Tag: Featured

-

WichitaLiberty.TV: The caucus and the presidency, Wichita prepares a new regulatory regime

Looking back at the Kansas presidential caucus and should it matter who becomes president. A new regulatory regime in Wichita probably won’t help its stated purpose, but will be harmful. Then, more about regulation.

-

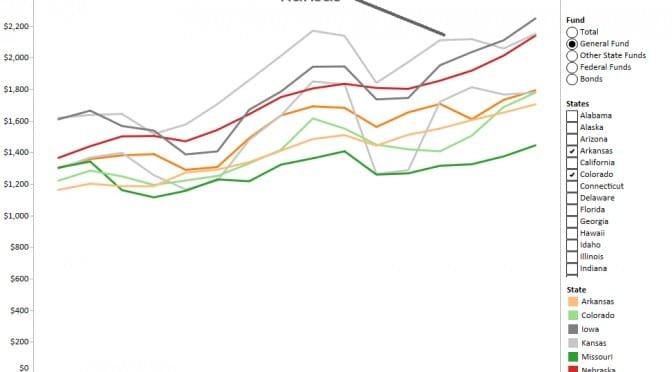

Spending in the states, per capita

An interactive visualization of per-capita spending in the states, by fund.

-

In Kansas, teachers unions should stand for retention

A bill requiring teachers union to stand for retention elections each year would be good for teachers, students, and taxpayers.

-

Kansas should adopt food sales tax amendment

A proposed constitutional amendment would reduce, then eliminate, the sales tax on food in Kansas.

-

WichitaLiberty.TV: Super Tuesday wrap up

In this episode of WichitaLiberty.TV: Radio show hosts Joseph Ashby and Andy Hooser join Bob Weeks to discuss Super Tuesday results and the contests going forward. Episode 112, broadcast March 6, 2016.

-

Wichita: A conversation for a positive community and city agenda

Wichita City Manager Robert Layton held a discussion titled “What are Wichita’s Strengths and Weaknesses: A Conversation for a Positive Community and City Agenda.”

-

Should the U.S. implement austerity measures?

Should the U.S. implement austerity measures due to the size of the national debt?

-

Wichita economic development items this week

Two economic development items on tap in Wichita this week illustrate failures or shortcomings of the regime.

-

Wichita to impose burdensome occupational requirements

The proposed massage therapist regulations in Wichita are likely to be ineffective, but will limit economic opportunity and harm consumers.

-

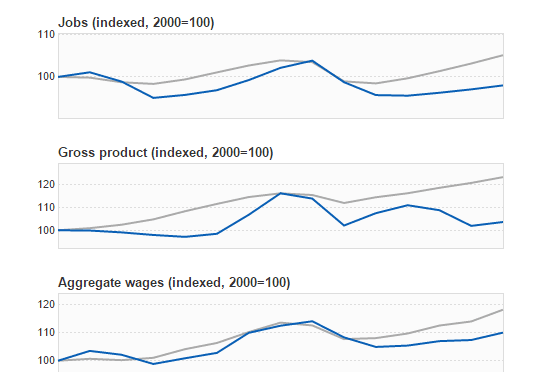

Brookings Metro Monitor and Wichita

A research project by The Brookings Institution illustrates the poor performance of the Wichita-area economy.

-

WichitaLiberty.TV: Heritage Foundation’s Bryan Riley on free trade

Foreign trade is an important issue in this year’s presidential campaign. Heritage Foundation economist and Senior Policy Analyst Bryan Riley explains concepts that voters can use in making an informed decision.

-

Kansas highway spending

An op-ed by an advocate for more highway spending in Kansas needs context and correction.