Tag: Economic development

-

Naftzger Park construction manager

The City of Wichita seeks a construction manager for the construction of Naftzger Park.

-

Naftzger Park contract: Who is in control?

The City of Wichita says it retains final approval on the redesign of Naftzger Park, but a contract says otherwise.

-

Downtown Wichita gathering spaces that don’t destroy a park

Wichita doesn’t need to ruin a park for economic development, as there are other areas that would work and need development.

-

Wichita in the Wall Street Journal

A Wall Street Journal article reports on Wichita, but there are a few issues with quotes from the mayor.

-

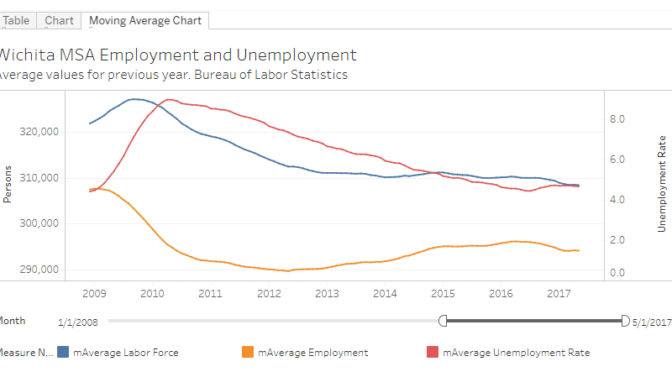

Wichita employment trends

While the unemployment rate in the Wichita metropolitan area has been declining, the numbers behind the decline are not encouraging.

-

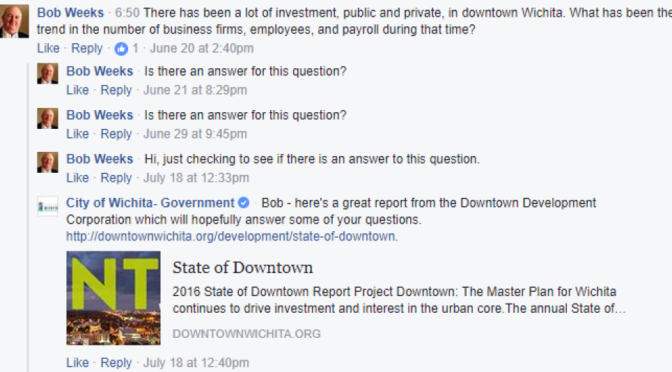

A Wichita social media town hall

A City of Wichita town hall meeting ends in less than nine minutes, with a question pending and unanswered.

-

Naftzger Park tax increment financing (TIF)

Background on tax increment financing (TIF) as applied to Naftzger Park in downtown Wichita.

-

Upcoming Naftzger Park legislative action

The redesign of Naftzger Park in downtown Wichita is not a done deal, at least not legally.

-

Wichita MSA employment series

Charts of employment in the Wichita metro area, along with Kansas and the United States.

-

Wichita WaterWalk contract not followed, again

Wichita city hall failed to uphold the terms of a development agreement from five years ago, not monitoring contracts that protect the public interest.

-

In Wichita, new stadium to be considered

The City of Wichita plans subsidized development of a sports facility as an economic driver.

-

More Cargill incentives from Wichita detailed

More, but likely not all, of the Cargill incentives will be before the Wichita City Council this week.