Tag: Kansas legislature

-

In Kansas, sweeps to continue

Even though the Kansas Legislature raised taxes, sweeps from the highway fund will continue.

-

Kansas bills deserve the veto pen

Kansas Governor Sam Brownback may exercise a line item veto over any item in the just-passed budget and school spending bills. Here are a few ideas that deserve the veto.

-

The yardstick for the Kansas experiment

A politician’s boasting should not be the yardstick for policy.

-

WichitaLiberty.TV: James Franko, Kansas Policy Institute

In this episode of WichitaLiberty.TV: James Franko of Kansas Policy Institute joins Bob Weeks and Karl Peterjohn. Topics are the new Kansas school finance bill and the new tax bill.

-

WichitaLiberty.TV: Radio Host Andy Hooser

In this episode of WichitaLiberty.TV: Radio talk show host Andy Hooser joins Bob Weeks to discuss millennials, issues in Kansas state government, and the Donald Trump Presidency. Episode 151, broadcast May 21, 2017.

-

Explaining the Kansas budget, in a way

A video explaining the Kansas budget is accurate in many aspects, but portrays a false and harmful myth regarding school spending.

-

Medicaid expansion survey in Kansas

Should Kansans accept the results of a public opinion poll when little is known about it?

-

Breaking the statehouse budget deadlock

Kansas taxpayers need to have a say in the massive new spending schemes appearing at the statehouse, writes Karl Peterjohn.

-

WichitaLiberty.TV: Kansas Policy Institute President Dave Trabert

Kansas Policy Institute Dave Trabert joins Bob Weeks and Karl Peterjohn to discuss the Kansas economy, budget, and schools.

-

Rich States, Poor States, 2107 edition

In Rich States, Poor States, Kansas improves its middle-of-the-pack performance, but continues with a mediocre forward-looking forecast.

-

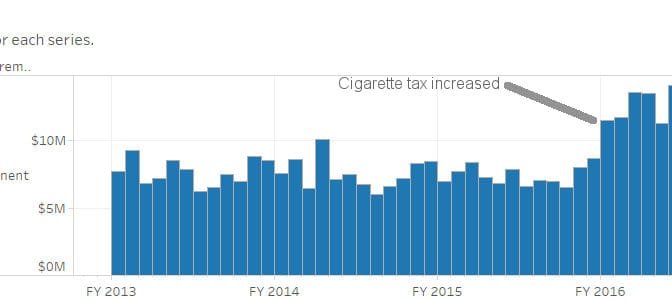

Kansas cigarette tax collections

Kansas raised the cigarette tax. What happened?

-

Cargill subsides start forming

Details of the subsidy programs used to keep Cargill in Wichita are starting to take shape.