Tag: Taxation

-

Wichita City Council fails to support informing the taxed

What does it say about Wichita’s economic development strategy that if you fully inform citizens and visitors, it renders a tool useless?

-

Rural Kansans’ billion-dollar subsidy of wind farms

In addition to receiving taxpayer subsidies and benefiting from mandates to buy their product, wind power producers largely escape the burden of property taxes, writes Dave Trabert of Kansas Policy Institute.

-

In Wichita, if you don’t like it, just don’t go there

As Wichita city officials prepare a campaign to raise the sales tax in Wichita, let’s recall some council members’ attitude towards citizens.

-

State financial data, an interactive presentation

Selected statistics about state finances from the United States Census Bureau are presented in an interactive visualization.

-

WichitaLiberty.TV: Wichita’s city tourism fee, Special taxes for special people

The Wichita City Council will hold a meeting regarding an industry that wants to tax itself, but really is taxing its customers. Also, the city may be skirting the law in holding the meeting. Then: The Kansas Legislature is considering special tax treatment for a certain class of business firms. What is the harm in…

-

Pompeo on Obama budget

Rep. Mike Pompeo appeared on Stossel and told the host that President Obama’s budget will leave the U.S. begging for money down the road.

-

Wichita seeks to add more tax to hotel bills

The city of Wichita wants hotel guests to make a “marketing investment” in Wichita by paying a “City Tourism Fee.”

-

Special interests struggle to keep special tax treatment

When a legislature is willing to grant special tax treatment, it sets up a battle to keep — or obtain — that status.

-

WichitaLiberty.TV: Government planning, taxes, and carbon

The City of Wichita held a workshop where the Community Investments Plan Steering Committee delivered a progress report to the city council. The document holds some facts that ought to make Wichitans think, and think hard. Then: What is the purpose of high tax rates on high income earners? Finally: Advances in producing oil and…

-

Wichita planning documents hold sobering numbers

Planning documents released this week hold information that ought to make Wichitans think, and think hard. The amounts of money involved are large, and portions represent deferred maintenance. That is, the city has not been taking care of the assets that taxpayers have paid for.

-

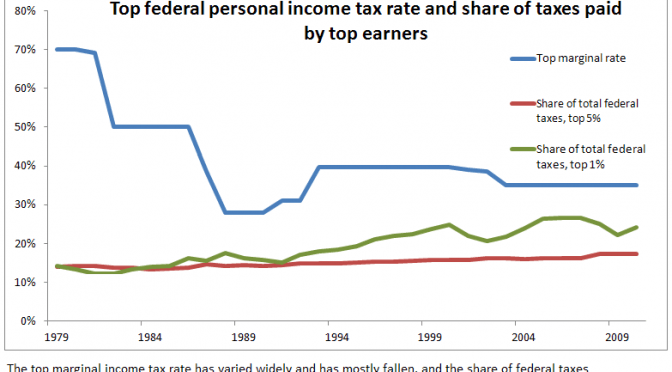

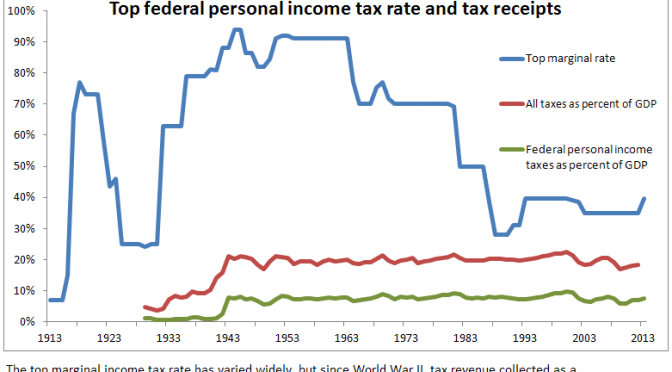

The relevance of income tax rates

Data shows that high tax rates on top earners doesn’t mean that they actually pay taxes at correspondingly higher rates.

-

The purpose of high tax rates on the rich

The purpose of high taxes on the rich is not to get the rich to pay money, it’s to get the middle class to feel better about paying high taxes.