Tag: Featured

-

The Kansas economy and agriculture

There’s no need for Kansas state government to exaggerate the value of agriculture to the Kansas economy.

-

Wichita Business Journal reporting misses the point

Reporting by the Wichita Business Journal regarding economic development incentives in Wichita makes a big mistake in overlooking where the real money is.

-

WichitaLiberty.TV: Debate expert Rodney Wren and the presidential debates

Debate and communications coach and expert Rodney Wren explains the recent presidential debate. What should viewers look for as they watch?

-

Kansas schools ask to fund extraordinary needs

Asking taxpayer-funded entities whether they are operating efficiently is a perfectly legitimate question that, frankly, should be the starting point of every budget discussion. That some find it offensive is indication that the issue should be much more aggressively pursued across government, writes Dave Trabert of Kansas Policy Institute.

-

Kansas Budget Director Shawn Sullivan

Kansas State Budget Director Shawn Sullivan spoke at the Wichita Pachyderm Club on August 21, 2015.

-

Kansas school standards found lower than in most states

A second study finds that Kansas uses low standards for evaluating the performance of students in its public schools.

-

Wichita property tax delinquency problem not solved

Despite a government tax giveaway program, problems with delinquent special assessment taxes in Wichita have become worse.

-

Intellectuals vs. the rest of us

Why are so many opposed to private property and free exchange — capitalism, in other words — in favor of large-scale government interventionism? Lack of knowledge, or ignorance, is one answer, but there is another.

-

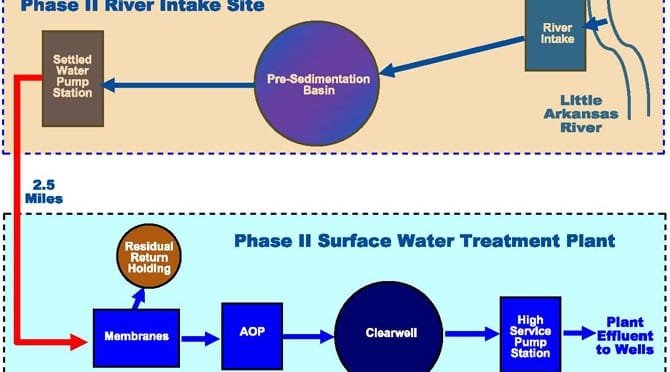

Wichita water statistics update

The Wichita ASR water project produced little water in July, continuing to fail to produce water at the projected rate or design capacity.

-

WichitaLiberty.TV: Rodger Woods of Americans for Prosperity-Kansas

Americans for Prosperity is one of the largest grassroots political action groups. Its motto is “Economic Freedom in Action.” Rodger Woods, deputy state director for AFP-Kansas, joins me to explain AFP’s mission and goals, and some specific issues.

-

Wichita Chamber speaks on county spending and taxes

The Wichita Metro Chamber of Commerce urges spending over fiscally sound policies and tax restraint in Sedgwick County.

-

Cost of restoring quality of life spending cuts in Sedgwick County: 43 deaths

An analysis of public health spending in Sedgwick County illuminates the consequences of public spending decisions. In particular, those calling for more spending on zoos and arts must consider the lives that could be saved by diverting this spending to public health, according to analysis from Kansas Health Institute.