Tag: Kansas legislature

-

WichitaLiberty.TV: Kansas Senator Ty Masterson

Kansas Senator Ty Masterson joins Bob Weeks and Karl Peterjohn to discuss legislative issues and politics.

-

From Pachyderm: Kansas legislative update

From the Wichita Pachyderm Club: Members of the Kansas Legislature from the Wichita area briefed members and guests on happenings in the Kansas Senate and House of Representatives.

-

WichitaLiberty.TV: Health care in Kansas and taxes in Sedgwick County

In this episode of WichitaLiberty.TV: Bob Weeks and Karl Peterjohn discuss health care in Kansas and taxes in Sedgwick County.

-

Kansas House voting on Medicaid expansion

How members of the Kansas House of Representatives voted on the three votes concerning Medicaid expansion in Kansas.

-

Kansas House voting on Medicaid expansion

Kansas House voting on Medicaid expansion

-

Kansas Senate voting on Medicaid expansion

Kansas Senate voting on Medicaid expansion

-

Highway budget cuts and sweeps in Kansas

A public interest group makes claims about Kansas roads and highways that are not supported by data. It’s not even close.

-

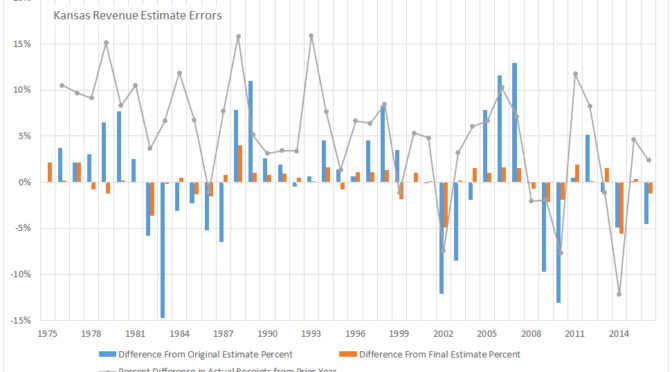

Kansas revenue estimates

Kansas revenue estimates are frequently in the news and have become a political issue. Here’s a look at them over the past decades.

-

During Sunshine Week, here are a few things Wichita could do

The City of Wichita says it values open and transparent government, but the city lags far behind in providing information and records to citizens.

-

In Kansas, the war on property rights

John Todd makes an appearance on The Voice of Reason with Andy Hooser to talk about proposed legislation in Kansas that would be harmful to private property rights.

-

WichitaLiberty.TV: Kansas Director of Budget Shawn Sullivan

Kansas Director of Budget Shawn Sullivan joins Karl Peterjohn and Bob Weeks to explain issues related to the Kansas budget.