In Community Improvement Districts (CID), merchants charge additional sales tax for the benefit of the property owners, instead of the general public. Wichita may have an additional three, contributing to the problem of CID sprawl.

This week the Wichita City Council will hold public hearings considering the formation of three Community Improvement Districts. In Kansas Community Improvement Districts, merchants charge additional sales tax for the benefit of the property owners, instead of the general public.

Each of these CIDs will charge customers additional sales tax, with a cap on the amount that may be raised, and a separate cap on the length of the CID. For the three projects this week, here are the details:

Delano Catalyst CID: 2% additional tax, raising up to $3,000,000, up to 22 years

Spaghetti Works CID: 2% additional tax, raising up to $3,118,504, up to 22 years

Chicken N Pickle CID: 1.5% additional tax, raising up to $2,300,000, up to 15 years

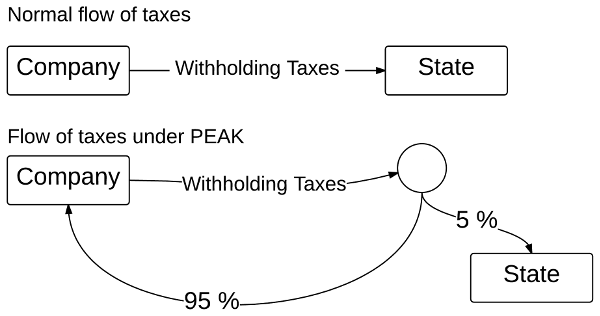

All these CIDs are of the pay-as-you-go type, which means the city is not borrowing money that would be repaid by the CID tax proceeds. Instead, the CID tax proceeds are periodically sent to the landowners as they are collected. The city retains a 5% administrative fee.

Additionally, two of these CIDs earmark 10% of the CID tax collections for public benefits, which are extra park maintenance for the Spaghetti Works CID, and street improvements for the Chicken N Pickle CID. While these earmarks may seem magnanimous gestures, they directly work to the developers’ benefit. For Spaghetti Works, Naftzger Park is, in effect, becoming the front yard to a development. It will be of great benefit for it to be maintained well, especially considering that the developers will be able to close the park for private events. For the Chicken N Pickle CID, the street improvements the CID will fund are usually paid for by special tax assessments on the nearby landowners, which in this case is the Chicken N Pickle. This is a large savings.

By the way, none of the applications for these economic development incentives pleads economic necessity. They simply want more money, and are willing to let government take the blame when customers notice they’re paying 9% or 9.5% sales tax in these districts.

Of additional note: The Delano and Spaghetti Works developments are receiving many millions of taxpayer-provided subsidy from other economic development incentive programs.

It will be interesting to see how the council’s two new members, Brandon Johnson (district 1, northeast Wichita) and Cindy Claycomb (district 6, north central Wichita), will vote in these matters. As Progressives, we might expect them to be opposed to higher sales taxes, which affect low-income households disproportionally. We also might expect them to be opposed to targeted tax incentives for the “wealthy,” such as the now-defunct exemption on pass-through business income in Kansas. Here, they are asked to vote on a highly targeted tax incentive that will benefit identifiable wealthy parties.

Issues regarding CID

Perhaps the most important public policy issue regarding CIDs is this: If merchants feel they need to collect additional revenue from their customers, why don’t they simply raise their prices? But the premise of this question is not accurate, as it is not the merchants who receive CID funds. The more accurate question is why don’t landlords raise their rents? That puts them at a competitive disadvantage with property owners that are not within CIDs. Better for us, they rationalize, that unwitting customers pay higher sales taxes for our benefit.

Consumer protection

Customers of merchants in CIDS ought to know in advance that an extra CID tax is charged. Some have recommended warning signage that protects customers from unknowingly shopping in stores, restaurants, and hotels that will be adding extra sales tax to purchases. Developers who want to benefit from CID money say that merchants object to signage, fearing it will drive away customers.

State law is silent on this. The City of Wichita requires a sign indicating that CID financing made the project possible, with no hint that customers will pay additional tax, or how much extra tax. The city also maintains a website showing CIDs. This form of notification is so weak as to be meaningless. See Wichita community improvement districts should have warning signs and In Wichita, two large community improvement districts proposed. In the latter, future Wichita Mayor Jeff Longwell argued that signs showing different tax rates for different merchants would be confusing. Council Member Sue Schlapp said she supported transparency in government, but informing consumers of extra taxes would make the program “useless.”

Eligible costs

One of the follies in government economic development policy is the categorization of costs into eligible and non-eligible costs. The proceeds from programs like CIDs and tax increment financing may be used only for costs in the “eligible” category. I suggest that we stop arbitrarily distinguishing between “eligible costs” and other costs. When city bureaucrats and politicians use a term like “eligible costs” it makes this process seem benign. It makes it seem as though we’re not really supplying corporate welfare and subsidy.

As long as the developer has to spend money on what we call “eligible costs,” the fact that the city subsidy is restricted to these costs has no economic meaning. Suppose I gave you $10 with the stipulation that you could spend it only on next Monday. Would you deny that I had enriched you by $10? Of course not. As long as you were planning to spend $10 next Monday, or could shift your spending from some other day to Monday, this restriction has no economic meaning.

Notification and withdrawal

If a merchant moves into an existing CID, how might they know beforehand that they will have to charge the extra sales tax? It’s a simple matter to learn the property taxes a piece of property must pay. But if a retail store moves into a vacant storefront in a CID, how would this store know that it will have to charge the extra CID sales tax? This is an important matter, as the extra tax could place the store at a competitive disadvantage, and the prospective retailer needs to know of the district’s existence and its terms.

Then, if a business tires of being in a CID — perhaps because it realizes it has put itself at a competitive disadvantage — how can the district be dissolved?

The nature of taxation

CIDs allow property owners to establish their own private taxing district for their exclusive benefit. This goes against the grain of the way taxes are usually thought of. Generally, we use taxation as a way to pay for services that everyone benefits from, and from which we can’t exclude people. An example would be police protection. Everyone benefits from being safe, and we can’t exclude people from participating in — and benefiting from — police protection.

But CIDs allow taxes to be collected for the benefit of one specific entity. This goes against the principle of broad-based taxation to pay for an array of services for everyone. But in this case, the people who benefit from the CID are quite easy to identify: the property owners in the district.

—

Notes

Many will undoubtedly cheer the Spirit announcement as an economic development win on a large scale. It will add many jobs. But the Wichita-area economy is so far behind it will take much more growth than this to catch up with the rest of the nation. In fact, the Wichita-area economy shrank last year.

Many will undoubtedly cheer the Spirit announcement as an economic development win on a large scale. It will add many jobs. But the Wichita-area economy is so far behind it will take much more growth than this to catch up with the rest of the nation. In fact, the Wichita-area economy shrank last year.