Tag: Kansas Policy Institute

-

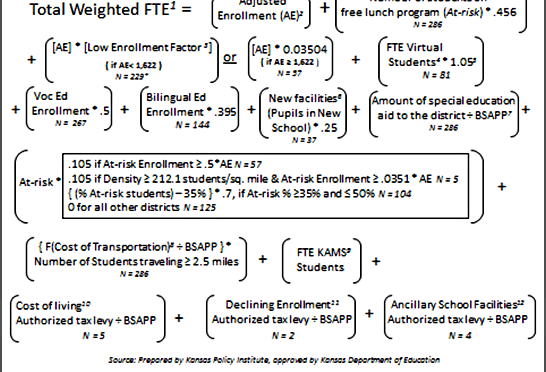

Kansas school finance formula explained

The updated version of the formula that will be used by the Kansas State Department of Education to determine student weighting in the coming school year is presented below.

-

Kansas budgeting “off the tops” is bad policy

Direct transfers of taxpayer money sent to a specific business or industry is always a tough sell to politicians, let alone the voting public. But, that is why some corporations pay lots of money to lobbyists, writes Steve Anderson for Kansas Policy Institute.

-

What the Wichita city council could do

While the proposed Wichita city sales tax is a bad idea, the city could do a few things that would not only improve its chance of passage, but also improve local government.

-

Women for Kansas voting guide should be read with caution

If voters are relying on a voter guide from Women for Kansas, they should consider the actual history of Kansas taxation and spending before voting.

-

For McGinn, a liberal voting record is a tradition

Based on votes made in the Kansas Senate, the advertising claims of Sedgwick County Commission candidate Carolyn McGinn don’t match her record.

-

WichitaLiberty.TV: Waste, economic development, and water issues.

Wichitans ought to ask city hall to stop blatant waste before it asks for more taxes. Then, a few questions about economic development incentives. Finally, how should we pay for a new water source, and is city hall open to outside ideas?

-

For Wichita leaders, novel alternatives on water not welcome

A forum on water issues featured a presentation by Wichita city officials and was attended by other city officials, but the city missed a learning opportunity.

-

WichitaLiberty.TV: Water, waste, signs, gaps, economic development, jobs, cronyism, and water again.

A look at a variety of topics, including an upcoming educational event concerning water in Wichita, more wasteful spending by the city, yard signs during election season, problems with economic development and cronyism in Wichita, and water again.

-

Third annual Kansas Freedom Index released

The third annual Kansas Freedom Index takes a broad look at voting records and establishes how supportive state legislators are regarding economic freedom, student-focused education, limited government, and individual liberty.

-

Examining Wichita’s water future

On Thursday 17 July, come hear from the City of Wichita and others on the scope of the problems, possible solutions, and the perspectives of several experts in the debate over Wichita’s water future.

-

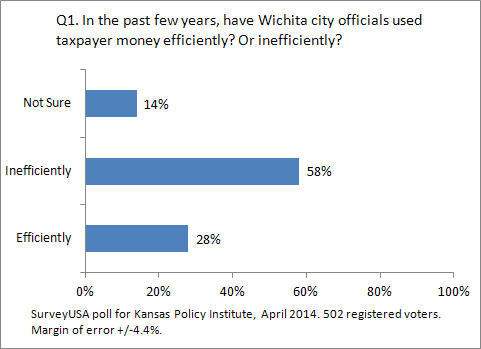

To fund government, Wichitans prefer alternatives to raising taxes

Wichita voters told pollsters they prefer adjusting spending, becoming more efficient, using public-private partnerships, and privatization to raising taxes.

-

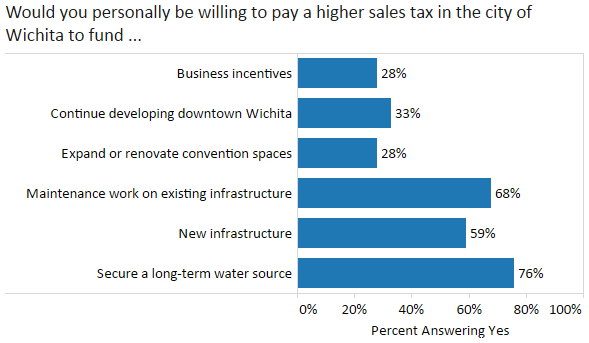

Wichita voter opinion on city spending and taxation

Wichita voters give their opinions on city spending, subsidies for economic development, and their willingness to pay higher taxes for certain services.