Category: Kansas state government

-

The Kansas economy under guidance of moderates

Before wishing for a return to the “good old days,” let’s make sure we understand the record of the Kansas economy.

-

Job growth in the states and Kansas

Let’s ask critics of current Kansas economic policy if they’re satisfied with the Kansas of recent decades.

-

Third annual Kansas Freedom Index released

The third annual Kansas Freedom Index takes a broad look at voting records and establishes how supportive state legislators are regarding economic freedom, student-focused education, limited government, and individual liberty.

-

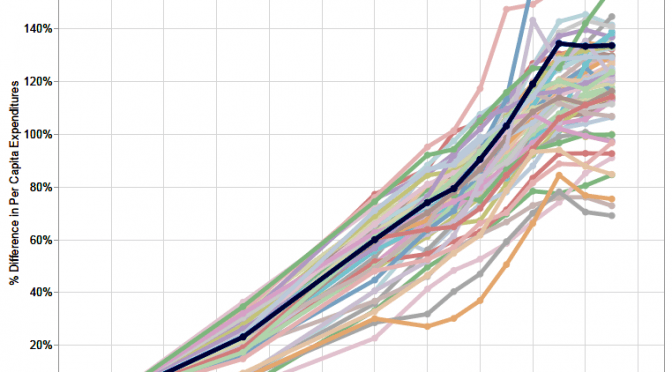

Kansas expenditures, compared to others

Spending by Kansas state and local governments has grown faster than in most other states.

-

Kansas political signs are okay, despite covenants

Kansas law overrides neighborhood covenants that prohibit political yard signs before elections.

-

Kauffman index of entrepreneurial activity

The performance of Kansas in entrepreneurial activity is not high, compared to other states.

-

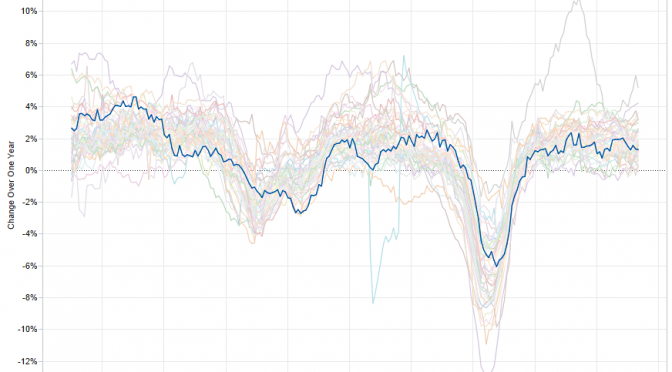

Kansas economy has been lagging for some time

Critics of tax reform in Kansas point to recent substandard performance of the state’s economy. The recent trend, however, is much the same as the past.

-

Debunking CBPP on tax reform and school funding — Part 4

States that spend less, tax less — and grow more, writes Dave Trabert of Kansas Policy Institute.

-

Myth: The Kansas tax cuts haven’t boosted its economy

While tax reform hasn’t produced the “shot of adrenaline” predicted by Governor Brownback, the problem is one of political enthusiasm rather than economics, writes Dave Trabert of Kansas Policy Institute.

-

Renewables portfolio standard bad for Kansas economy, people

A report submitted to the Kansas Legislature claims the Kansas economy benefits from the state’s Renewables Portfolio Standard, but an economist presented testimony rebutting the key points in the report.

-

CBPP misleading Kansans on revenue

Center on Budget and Policy Priorities is spreading false information about State of Kansas revenues.

-

In Kansas, tax giveaways for job creation found ineffective

Kansas has forked over millions in tax breaks since 2009, but new research says it has been ineffective at accomplishing its main goal: Creating new jobs.