Tag: Wichita city government

-

WichitaLiberty.TV: Naftzger Park

Wichita Assistant City Manager and Director of Development Scot Rigby joins hosts Bob Weeks and Karl Peterjohn to discuss the plans for Naftzger Park. Then, Bob and Karl continue the discussion.

-

Naftzger Park construction manager

The City of Wichita seeks a construction manager for the construction of Naftzger Park.

-

Naftzger Park contract: Who is in control?

The City of Wichita says it retains final approval on the redesign of Naftzger Park, but a contract says otherwise.

-

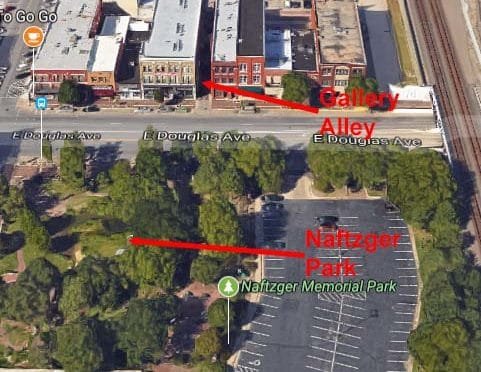

Downtown Wichita gathering spaces that don’t destroy a park

Wichita doesn’t need to ruin a park for economic development, as there are other areas that would work and need development.

-

Naftzger Park concerts and parties?

In Wichita, a space for outdoor concerts may be created across the street from where amplified concerts are banned.

-

Wichita in the Wall Street Journal

A Wall Street Journal article reports on Wichita, but there are a few issues with quotes from the mayor.

-

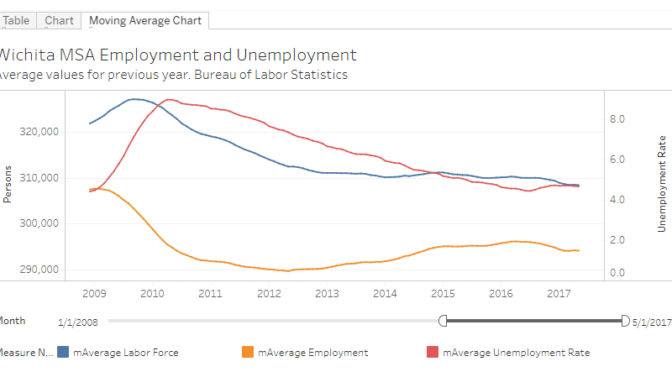

Wichita employment trends

While the unemployment rate in the Wichita metropolitan area has been declining, the numbers behind the decline are not encouraging.

-

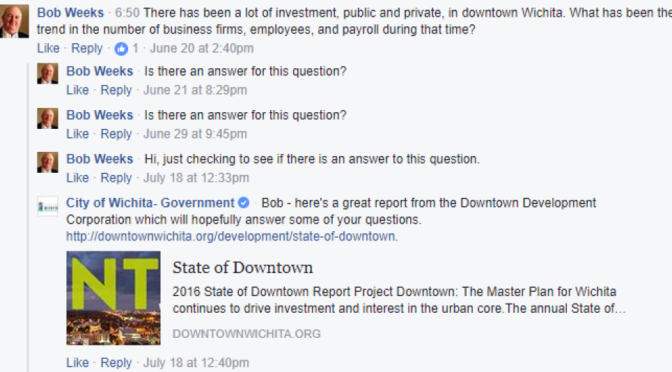

A Wichita social media town hall

A City of Wichita town hall meeting ends in less than nine minutes, with a question pending and unanswered.

-

Naftzger Park tax increment financing (TIF)

Background on tax increment financing (TIF) as applied to Naftzger Park in downtown Wichita.

-

Upcoming Naftzger Park legislative action

The redesign of Naftzger Park in downtown Wichita is not a done deal, at least not legally.

-

Wichita WaterWalk contract not followed, again

Wichita city hall failed to uphold the terms of a development agreement from five years ago, not monitoring contracts that protect the public interest.

-

In Wichita, new stadium to be considered

The City of Wichita plans subsidized development of a sports facility as an economic driver.