics update

The Wichita ASR water project produced no water in October. There were two days when river flow was adequate.

-

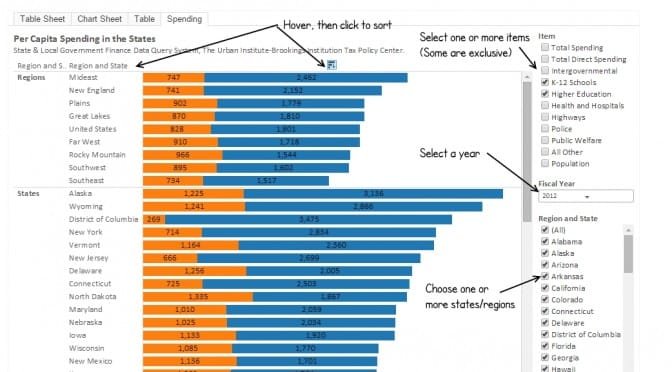

Spending in the states, per capita

An interactive visualization holding per-capita spending in several categories for each state.

-

In Depth with Walter Williams

This Sunday Dr. Walter E. Williams appeared on the C-SPAN program In Depth.

-

Kansas fiscal experiment

Those evaluating the Kansas fiscal “experiment” should consider what is the relevant input variable.

-

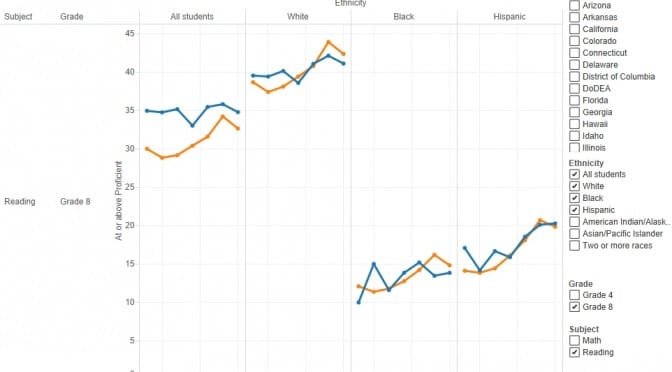

Kansas NAEP scores for 2015

Reactions to the release of National Assessment of Educational Progress scores for Kansas and the nation. Also, an interactive visualization.

-

Bombardier can be a learning experience

The unfortunate news of the cancellation of a new aircraft program can be a learning opportunity for Wichita.

-

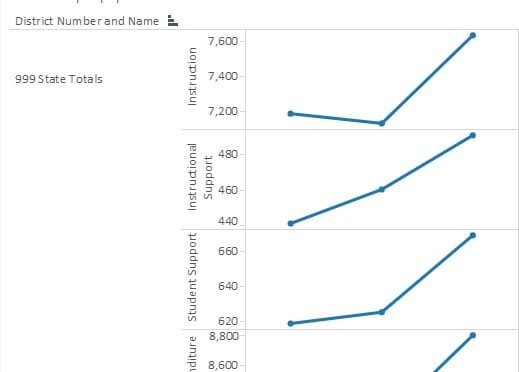

Kansas school support

An interactive visualization of data provided to members of the Kansas 2015 Special Committee on K-12 Student Success.

-

Wichita Chamber calls for more cronyism

By advocating for revival of the Export-Import Bank of the United States, the Wichita Metro Chamber of Commerce continues its advocacy for more business welfare, more taxes, more wasteful government spending, and more cronyism

-

FBI and counterterrorism

John Sullivan, who is Supervisory Special Agent for the Federal Bureau of Investigation (FBI) in Wichita, spoke to members and guests of the Wichita Pachyderm Club on the topic “Counterterrorism.”

-

WichitaLiberty.TV: Radio talk show host Andy Hooser of the Voice of Reason

Radio talk show host Andy Hooser of the Voice of Reason introduces himself to Wichita and talks about millennials, local politics, and the presidential races.

-

What are opinions of the level of Kansas school spending?

Part of the difficulty in understanding and debating school spending in Kansas is the starting point, that is, the lack of factual information. From 2012, a look at a survey that revealed the level of knowledge of school spending by Kansans.

-

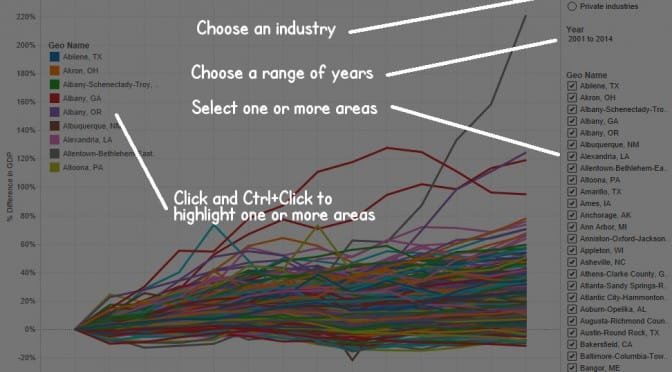

Wichita’s growth in gross domestic product

An interactive visualization of gross domestic product for metropolitan areas.