Tag: Taxation

-

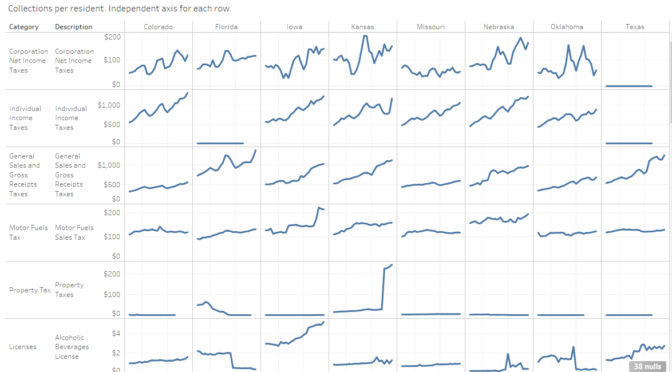

Updated: State government tax collections

Kansas personal income tax collections rose by $372 per person in 2018, an increase of 46.5 percent.

-

Updated: Kansas hotel guest tax collections

Kansas hotel guest tax collections presented in an interactive visualization. Updated through January 2019.

-

Wichita considers a new stadium

The City of Wichita plans subsidized development of a sports facility as an economic driver. Originally published in July 2017.

-

Wichita city sales tax passed

Wichita voters might be surprised to learn that they passed a city sales tax, according to city documents.

-

In Wichita, a gentle clawback

Despite the mayor’s bluster, Wichita mostly lets a company off the hook.

-

WichitaLiberty.TV: Economic development incentives

A look at some economic development incentive programs in Wichita and Kansas. Second in a series. Tax increment financing (TIF) is prominent in this episode.

-

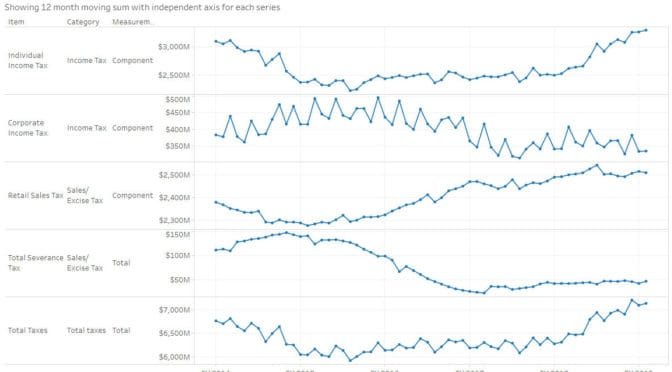

Updated: Kansas tax receipts

Kansas tax receipts by category, presented in an interactive visualization.

-

WichitaLiberty.TV: Economic development incentives

A look at some economic development incentive programs in Wichita and Kansas. First in a series.

-

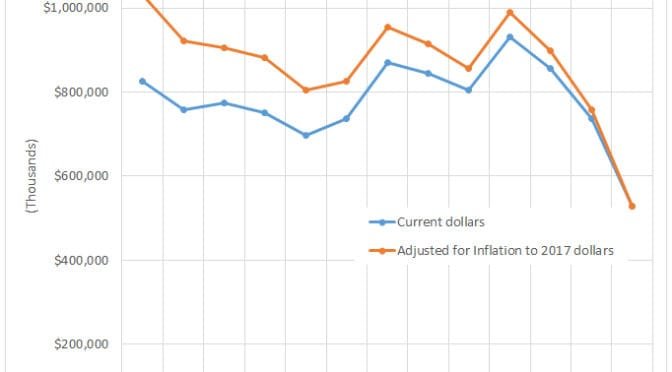

Kansas highway spending

A look at actual spending on Kansas highways, apart from transfers.

-

Kansas tax receipts

Kansas tax receipts by category, presented in an interactive visualization.

-

The use of sales tax proceeds in Wichita

Must the City of Wichita spend its share of Sedgwick County sales tax proceeds in a specific way?

-

More TIF spending in Wichita

The Wichita City Council will consider approval of a redevelopment plan in a tax increment financing (TIF) district.