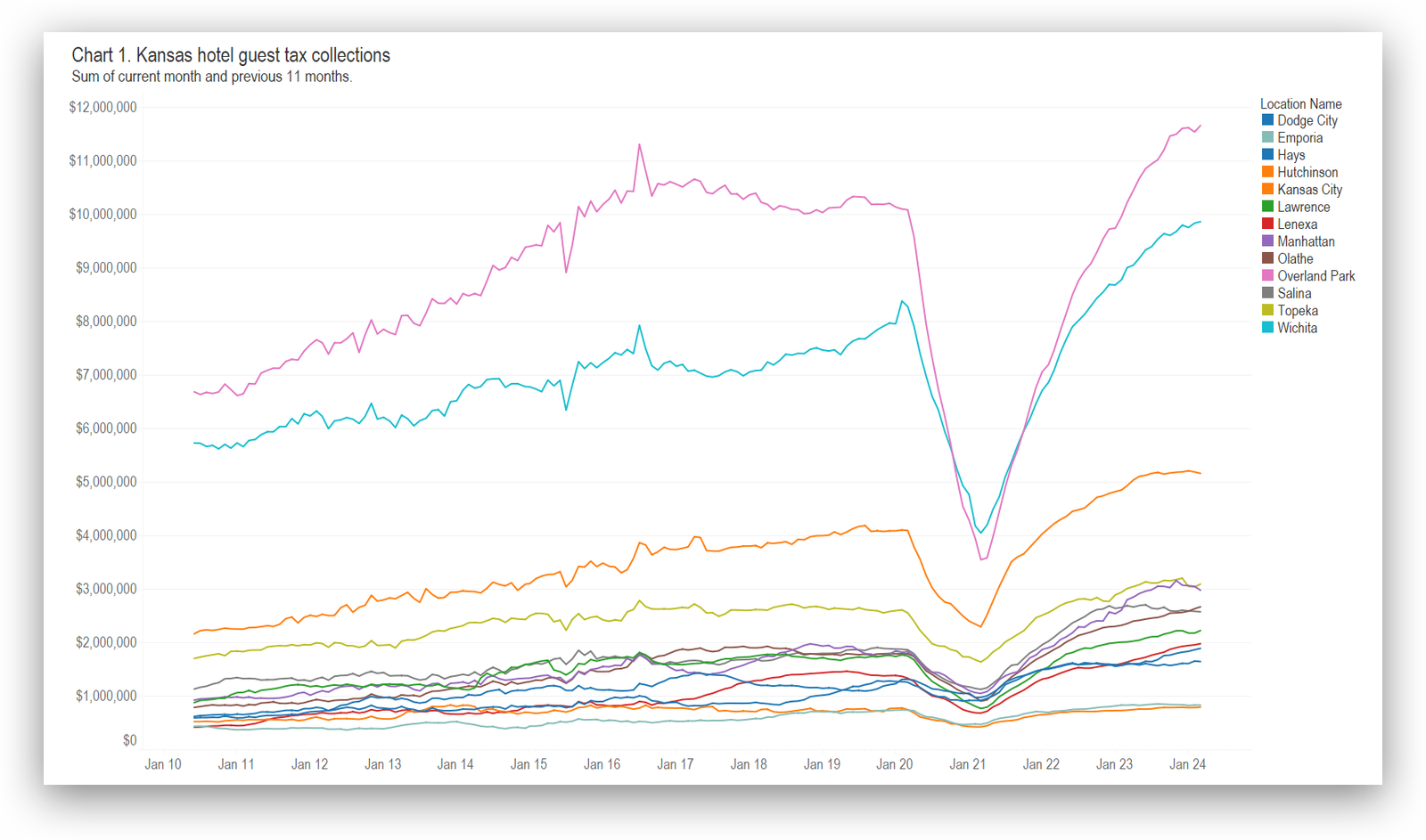

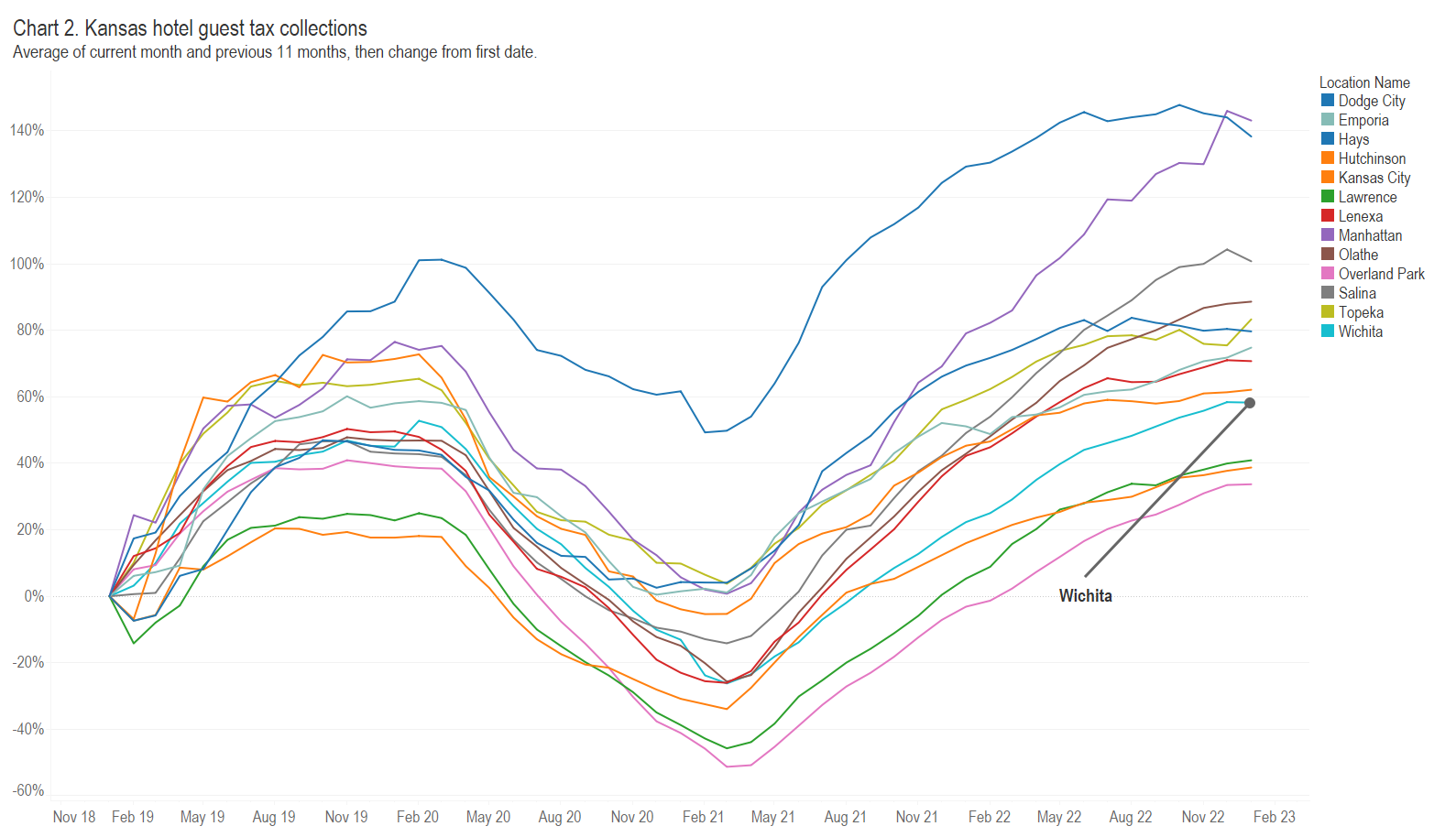

Kansas hotel guest tax collections presented in an interactive visualization. Updated with data through March 2024. (more…)

Tag: Visit Wichita

Updated: Kansas hotel guest tax collections

Kansas hotel guest tax collections presented in an interactive visualization. Updated with data through January 2023. (more…)

Wichita needs transparency from its agencies

When the Wichita city council delegates spending to outside agencies such as Visit Wichita, it should insist on the same transparency requirements the city itself faces.

The Kansas Open Records Act is designed to give citizens access to data concerning their government. In the words of the Kansas Attorney General, “An open and transparent government is essential to the democratic process.”

The preamble to the Kansas act states, “It is declared to be the public policy of the state that public records shall be open for inspection by any person unless otherwise provided by this act, and this act shall be liberally construed and applied to promote such policy.” (emphasis added)

That isn’t always the case in Wichita. Here, the city has formed several non-profit organizations that are funded in large part by tax revenue. But these organizations believe they are not covered by KORA, and so far the city agrees with that.

An example is Visit Wichita, the city’s convention and visitors bureau. This week the Wichita City Council will consider the scope of services and budget for the money the agency receives from Wichita’s Tourism Business Improvement District. This is a tax of 2.75 percent that is added to hotel bills in the city. From 2016 to 2018 this tax brought in an average of just over three million dollars per year.

If the city itself was spending these funds, there is no doubt that the spending records would be public. But Visit Wichita wants to spend this money in secret. It also wants to enter into contracts in secret.

In the Kansas law, here is the definition of a public agency: “‘Public agency’ means the state or any political or taxing subdivision of the state or any office, agency or instrumentality thereof, or any other entity receiving or expending and supported in whole or in part by the public funds appropriated by the state or by public funds of any political or taxing subdivision of the state.” There is an exception, which doesn’t apply here: “‘Public agency’ shall not include: … Any entity solely by reason of payment from public funds for property, goods or services of such entity.”

As can be seen in the nearby table, Visit Wichita gets around 93 percent of its funds from taxes. Surely this qualifies as “supported in whole or in part by the public funds.”

In the past, agencies have objected to the release of records on the basis that they would reveal information or strategies that would benefit Wichita’s competitors for jobs, conventions, and tourists. But the requests I have made (and which were rejected) asked for past data, not contemporaneous data. Further, if Wichita was successful in attracting jobs, conventions, and tourists, this might make some sense. But Wichita lags in these categories, which means that oversight is important. For example, among large hotel markets in Kansas, Wichita is near the bottom in growth.

The records that Visit Wichita needs to disclose are its spending records, which means the checks it has written and credit card charges made. It also needs to disclose its contracts. This is the law, and it is also good public policy.

When my records requests were rejected, I asked the Sedgwick County District Attorney to enforce the law. The DA sided with Visit Wichita (then known as Go Wichita) and the city’s other non-profit agencies, concluding that they were not “public agencies.”

That determination simply meant that Visit Wichita could not be forced to reveal records. But it does not prohibit the agency from supplying records — if it wanted.

This issue is important so that people can trust their government. But leadership in Wichita has not agreed. Now, as Wichita considers large public investments in facilities like a convention center — something desired by Visit Wichita — we need transparency, not secrecy.

Wichita Mayor Brandon Whipple campaigned on greater government transparency. An amendment to the city’s recommended action could require that Visit Wichita recognize itself for what it is — a public agency as defined in the Kansas Open Records Act. Proposing a motion to include this requirement would allow the mayor to fulfill a campaign promise, and it would let Wichitans know where council members stand on this issue.

For more information, see Open Records in Kansas.

Click for larger.

Wichita tourism fee budget

The Wichita City Council will consider a budget for the city’s tourism fee paid by hotel guests.

If you stay at a hotel in Wichita, you’ll pay sales tax of 7.5 percent, hotel tax (transient guest tax) of 6.00 percent, and since 2015, a tourism fee of 2.75 percent. The tourism fee arises from the city’s creating of a Tourism Business Improvement District (TBID), with boundaries matching those of the city. 1 Funds collected from this fee go to Visit Wichita, the city’s visitor and convention bureau. (Of note, the TBID ordinance specifies that if the tax is itemized on hotel bills, it is to be called the “Tourism Fee.” Everyone pays, even those who are not tourists.) (Also, some hotels are in Community Improvement Districts, charging up to another 2 percent.)

Coming to Wichita for business. (Click for a larger version.)  This week the Wichita City Council will consider the budget for the use of this tourism fee revenue. 2 City documents (the agenda packet) show actual results and goals for economic impact. As can be seen in the nearby excerpt, for leisure travel in 2017, Visit Wichita claims $81,343,227 in economic impact. This figure comes from summing identifiable dollars, which comes to $20,433,737. Then a multiplier is applied to produce the economic impact. All this results in a return of investment of $53 dollars for every dollar of investment (“Media Leisure Investment”), Visit Wichita says. (This is for the “leisure” market segment only. There are separate goals and statistics for group travel, which is meetings, conventions, or sporting events.)

This week the Wichita City Council will consider the budget for the use of this tourism fee revenue. 2 City documents (the agenda packet) show actual results and goals for economic impact. As can be seen in the nearby excerpt, for leisure travel in 2017, Visit Wichita claims $81,343,227 in economic impact. This figure comes from summing identifiable dollars, which comes to $20,433,737. Then a multiplier is applied to produce the economic impact. All this results in a return of investment of $53 dollars for every dollar of investment (“Media Leisure Investment”), Visit Wichita says. (This is for the “leisure” market segment only. There are separate goals and statistics for group travel, which is meetings, conventions, or sporting events.)This data represents what is called “incremental” travel, for which Visit Wichita takes credit: “The rate of travel by those who are ‘unaware’ is considered the base rate of travel, which would have been achieved if no advertising were placed. Any travel above this base by ‘aware’ households is considered influenced — or the rate of incremental travel.” 3

As for the performance of the overall Wichita hotel market, growth is slow. Looking at growth in hotel tax collections, only two of the ten largest markets in Kansas have grown slower than Wichita. This is since January 1, 2015, which was when the tourism fee started. (Hotel tax collections collected by the Kansas Department of Revenue do not include local taxes like the city tourism fee.)

Further, if we were expecting a boost in hotel sales from the recent hosting of NCAA basketball tournament games, that didn’t happen. See Effect of NCAA basketball tournament on Wichita hotel tax revenues.

Kansas transient guest tax collections are available in an interactive visualization here.

Example from the visualization. Click for larger. —

Notes- City of Wichita, Ordinance No. 49-677. Available at http://www.wichita.gov/CityClerk/OrdanicesDocuments/49-677%20TBID%20Ordinance%20-%20version%204.pdf. ↩

- Wichita city council agenda packet for May 1, 2018. ↩

- City council agenda packet. ↩

Liquor tax and the NCAA basketball tournament in Wichita

Liquor enforcement tax collections provide insight into the economic impact of hosting NCAA basketball tournament games in Wichita.

In Kansas, a tax is collected at liquor stores, grocery stores, and convenience stores on the sale of alcoholic beverages. The same tax is also collected on sales to clubs, drinking establishments, and caterers by distributors. 1 This tax is called the liquor enforcement tax. The rate has been 8 percent since 1983, when it was raised from 4 percent. 2

This tax provides some insight into the level of sales of alcoholic beverages at bars, clubs, and restaurants. It is not a perfect measurement of that, and perhaps not even a very good measurement, as it also includes sales at retail outlets for consumption offsite.

Nonetheless, it’s data we have. The Kansas Department of Revenue provides this data on a monthly basis for each county. With the touted influx of visitors for the NCAA men’s basketball tournament games in Wichita in May — along with the generalized party atmosphere — we might to expect to see these tax collections rise during March. Here’s what happened.

The liquor tax collections exhibit pronounced seasonality, so it’s useful to compare the same month of the previous year, as follows for Sedgwick County:

March 2017: $1,315,653

March 2018: $1,085,214

Change: -$230,439, a decline of 17.5 percent.Not only was March 2018 lower than March 2017, it was lower than five of the previous six months of March.

The monthly average for the 12 months prior to March 2018 was $1,243,793. March 2018 didn’t meet that standard.

Kansas liquor enforcement tax collections are available in an interactive visualization here.

Liquor enforcement tax collections in Sedgwick County. Click for larger. —

Notes- “Liquor Enforcement or Sales Tax. The second level of taxation is the enforcement or sales tax, which is imposed on the gross receipts from the sale of liquor or CMB to consumers by retail liquor dealers and grocery and convenience stores; and to clubs, drinking establishments, and caterers by distributors.”

Also: “Enforcement. Enforcement tax is an in-lieu-of sales tax imposed at the rate of 8 percent on the gross receipts of the sale of liquor to consumers and on the gross receipts from the sale of liquor and CMB to clubs, drinking establishments, and caterers by distributors.

A consumer purchasing a $10 bottle of wine at a liquor store is going to pay 80 cents in enforcement tax.

The club owner buying the case of light wine (who already had paid the 30 cents per gallon gallonage tax as part of his acquisition cost) also now would pay the 8 percent enforcement tax.”

Kansas Legislative Research Department. Kansas Legislator Briefing Book 2017. Available at http://www.kslegresearch.org/KLRD-web/Publications/BriefingBook/2017Briefs/J-4-LiquorTaxes.pdf. ↩ - Kansas Wine & Spirits Wholesalers Association. A Brief Review of Alcoholic Beverages in Kansas. Available at http://www.kwswa.org/KSBeverageAlcoholHistory.pdf. ↩

- “Liquor Enforcement or Sales Tax. The second level of taxation is the enforcement or sales tax, which is imposed on the gross receipts from the sale of liquor or CMB to consumers by retail liquor dealers and grocery and convenience stores; and to clubs, drinking establishments, and caterers by distributors.”

Effect of NCAA basketball tournament on Wichita hotel tax revenues

Hotel tax collections provide an indication of the economic impact of hosting a major basketball tournament.

The Kansas Department of Revenue has released transient guest tax collections for March 2018. This is a tax added to hotel bills in addition to sales tax. The rate in Kansas is 6.00 percent, although some localities add additional tax to that.

For the city of Wichita, here are the collections:

March 2017: $538,539

March 2018: $543,844

Increase: $5,305 or 0.99 percentWith the hotel tax at 6.00 percent, that increase implies additional sales of $88,417 for the same month of the prior year. (The 2.75% tourism fee that is also added to Wichita hotel bills is paid directly to the city, so it does not appear in the statistics from the Kansas Department of Revenue.)

While an increase from the same month of the previous year is good, the average monthly hotel tax collections for the year before (March 2017 through February 2018) was $590,770.

So March 2018 didn’t exceed the average month of the previous year. It also didn’t exceed March 2016. Whatever was happening in Wichita during that month, the city generated $665,854 in hotel taxes.

Kansas transient guest tax collections are available in an interactive visualization here.

Wichita hotel tax collections. Click for larger.

This week the

This week the