Tag: Taxation

-

Wichita presents industrial revenue bonds

A presentation by the City of Wichita regarding IRBs is good as far as it goes, which is not far enough.

-

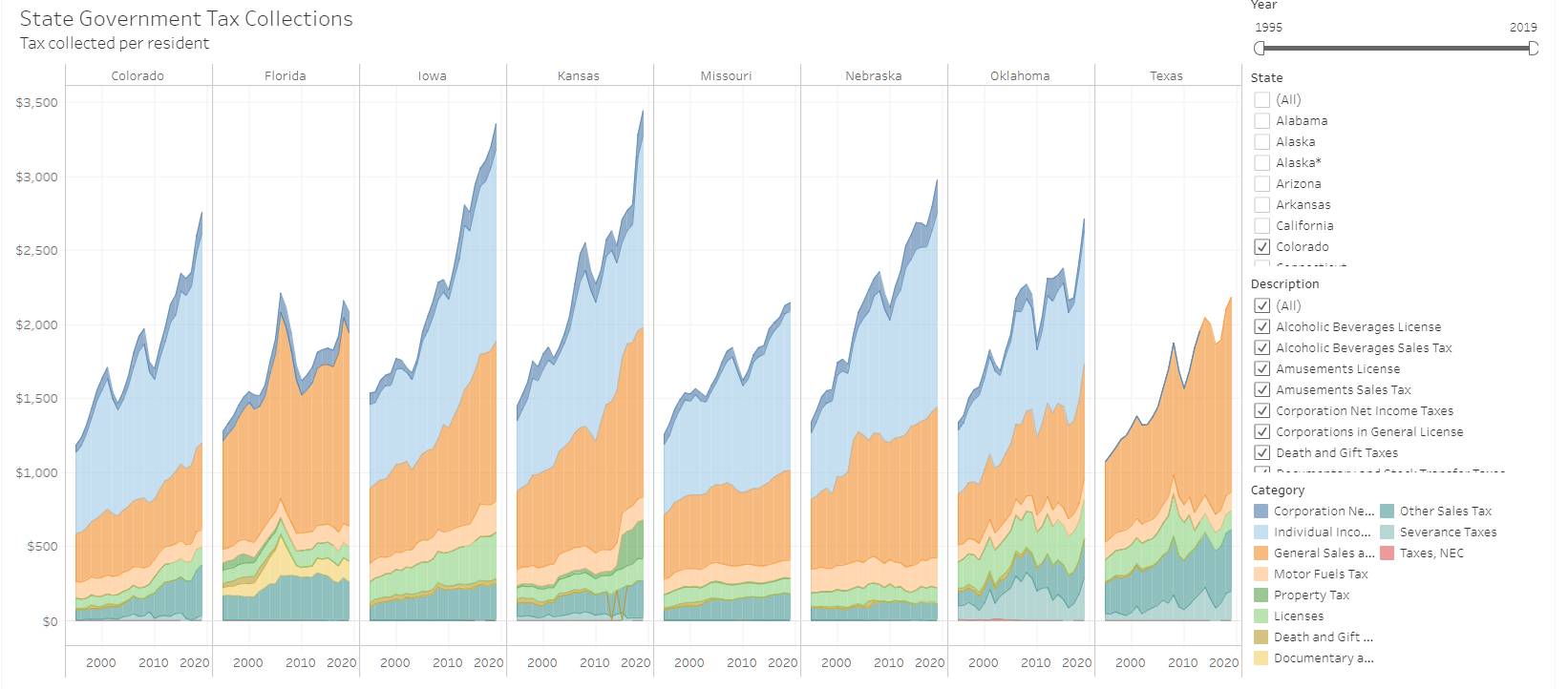

State government tax collections for 2019

Kansas state government tax collections rose to $3,443 per person in 2019, an increase of 5.0 percent from 2018.

-

Kansas tax revenue experiences effects of pandemic response

For April, Kansas retail sales tax collections fell by 8.2 percent from last April, and much income tax revenue is deferred to July.

-

Wichita city council to address misunderstanding

The Wichita city council will address a misunderstanding regarding imprecise language in an economic development incentive agreement.

-

Kansas tax receipts

Kansas tax receipts by category, presented in an interactive visualization. Now with data through December 2019.

-

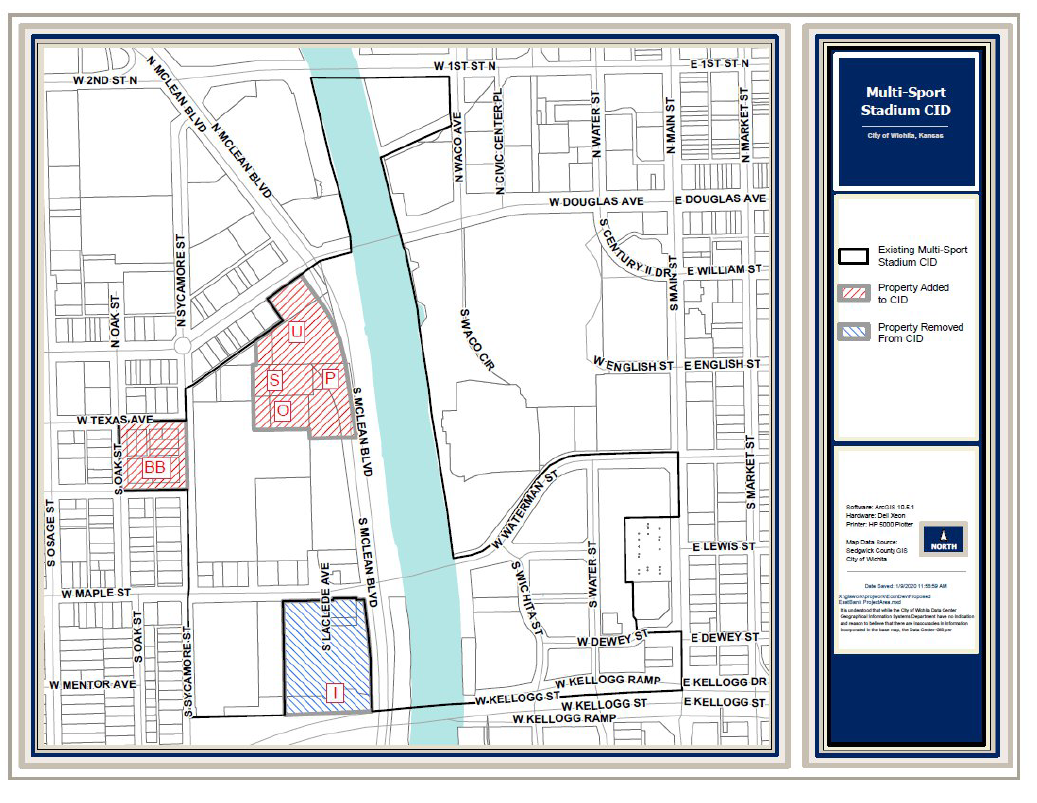

Wichita taxing district to expand

The City of Wichita plans to expand a special tax district.

-

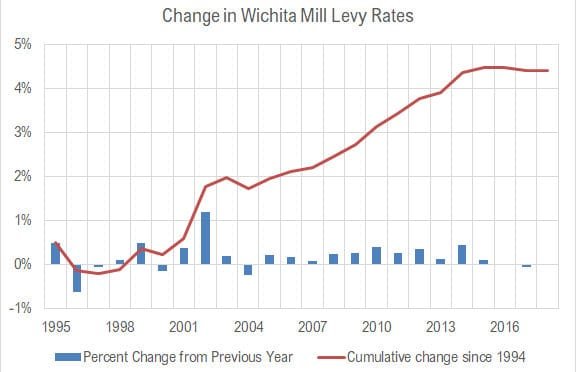

Wichita property tax rate: Up

The City of Wichita property tax mill levy rose for 2019.

-

Financial state of the cities

Wichitans carry a “Taxpayer Burden” of $1,200 per taxpayer, which is not as bad as many cities.

-

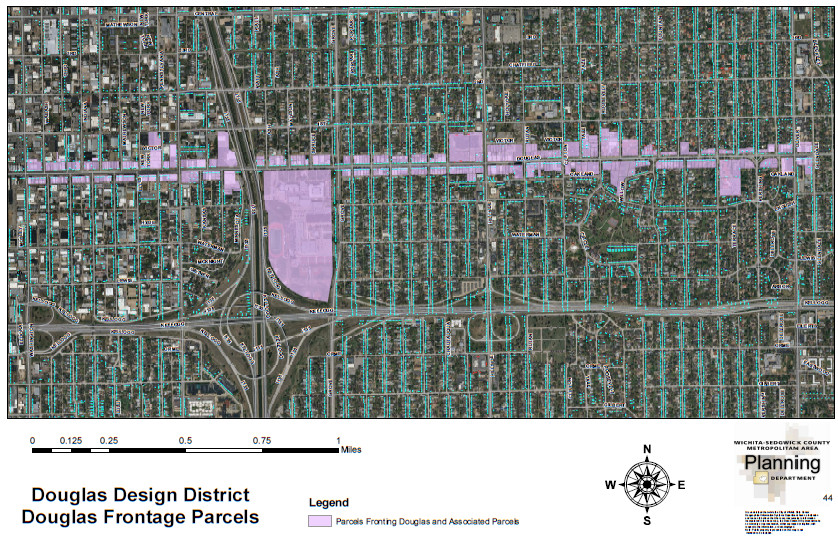

Business improvement district on tap in Wichita

The Douglas Design District seeks to transform from a voluntary business organization to a tax-funded branch of government.

-

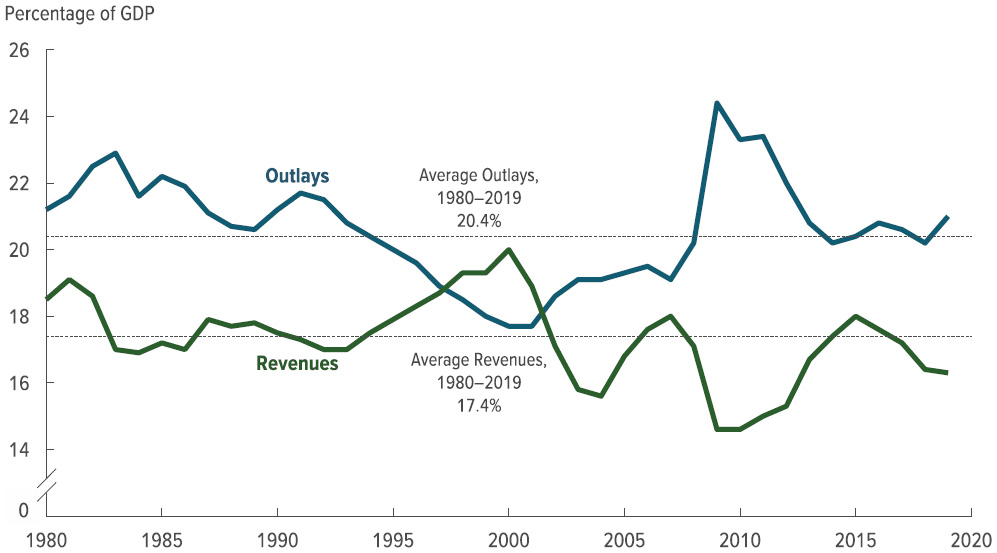

Federal budget summary for 2019

Federal revenues for 2019 were up, but spending increased by a larger amount, resulting in a higher deficit.

-

Wichita property tax rate: Unchanged

The City of Wichita property tax mill levy was unchanged for 2018.

-

In Wichita, revision of water history

In 2014 Wichita voters rejected a sales tax which would have provided $250 million to spend on a water project. What were the city’s concerns?