Tag: Featured

-

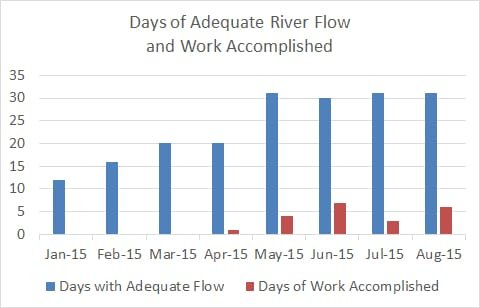

Wichita ASR water project work accomplished

The $247 million Wichita ASR water project operates at just a fraction of its design capacity.

-

State taxes and charitable giving

States with higher rates of economic growth grow total charitable giving at a faster rate than states with low rates of economic growth, finds a new report by American Legislative Exchange Council.

-

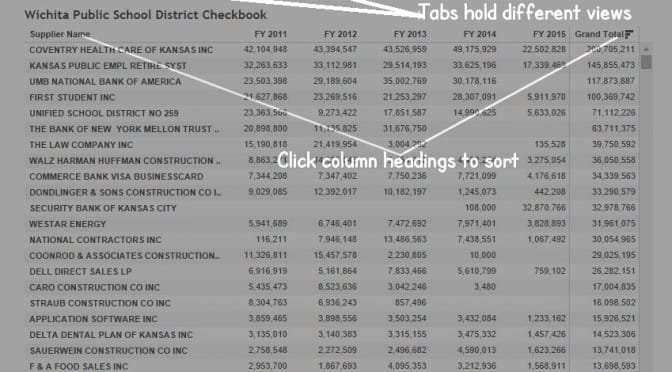

Wichita school district checkbook updated

An interactive table of checkbook spending by the Wichita public school district.

-

WichitaLiberty.TV: Sales tax exemptions, criminal justice reform, and charity

Does the elimination of sales tax exemptions hold the solution to Kansas budget problems? We have a problem with overcriminalization and the criminal justice system. Then, is there a difference between government and charity?

-

Where are our documents?

Government promotes and promises transparency, but finds it difficult to actually provide.

-

Kansas private nonfarm employment by county

An interactive visualization of private nonfarm employment in Kansas, for each county.

-

Criminal justice reform: Why it matters

Mark Holden, Senior Vice President and General Counsel at Koch Industries, Inc., speaks about criminal justice reform initiatives Koch is encouraging in and why they’re important from moral, constitutional and fiscal perspectives.

-

WichitaLiberty.TV: Lack of information sharing by government, community improvement districts, and the last episode of “Love Gov”

Do our governmental agencies really want to share data and documents with us? Community Improvement Districts and homeowners compared. And, the last episode of “Love Gov” from the Independent Institute.

-

Kansas Center for Economic Growth and the truth

Why can’t Kansas public school spending advocates — especially a former Kansas state budget director — tell the truth about schools and spending, wonders Dave Trabert of Kansas Policy Institute.

-

Sales tax exemptions in Kansas

Can eliminating sales tax exemptions in Kansas generate a pot of gold?

-

Wichita’s demolition policy

Wichita homeowners must pay for demolition of their deteriorating homes, but the owners of a long-festering and highly visible commercial property get to use tax funds for their demolition expense.

-

Wichita can implement transparency, even though tax did not pass

Wichitans have to wonder: Was transparency promised only as an inducement to vote for the sales tax? Or is it a governing principle of our city?