The writing of Duane Goossen, a former Kansas budget director, requires decoding and explanation. This time, his vehicle is “Rise Up, Kansas.”

Duane Goossen was Kansas budget director from 1998 to 2010.1 He is critical of the administration of Kansas Governor Sam Brownback and recent sessions of the Kansas Legislature. It’s useful to examine his writings so that Kansans may become aware of the ramifications of his recommendations, and how during his years as budget director he was unable to adhere to the principles he now advocates. Following, some language from his recent article Rise Up, Kansas.

Goossen: “This marks the beginning of a hopeful new chapter in the Kansas story. It also presents a desperately needed opening for comprehensive tax reform.”

Comprehensive tax reform. That sounds good, as “reform” has a positive connotation. It means change for the better. But in this case reform means raising taxes, and by a lot. In fact, advocates of tax increases generally won’t say by how much they want to raise taxes.

As an example, in May a coalition of spending groups called for what they termed “Option 4.” It would eliminate all tax cuts enacted since 2012. This action would reinstate the tax on pass-through business income — the so-called “LLC loophole.” But this would also raise income taxes wage income, as those tax rates also were reduced in 2012. For example, income tax rates for a married family earning up to $30,000 would rise to 3.50 percent from the current 2.70 percent. That’s an increase of 30 percent in the income tax rate. For other income levels the increase is greater.2

A spokesperson for the Option 4 coalition argued that rolling back the tax cuts could increase revenue to the state by $1 billion. By the way, the Option 4 coalition did not call for the rollback of the sales tax increase passed in 2015. I should qualify that with apparently, as no handouts explaining Option 4 can be found. In addition, an audio recording of the press conference has been removed.

Members of the Option 4 coalition included Shannon Cotsoradis of Kansas Action for Children, Bob Totten from the Kansas Contractors Association, Rebecca Proctor of the Kansas Organization of State Employees, and Mark Desetti from the Kansas National Education Association.3

With the exception of the pass-through business income tax, failing to be specific about whose taxes will be raised by how much is characteristic of spending groups. In fact, these spending groups generally shy away from using the term tax. Look at these examples of language from Goossen’s article:

- damage to state finances

- hemorrhage revenue

- can’t start healing while still in triage mode

- fix our structural revenue imbalance

- broaden the tax base

- means reviewing our entire tax code

- modernizing all revenue sources

- get our fiscal house back in order

- begin with commonsense basics

- new priorities

- recover the opportunities we lost

- senseless era of crisis

- begin restoring those opportunities

- rise above the political fray

- find courage to make difficult decisions

- imagine the possibilities

Commonsense basics. Who could be against that? Yet each of these terms is a call for more and higher taxes.

Goossen: “Three credit rating downgrades”

The Kansas credit rating has declined. In making this decision, Moody’s mentioned “revenue reductions (resulting from tax cuts) which have not been fully offset by recurring spending cuts.4 So Kansas has a decision: Offset revenue reductions with higher taxes or spending cuts. Moody’s doesn’t care which is chosen, but Goossen and the spending coalition does.

Of note, Moody’s mentions another problem: “an underfunded retirement system for which the state is not making actuarially required contributions.” This is an ongoing problem, as the nearby chart illustrates. The funding ratio of the Kansas retirement plan has deteriorated for many years, including the years when Duane Goossen was Kansas budget director. (Recently Kansas has improved the funding ratio of KPERS, but it did that by borrowing funds, which was an unwise decision. Because of the borrowing, Kansas has delayed schedule KPERS contributions, which effectively pays for current spending with long-term debt.5)

Of note, Moody’s mentions another problem: “an underfunded retirement system for which the state is not making actuarially required contributions.” This is an ongoing problem, as the nearby chart illustrates. The funding ratio of the Kansas retirement plan has deteriorated for many years, including the years when Duane Goossen was Kansas budget director. (Recently Kansas has improved the funding ratio of KPERS, but it did that by borrowing funds, which was an unwise decision. Because of the borrowing, Kansas has delayed schedule KPERS contributions, which effectively pays for current spending with long-term debt.5)

Moody’s also mentioned “In recent years the state has appropriated funds from or shifted costs to the State Highway Fund to help balance the general fund budget.” This too, is an ongoing problem.6 “Raiding the Bank of KDOT” has been a problem for many years, including the years when Duane Goossen was Kansas budget director.

Goossen: “It will likely take a generation to fully recover from this horrible experiment.”

Goossen: “lifting the burden the Brownback plan forced onto our lowest-earning Kansans.”

Yes, we should sharply reduce or eliminate the sales tax on groceries. It affects low-income households most severly.9

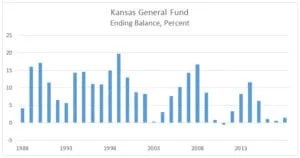

Goossen: “And it means establishing a responsible state savings account.”

—

Notes

- Goossen, Duane. Kansas Budget Blog. http://www.kansasbudget.com/. ↩

- Kansas Policy Institute. *Option 4: Soak the poor. https://kansaspolicy.org/option-4-soak-poor/. ↩

- Hancock, Peter. Session resumes with call for total repeal of Brownback tax cuts. Lawrence Journal-World, April 27, 2016. http://www2.ljworld.com/news/2016/apr/27/session-resumes-call-total-repeal-brownback-tax-cu/. ↩

- Moody’s Investors Service, Inc. Moody’s downgrades Kansas issuer rating to Aa2 from Aa1, notched ratings to Aa3 from Aa2 and KDOT highway revenue bonds to Aa2 from Aa1; outlook stable. April 30, 2014. https://www.moodys.com/research/Moodys-downgrades-Kansas-issuer-rating-to-Aa2-from-Aa1-notched–PR_298383. ↩

- Weeks, Bob. This is why we must eliminate defined-benefit public pensions. http://wichitaliberty.org/kansas-government/we-must-eliminate-defined-benefit-public-pensions/. ↩

- Weeks, Bob. Kansas transportation bonds economics worse than told. http://wichitaliberty.org/kansas-government/kansas-transportation-bonds-economics-worse-than-told/. ↩

- Weeks, Bob. Kansas government spending. http://wichitaliberty.org/kansas-government/kansas-government-spending-2/. ↩

- Weeks, Bob. Spending in the states, per capita. Interactive visualization. http://wichitaliberty.org/economics/spending-states-per-capita-2/. ↩

- Weeks, Bob. Kansas sales tax has disproportionate harmful effects. http://wichitaliberty.org/taxation/kansas-sales-tax-has-disproportionate-harmful-effects/. ↩

- Weeks, Bob. Kansas General Fund. http://wichitaliberty.org/kansas-government/kansas-general-fund-2/. ↩

Leave a Reply