Tag: Featured

-

WichitaLiberty.TV: Health care in Kansas and taxes in Sedgwick County

In this episode of WichitaLiberty.TV: Bob Weeks and Karl Peterjohn discuss health care in Kansas and taxes in Sedgwick County.

-

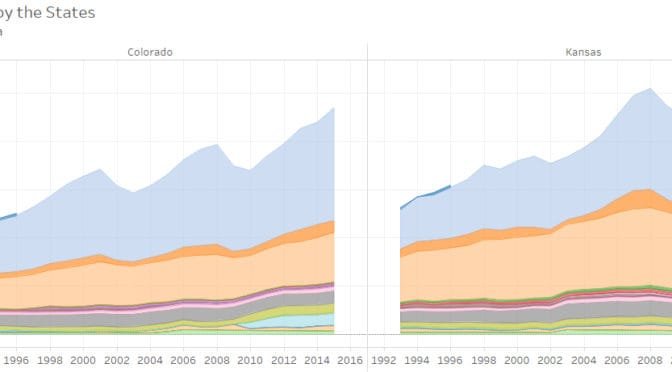

Tax collections by the states

An interactive visualization of tax collections by state governments.

-

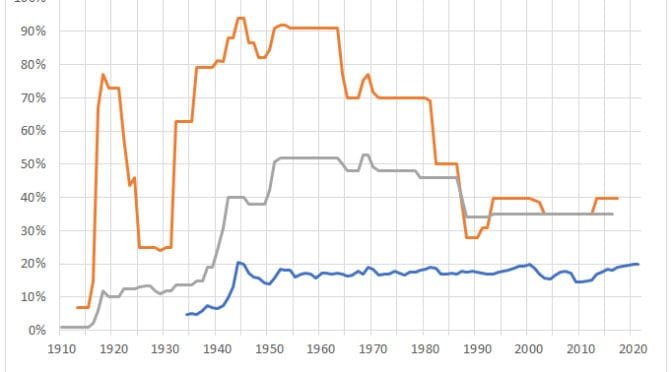

Tax rates and taxes paid

Is there a relationship between marginal tax rates and tax dollars collected?

-

Kansas House voting on Medicaid expansion

How members of the Kansas House of Representatives voted on the three votes concerning Medicaid expansion in Kansas.

-

Kansans are concerned about the level of state spending on schools

A public opinion poll asks whether Kansans are concerned about school spending, but leaves us wondering why they are concerned.

-

WichitaLiberty.TV: The regulatory and administrative state

Fred L. Smith, Jr. is the founder of the Competitive Enterprise Institute. He explains the problems with excessive regulation and a large administrative state.

-

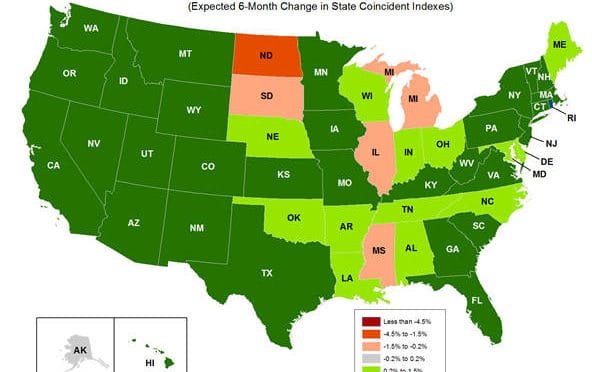

Economic indicators for the states

An index of past economic activity for each state, and another index looking forward.

-

Jeff Glendening of Americans for Prosperity

Jeff Glendening is Kansas State Director for Americans for Prosperity. He spoke on the topic “It’s Time to Wake Up!”

-

WichitaLiberty.TV: Ben Jones on the death penalty in Kansas

Ben Jones of Equal Justice USA and Conservatives Concerned about the Death Penalty explains issues surrounding the death penalty.

-

For Wichita Eagle, no concern about relationships

Should the Wichita Eagle, a city’s only daily newspaper and the state’s largest, be concerned about the parties to its business relationships?

-

Sedgwick County to consider raising debt limit

This week the Sedgwick County Commission will consider raising its limit on borrowing for reasons which need to be revealed, and then carefully examined.

-

Sedgwick County may abolish scheduled tax decrease

The Sedgwick County Commission had scheduled a reduction in the property tax rate, but may abandon it.