Tag: Kansas legislature

-

From Pachyderm: Kansas Senate President Susan Wagle

Kansas Senate President Susan Wagle addressed members and guests of the Wichita Pachyderm Club on November 10, 2017. School finance and the Kansas Supreme Court was a prominent topic.

-

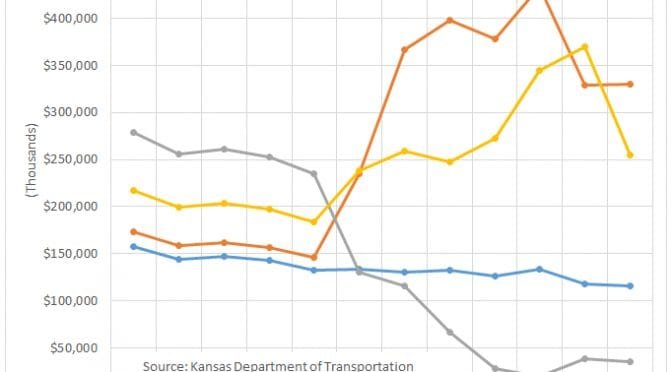

Kansas highway spending

A look at actual spending on Kansas highways, apart from transfers.

-

WichitaLiberty.TV: Kansas Speaker of the House Ron Ryckman

Speaker of the Kansas House of Representatives Ron Ryckman joins hosts Bob Weeks and Karl Peterjohn to discuss current governmental affairs in Kansas.

-

From Pachyderm: Kansas Secretary of Revenue Sam Williams

From the Wichita Pachyderm Club: Kansas Secretary of Revenue Sam Williams.

-

WichitaLiberty.TV: After the Kansas tax increases

Jonathan Williams, chief economist at American Legislative Exchange Council (ALEC), joins Bob Weeks and Karl Peterjohn to discuss what ALEC does, and then topics specific to Kansas.

-

Kansas legislative highlights for 2017

Kansas Legislative Research Department has released its annual highlights of legislation document for the 2017 session.

-

Happy Fiscal New Year, Kansas (not)

A Kansas public policy group celebrates tax increases. But it isn’t enough, and more reform is required.

-

Deconstructing Don Hineman

Another Kansas legislator explains why raising taxes was necessary. So he says.

-

WichitaLiberty.TV: Kansas Representative Susan Humphries

Kansas Representative Susan Humphries joins Bob Weeks and Karl Peterjohn to discuss issues in the Kansas Legislature. Humphries represents District 99 in far east Wichita and Andover, and just completed her first term.

-

Decoding Duane Goossen

When reading the writings of former Kansas State Budget Director Duane Goossen, it’s useful to have a guide grounded in reality.

-

WichitaLiberty.TV: Kansas Representative Leo Delperdang

Kansas Representative Leo Delperdang joins Bob Weeks and Karl Peterjohn to discuss issues in the Kansas Legislature. Delperdang represents District 94 in west Wichita, and just completed his first term.

-

Voting to raise taxes in Kansas

Printable tables of voting on legislation that raised taxes in Kansas.