Tag: Featured

-

What else can Wichita do for downtown companies?

With all Wichita has done, it may not be enough.

-

In Wichita, revealing discussion of property rights

Reaction to the veto of a bill in Kansas reveals the instincts of many government officials, which is to grab more power whenever possible.

-

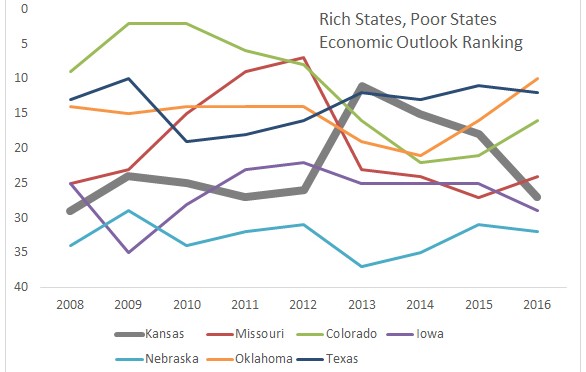

Rich States, Poor States, 2106 edition

In Rich States, Poor States, Kansas continues with middle-of-the-pack performance, and fell sharply in the forward-looking forecast.

-

Governor Brownback steps up for property rights

Senate Bill 338 opens the door for serious abuse in Kansas. Governmental authority to take property from one private citizen and give it to another private citizen should be limited, but this bill would have the effect of expanding such authority without adequate safeguards, wrote Kansas Governor Sam Brownback in his veto message.

-

Wichita economic development and capacity

An expansion fueled by incentives is welcome, but illustrates a larger problem with Wichita-area economic development.

-

Sedgwick County District Attorney Marc Bennett

Sedgwick County District Attorney Marc Bennett spoke to the Wichita Pachyderm Club, providing an update on the activities in his office.

-

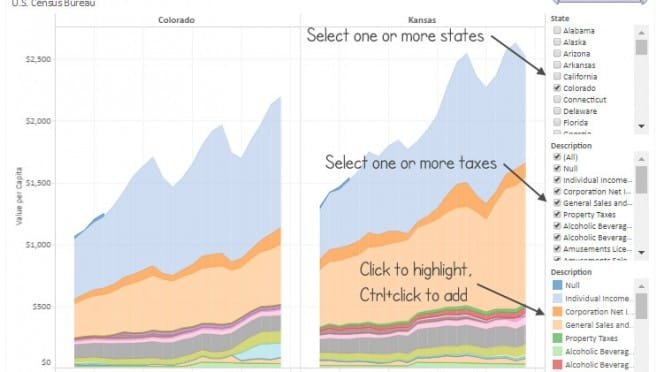

Tax collections by the states

An interactive visualization of tax collections by state governments.

-

Northwest High prank, some underlying facts

Instead of pranking, Wichita public school students and their leaders might consider a few facts.

-

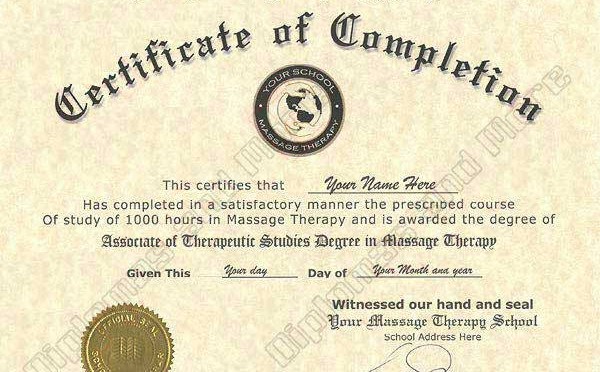

Wichita on verge of new regulatory regime

The Wichita City Council is likely to create a new regulatory regime for massage businesses in response to a problem that is already addressed by strict laws.

-

WichitaLiberty.TV: Markets or government, legislative malpractice, and education reform

Do corporations prefer markets or big government? Legislative malpractice in Kansas. Education reform, or lack thereof.

-

Governor Brownback, please veto this harmful bill

Kansas Governor Sam Brownback should veto a bill that is harmful to property rights, writes John Todd.

-

WichitaLiberty.TV: Bob’s shaking his head, Wichita water woes, and the harm of teachers unions

There are a few things that make Bob wonder. Then, a troubling episode for Wichita government and news media. Finally, the harm of teachers unions.