Tag: Featured

-

Forget the vampires. Let’s tackle the real monsters.

Public service announcements on Facebook and Wichita City Channel 7 urge Wichitans to take steps to stop “vampire” power waste. But before hectoring people to introduce inconvenience to their lives in order to save small amounts of electricity, the city should tackle the real monsters of its own creation.

-

Voice for Liberty Radio: Sedgwick County Commission Candidates

In this episode of Voice for Liberty Radio: Candidates for Republican party nominations in two districts for Sedgwick County Commission spoke at the Wichita Pachyderm Club on June 20, 2014.

-

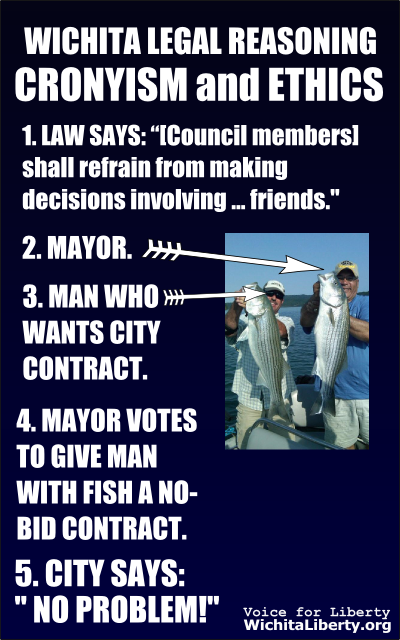

WichitaLiberty.TV: The harm of cronyism, local and national

Does Wichita have a problem with cronyism? The mayor, city council, and bureaucrats say no, but you can decide for yourself. Then, from LearnLiberty.org, the harm of cronyism at the national level.

-

Wichita city council schools citizens on civic involvement

Proceedings of a recent Wichita City Council meeting are instructive of the factors citizens should consider if they want to interact with the council and city government at a public hearing.

-

In Wichita, a public hearing with missing information

The Wichita City Council is holding a public hearing, but citizens don’t have information that would be useful if they’re interested in conducting oversight.

-

Would you rent space from this landlord?

Commercial retail space owned by the City of Wichita in a desirable downtown location was built to be rented. But most is vacant, and maintenance issues go unresolved.

-

Voice for Liberty Radio: U.S. Senate candidate Dr. Milton Wolf

In this episode of Voice for Liberty Radio: Candidate for United States Senate Dr. Milton Wolf spoke to the Wichita Pachyderm Club on Friday June 13

-

Wichita advances in the field of cost savings

With only two of the four sidewalk bench lights illuminating the sidewalk despite the cloudless midday sky, there is good news.

-

WichitaLiberty.TV: Tech advice for activism, then a lesson in economic development in Wichita

In this episode of WichitaLiberty.TV: A few tips on using your computer and the internet. Then, how to be informed. Finally, a look at a recent episode of economic development in Wichita, and what we can we learn from that.

-

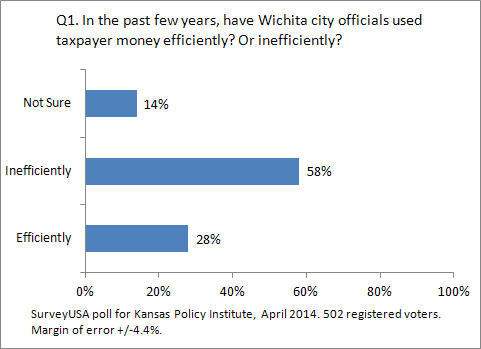

Before asking for more taxes, Wichita city hall needs to earn trust

Before Wichita city hall asks its subjects for more tax revenue, it needs to regain the trust of Wichitans.

-

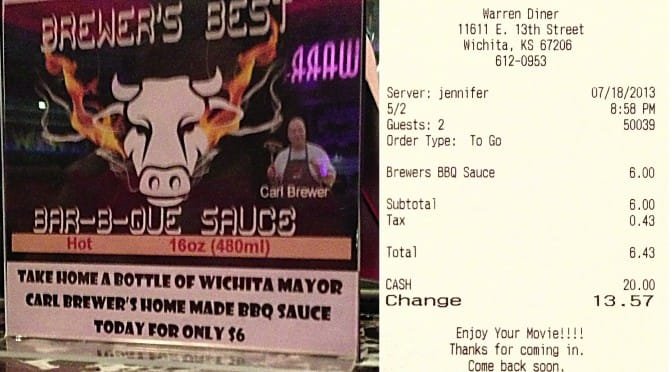

Problems with the Wichita economy. Is it cronyism?

The Wichita economy has not performed well. Could cronyism be a contributing factor? Mayor Carl Brewer says it’s time to put politics and special interests aside. Is our political leadership capable of doing this?

-

Wichita voter opinion on city spending and taxation

Wichita voters give their opinions on city spending, subsidies for economic development, and their willingness to pay higher taxes for certain services.