Category: Kansas state government

-

Kansas is not an entrepreneurial state

The performance of Kansas in entrepreneurial activity is not high, compared to other states.

-

Balancing the Kansas budget

Dave Trabert of the Kansas Policy Institute, spoke on the topic “Debunking False Claims about Kansas Budget and Economy.”

-

Government employment and payroll in Kansas

The United States Census Bureau collects employment data from governmental units.

-

Kansas cities should not unilaterally grant tax breaks

When Kansas cities grant economic development incentives, they may also unilaterally take action that affects overlapping jurisdictions such as counties, school districts, and the state itself. The legislature should end this.

-

In Kansas, voters want government to concentrate on efficiency and core services before asking for taxes

A survey of Kansas voters finds that Kansas believe government is not operating efficiently. The also believe government should pursue efficiency savings, focus on core functions, and spend unnecessary cash reserves before cutting services or raising taxes.

-

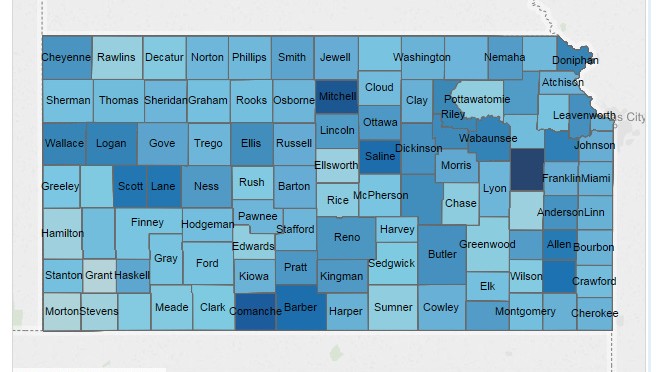

Kansas property tax data, the interactive visualization

Here is an interactive visualization that holds property tax data for Kansas counties from 1997 to 2013.

-

Secretary of State vote in Sedgwick County, November 4, 2014

Here’s a map I created of the vote percentage Kansas Secretary of State Kris Kobach received by precinct.

-

Governor vote in Sedgwick County, November 4, 2014

Here’s a map I created of the vote percentage Governor Sam Brownback received by precinct.

-

Religion and politics; two subjects that divide friends and family members alike

If we really want to protect religious freedom in our country, then we should elect candidates who will defend the rights of all citizens to practice whichever religion they choose. That is true religious liberty, writes Eileen Umbehr.

-

Kansas sales tax on groceries is among the highest

Kansas has nearly the highest statewide sales tax rate for groceries. Cities and counties often add even more tax on food.

-

You, too, may be a Kansas budget analyst

To help Kansans understand the options for future Kansas budgets, Kansas Policy Institute has produced a calculator that lets voters experiment with scenarios of their own making.

-

Where is Duane Goossen, former Kansas budget director?

Kansans are being inundated with the false choice of tax increases or service reductions, all for political gain, writes Dave Trabert of Kansas Policy Institute.