Tag: United States government

-

FBI and counterterrorism

John Sullivan, who is Supervisory Special Agent for the Federal Bureau of Investigation (FBI) in Wichita, spoke to members and guests of the Wichita Pachyderm Club on the topic “Counterterrorism.”

-

WichitaLiberty.TV: Lack of information sharing by government, community improvement districts, and the last episode of “Love Gov”

Do our governmental agencies really want to share data and documents with us? Community Improvement Districts and homeowners compared. And, the last episode of “Love Gov” from the Independent Institute.

-

WichitaLiberty.TV: Debate expert Rodney Wren and the presidential debates

Debate and communications coach and expert Rodney Wren explains the recent presidential debate. What should viewers look for as they watch?

-

WichitaLiberty.TV: Michael Tanner of Cato Institute on deficits, debt, and entitlements

In this episode of WichitaLiberty.TV: Michael Tanner of the Cato Institute talks about his new book “Going for Broke: Deficits, Debt, and the Entitlement Crisis.” Episode 90, broadcast August 2, 2015.

-

‘Love Gov’ humorous and revealing of government’s nature

A series of short videos from the Independent Institute entertains and teaches lessons at the same time.

-

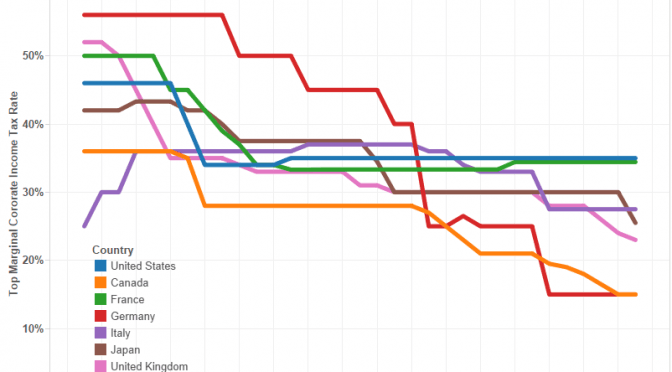

Corporate income tax rates in U.S. and other countries

Over the past two decades most large industrial countries have reduced their corporate income tax rates. Two countries, however, stand out from this trend: France and The United States.

-

WichitaLiberty.TV: United States Congressman Mike Pompeo

Congressman Mike Pompeo talks about risks to America from overseas, Benghazi, congressional scorecards, the Grant Return for Deficit Reduction Act, and labeling food with genetically engineered ingredients.

-

Corporate income tax rates in U.S. do not help our economy

Over the past two decades most large industrial countries have reduced their corporate income tax rates. Two countries, however, stand out from this trend: France and The United States.