Tag: Featured

-

WichitaLiberty.TV: Debate expert Rodney Wren

Debate expert Rodney Wren joins Bob Weeks to discuss the presidential debates and nomination contest.

-

Kansas Senate President Susan Wagle

Kansas Senate President Susan Wagle spoke to members and guests of the Wichita Pachyderm Club on Friday December 18, 2015.

-

Survey finds Kansans with little knowledge of school spending

As in years past, a survey finds that when Kansans are asked questions about the level of school spending, few have the correct information.

-

Employment by metropolitan area

An interactive visualization of employment in metropolitan areas.

-

WichitaLiberty.TV: Radio talk show host Joseph Ashby

Radio talk show host Joseph Ashby visits the WichitaLiberty.TV studios to help us understand the Republican presidential debate and nomination contest.

-

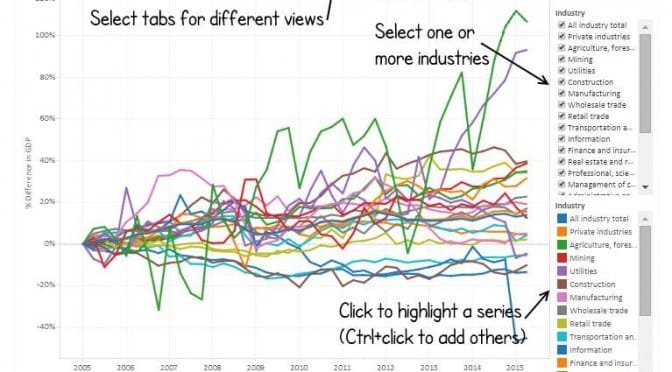

GDP by state and industry

An interactive visualization of a new data series from the Bureau of Economic Analysis.

-

WichitaLiberty.TV: Wichita’s attitude towards empowering citizens, tax credits, and school choice

The City of Wichita’s attitude towards empowering citizens, government spending through tax credits, and school choice in Kansas.

-

Kansas school reform

A Wichita economist and attorney offers advice to a committee of the Kansas Legislature on reforming Kansas schools for student achievement.

-

Wichita checkbook register

A records request to the City of Wichita results in data as well as insight into the city’s attitude towards empowering citizens with data.

-

Kansas Legislature and Elections: 2016 Preview

Natalie Bright and Marlee Carpenter of Bright and Carpenter Consulting briefed the Wichita Pachyderm Club on the results of the 2015 session of the Kansas Legislature, and what to look for in next year’s session and elections.

-

WichitaLiberty.TV: Wichita outreach, city council, and entrepreneurship

A look at Wichita community outreach and communications, rewriting city council history, and entrepreneurship.

-

Wichita to consider tax abatements

Wichita considers three tax abatements, in one case forcing an “investment” on others that it itself would not accept.