Tag: Featured

-

Year in Review: 2017

Here are highlights from Voice for Liberty and WichitaLiberty.TV for 2017.

-

WichitaLiberty.TV: Radio Host Andy Hooser

Radio Host Andy Hooser of the Voice of Reason appears with Bob Weeks to discuss issues in state and national political affairs.

-

From Pachyderm: Local legislative priorities

From the Wichita Pachyderm Club: Local government officials present their legislative priorities.

-

From Pachyderm: KPTS Chief Victor Hogstrom

From the Wichita Pachyderm Club: KPTS President and CEO Victor Hogstrom. This was recorded December 15, 2017.

-

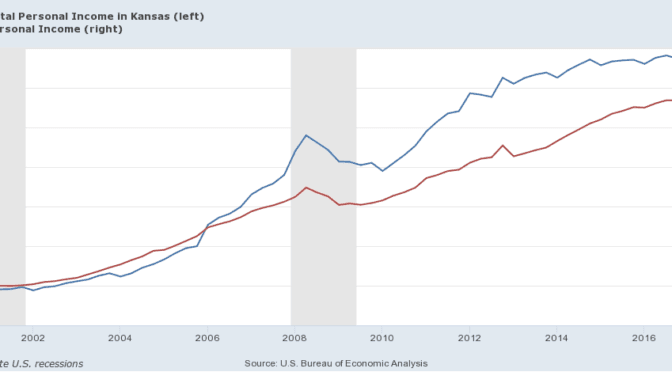

Kansas personal income

For the country as a whole, personal income grew at the annual rate of 0.7 percent from the previous quarter. For Kansas, the rate was 0.3 percent. That was the forty-seventh best rate.

-

Naftzger Park project details

The city has finalized a proposal for a development near Naftzger Park. It includes a few new and creative provisions.

-

WichitaLiberty.TV: Judicial selection in Kansas

Attorney Richard Peckham joins Karl Peterjohn and Bob Weeks to discuss judicial selection and other judicial issues in Kansas.

-

Panhandling in Wichita

The City of Wichita cracks down on panhandling.

-

Wichita check register

Wichita spending data presented as a summary, and as a list.

-

Delano catalyst site

A development near downtown Wichita may receive subsidy through four different avenues.

-

Spirit Aerosystems incentives reported

Opinions vary on economic development incentives, but we ought to expect to be told the truth of the details.

-

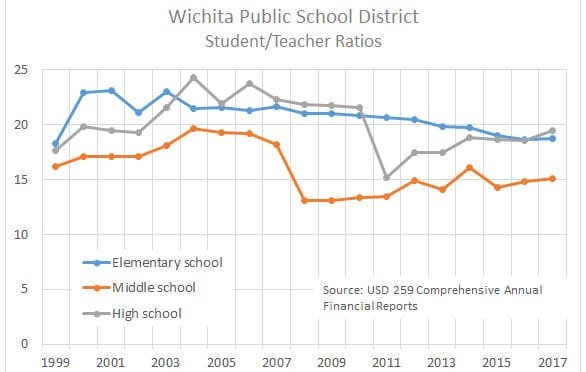

Wichita school student/teacher ratios

During years of purported budget cuts, what has been the trend of student/teacher ratios in the Wichita public school district?