Tag: Tax increment financing

-

How to turn $399,000 into $65,000 in downtown Wichita

Once embraced by Wichita officials as heroes, real estate listings for two floors of a downtown Wichita office building illustrate the carnage left behind by two developers

-

Downtown Wichita deal shows some of the problems with the Wichita economy

In this script from a recent episode of WichitaLiberty.TV: A look at the Wichita city council’s action regarding a downtown Wichita development project and how it is harmful to Wichita taxpayers and the economy.

-

WichitaLiberty.TV: A downtown Wichita deal shows some of the problems with the Wichita economy

In this episode of WichitaLiberty.TV: We’ll examine the city council’s action regarding a downtown Wichita development project and how it is harmful to Wichita taxpayers and the economy.

-

Exchange Place incentives, including free sales tax and an ethics bypass

A downtown Wichita project receives free sales taxes and a bypass of Wichita’s code of conduct for city council members.

-

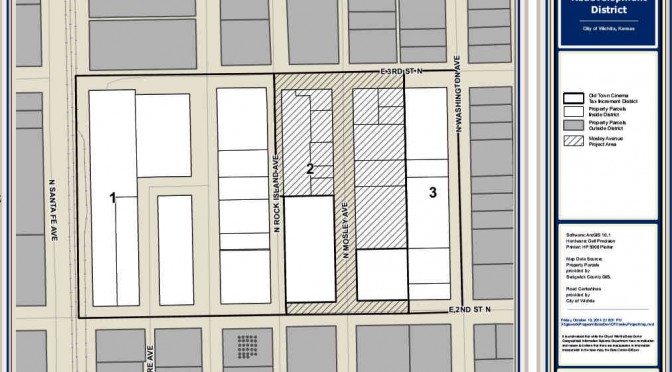

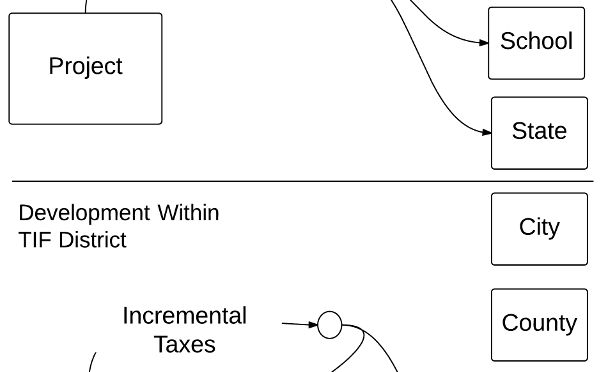

How TIF routes taxpayer-funded benefits to Wichita’s political players

In Wichita, tax increment financing (TIF) leads to taxpayer-funded waste that benefits those with political connections at city hall.

-

Community improvement districts in Kansas

In Kansas Community Improvement Districts, merchants charge additional sales tax for the benefit of the property owners, instead of the general public.

-

Wichita city hall falls short in taxpayer protection

An incentives agreement the Wichita city council passed on first reading is missing several items that city policy requires. How the council and city staff handle the second reading of this ordinance will let us know for whose interests city hall works: citizens, or cronies.

-

Wichita drops taxpayer protection clause

To protect itself against self-defeating appeals of property valuation in tax increment financing districts, the City of Wichita once included a protective clause in developer agreements. But this consideration is not present in two proposed agreements.

-

Tax increment financing (TIF) resources

Resources on tax increment financing (TIF) districts.

-

Wichita TIF projects: some background

Tax increment financing disrupts the usual flow of tax dollars, routing funds away from cash-strapped cities, counties, and schools back to the TIF-financed development. TIF creates distortions in the way cities develop, and researchers find that the use of TIF means lower economic growth.

-

Clawbacks illustrate difficulty of economic development

Politicians and government officials like clawbacks in economic development incentive agreements. But do these provisions have any negative aspects?