Tag: Featured

-

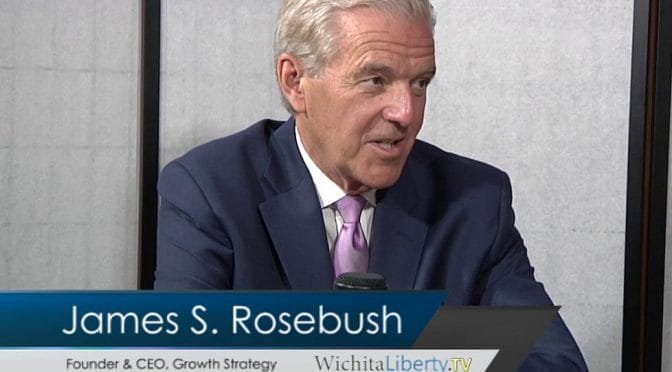

WichitaLiberty.TV: James Rosebush, author of ‘True Reagan’

James S. Rosebush worked in the White House as assistant to President Ronald Reagan. He’s written a book about Reagan titled “True Reagan: What Made Ronald Reagan Great and Why It Matters.”

-

Kansas Supreme Court: Making law, part 2

Do the justices on the Kansas Supreme Court make new law? Yes, and here is an example.

-

WichitaLiberty.TV: Cost of Kansas schools, government schools, and understanding Kansas school outcomes

Is it true that some Kansas schoolchildren have no hope of attending a private school? What’s wrong with government schools? Then a talk on “Rethinking Education Tomorrow Starts with Understanding Outcomes Today.”

-

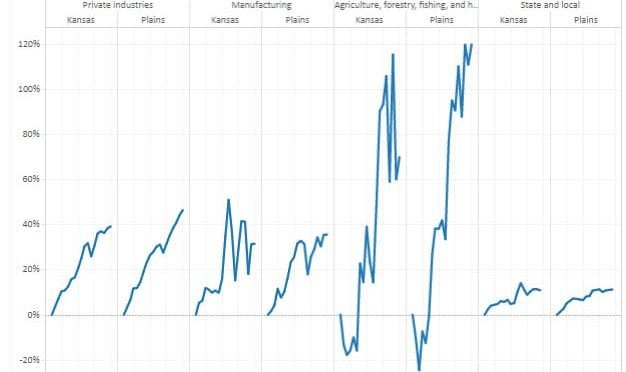

GDP by state and industry

An interactive visualization of gross domestic product by state and industry.

-

Kansas Supreme Court: Selecting Judges

While many believe that judges should not “legislate from the bench,” that is, make law themselves, the reality is that lawmaking is a judicial function.

-

From Wichita Pachyderm: Kansas House candidates

From the Wichita Pachyderm Club this week: Republican candidates for the Kansas House of Representatives participated in a candidate forum. This is an audio presentation recorded on June 17, 2016.

-

A Kansas school superintendent writes about school finance

A Kansas school superintendent explains school financing, but leaves out a large portion of the funds that flow to his district.

-

‘Game on’ makes excuses for Kansas public schools

Even if NAEP “proficient” is a lofty goal, it illustrates the shortcomings of Kansas public schools, especially for minority students.

-

A plea to a legislator regarding Kansas schools

On Facebook, a citizen makes an appeal to her cousin, who is a member of the Kansas Legislature.

-

They really are government schools

What’s wrong with the term “government schools?”

-

From Pachyderm: Sedgwick County Commission candidates

From the Wichita Pachyderm Club this week: A forum featuring Republican primary election candidates for Board of Sedgwick County Commissioners. This is an audio recording made on June 6, 2016.