Tag: Capitalism

-

Intellectuals vs. the rest of us

Why are so many opposed to private property and free exchange — capitalism, in other words — in favor of large-scale government interventionism? Lack of knowledge, or ignorance, is one answer, but there is another.

-

Wichita Chamber speaks on county spending and taxes

The Wichita Metro Chamber of Commerce urges spending over fiscally sound policies and tax restraint in Sedgwick County.

-

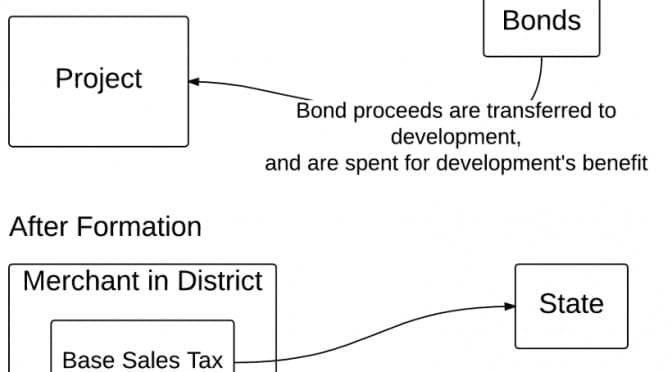

In Wichita, benefitting from your sales taxes, but not paying their own

A Wichita real estate development benefits from the sales taxes you pay, but doesn’t want to pay themselves.

-

The real free lunch: Markets and private property

As we approach another birthday of Milton Friedman, here’s his article where he clears up the authorship of a famous aphorism, and explains how to really get a free lunch

-

Friedman: Laws that do harm

As we approach another birthday of Milton Friedman, here’s his column from Newsweek in 1982 that explains that despite good intentions, the result of government intervention often harms those it is intended to help.

-

Are you in the top 1%?

Most Americans would be surprised to learn that they are, in fact, in the top one percent of income — when the entire world is considered. It is economic freedom in America that has been responsible for this high standard of living. But America’s ranking among the countries in economic freedom has declined, and may…

-

More government spending is not a source of prosperity

Kansas needs to trim state government spending so that its economy may grow by harnessing the benefits of the private sector over government.

-

No-bid contracts still passed by Wichita city council

Despite a policy change, the Wichita city council still votes for no-bid contracts paid for with taxpayer funds.

-

A Wichita Shocker, redux

Based on events in Wichita, the Wall Street Journal wrote “What Americans seem to want most from government these days is equal treatment. They increasingly realize that powerful government nearly always helps the powerful …” But Wichita’s elites don’t seem to understand this.