Tag: Elections

-

Stuck in the box in Wichita, part one

To pay for a new water supply, Wichita gives voters two choices and portrays one as bad. But the purportedly bad choice is the same choice the city made over the last decade to pay for the last big water project. We need out-of-the-box thinking here.

-

Water, economic development discussed in Wichita

Dr. Art Hall, Executive Director of the Center for Applied Economics at the University of Kansas School of Business, presented a lecture on water and economic development in light of the proposed Wichita sales tax.

-

WichitaLiberty.TV: Anita MonCrief, the whistleblower who exposed fraud at ACORN

In this episode of WichitaLiberty.TV: Anita MonCrief joins host Bob Weeks. She’s the whistleblower who exposed fraud at ACORN during the 2008 elections.

-

Before spending on new infrastructure, Wichita voters should ask why so much deferred maintenance

As the City of Wichita asks for more tax money for infrastructure, Wichita voters need to be aware of the projected costs of the city’s deferred maintenance.

-

Fact-checking Yes Wichita: Arithmetic

A group promoting the proposed Wichita sales tax makes an arithmetic error, which gives us a chance to ask a question: Is this error an indication of Yes Wichita and the city’s attitude towards, and concern for, factual information?

-

WichitaLiberty.TV: Wichita’s blatant waste, Transforming Wichita, and how you can help

Let’s ask that Wichita trim its blatant waste of tax dollars before asking for more. We’ll look back at a program called Transforming Wichita. Then: We need to hold campaigns accountable. I’ll give you examples why, and tell how you can help.

-

Fact-checking Yes Wichita: NetApp incentives

In making the case that economic development incentives are necessary and successful in creating jobs, a Wichita campaign overlooks the really big picture.

-

Fact-checking Yes Wichita: Paved streets

Will the proposed Wichita sales tax result in more paved streets? It depends on what you mean by “pave.”

-

Kansas campaign material repository

An accessible collection of campaign material will help hold candidates and campaigns accountable.

-

Welcome back, Gidget

Gidget stepped away for a few months, but happily she is back writing about Kansas politics at Kansas GOP Insider (wannabe).

-

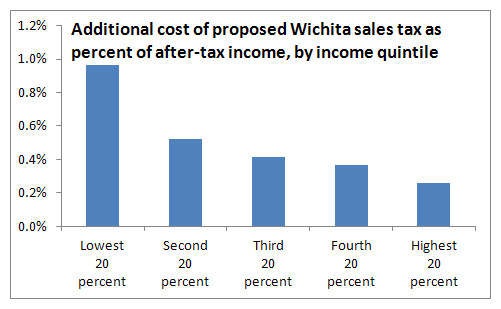

Wichita sales tax hike would hit low income families hardest

Analysis of household expenditure data shows that a proposed sales tax in Wichita affects low income families in greatest proportion, confirming the regressive nature of sales taxes.

-

U.S. Rep. Mike Pompeo

On the Joseph Ashby Show, United States Representative Mike Pompeo appeared two days after election day. Bob Weeks is the guest host.