State government tax revenue has generally recovered since the second quarter.

Data from the United States Census Bureau shows that state government tax revenue has largely rebounded since the pandemic.

The data, which is from the Quarterly Summary of State & Local Tax Revenue program, is now available for the third quarter of 2020, which is the months of July, August, and September. In this article and the accompanying charts and visualizations, I present state collections only.

Considering Kansas, total state tax collections in the first quarter were $2,730 million. That dipped to $2,452 million in the second quarter (April, May, and June) as the pandemic — or, rather, the response to the pandemic — affected the economy. In the third quarter, collections rebounded to $2,770, which is slightly more than the first quarter.

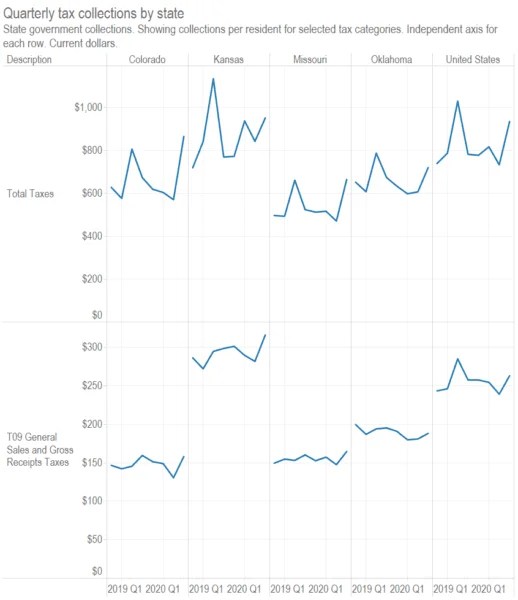

This pattern is common for many states, and appears in the totals for the nation. The nearby illustration shows Kansas, the nation, and nearby states.

Another chart illustrates that Kansas state government taxes are relatively high when expressed on a per resident basis.

To learn more about the data and access the interactive visualization, click on Visualization: Quarterly state government tax collections.

Leave a Reply