In Kansas, as in many states, tax revenues have not been a problem.

The United States Census Bureau collects data about tax collections in the states and publishes it quarterly. I’ve gathered this data and have presented it in an interactive visualization.

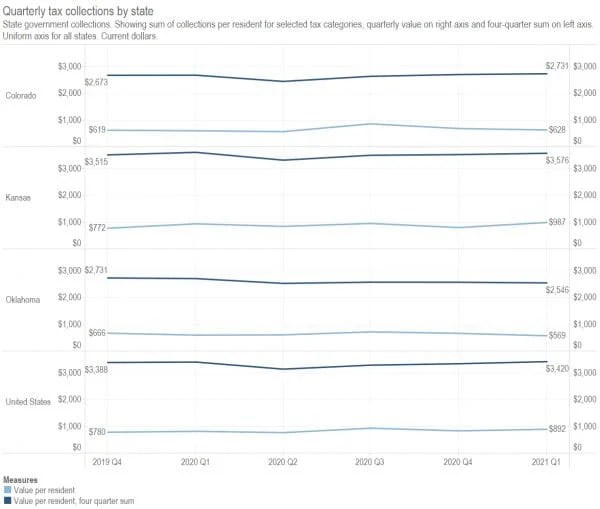

I present the quarterly data, and the sum of four quarters ending each quarter, which provides a moving yearly sum. The four-quarter sum is helpful as some categories of taxes exhibit wide seasonal variations.

In the nearby chart, I show quarterly tax collections starting with the fourth quarter of 2019 (October, November, and December), which was the last quarter not affected by the pandemic. The data continues through the first quarter of 2021 (January, February, and March), which is the most current data.

In the four quarters ending with 2019 Q4, we see that Kansas collected $3,515 per resident in total taxes. For the four quarters ending with 2021 Q1, the value was $3,576, increasing by 1.7 percent. (These values are current dollars, not adjusted for inflation.)

There is a similar pattern for all states: revenue rising from $3,388 per person to $3,420, which is 0.9 percent. Not all states saw increasing tax revenue, as can be seen with Oklahoma.

To learn more about this data and use the interactive visualization, click on Visualization: Quarterly state government tax collections.

Leave a Reply