Tag: Subsidy

-

Energy subsidies for electricity production, in proportion

To compare federal subsidies for the production of electricity, we must consider subsidy values in proportion to the amount of electricity generated, because the magnitude is vastly different.

-

Legislation to end Economic Development Administration introduced

U.S. Rep. Mike Pompeo calls for an end to a wasteful federal economic development agency.

-

WichitaLiberty.TV: A downtown Wichita deal shows some of the problems with the Wichita economy

In this episode of WichitaLiberty.TV: We’ll examine the city council’s action regarding a downtown Wichita development project and how it is harmful to Wichita taxpayers and the economy.

-

Exchange Place incentives, including free sales tax and an ethics bypass

A downtown Wichita project receives free sales taxes and a bypass of Wichita’s code of conduct for city council members.

-

WichitaLiberty.TV: Transportation issues in Wichita

In this excerpt from WichitaLiberty.TV: Wichita’s legislative agenda concerning transportation issues is unsound.

-

STAR bonds in Kansas

The Kansas STAR bonds program provides a mechanism for spending by autopilot, without specific appropriation by the legislature.

-

Community improvement districts in Kansas

In Kansas Community Improvement Districts, merchants charge additional sales tax for the benefit of the property owners, instead of the general public.

-

In Kansas, PEAK has a leak

A Kansas economic development incentive program is pitched as being self-funded, but is probably a drain on the state treasure nonetheless.

-

Wichita city hall falls short in taxpayer protection

An incentives agreement the Wichita city council passed on first reading is missing several items that city policy requires. How the council and city staff handle the second reading of this ordinance will let us know for whose interests city hall works: citizens, or cronies.

-

Government intervention may produce unwanted incentives

A Kansas economic development incentive program has the potential to alter hiring practices for reasons not related to applicants’ job qualifications.

-

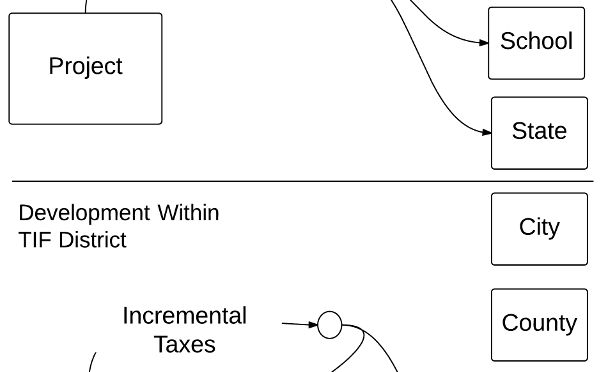

Tax increment financing (TIF) resources

Resources on tax increment financing (TIF) districts.

-

Wichita TIF projects: some background

Tax increment financing disrupts the usual flow of tax dollars, routing funds away from cash-strapped cities, counties, and schools back to the TIF-financed development. TIF creates distortions in the way cities develop, and researchers find that the use of TIF means lower economic growth.