The unrealized potential of an economic development incentive teaches lessons.

This week the Wichita City Council will consider an amendment to an economic development incentive agreement. 1

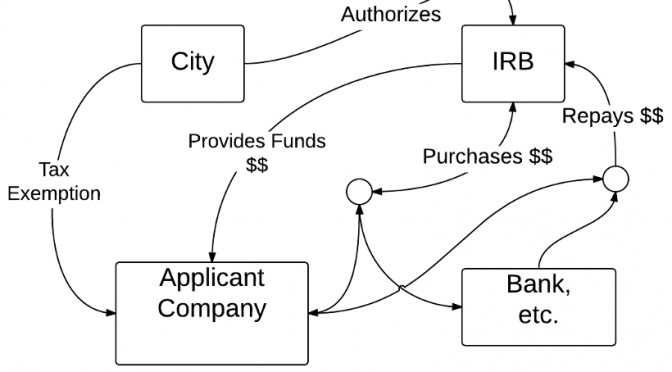

In 2008 the city awarded an incentive to a company in the form of exemption from paying property taxes, estimated by the city to be $93,175 annually at the time the incentive was awarded. 2

The incentive was awarded based on the applicant company creating a certain number of jobs and making a certain level of investment. It was rewarded on a five plus five basis, meaning that the city council reviewed the deal after five years. The plan was if the company met goals, the city would extend the incentive for another five years.

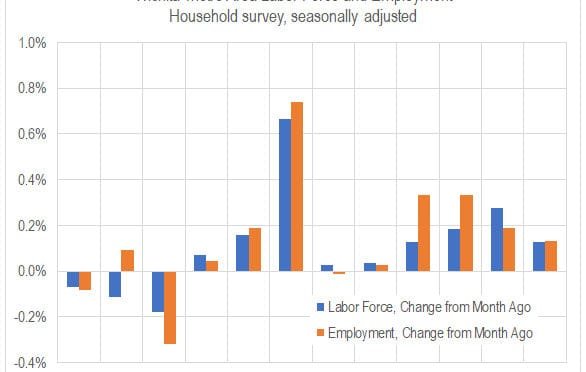

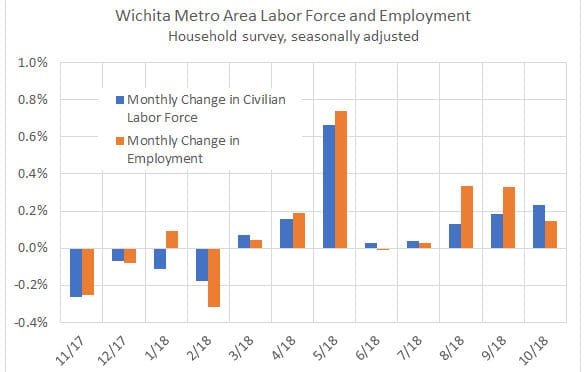

At the five-year review, however, the applicant company had not met the job goals. The city invoked an exception that allowed extension of the incentive based on a downturn in the economy as measured by the Wichita Current Conditions Index, which is produced by the Center for Economic Development and Business Research at Wichita State University. 3

Now is the end of the second five-year period. The job goals have not been met, and the city has decided the applicant company is in default of the agreement. The city is proposing a clawback, that is, recovery of the value of the incentive for the second five-year period. According to the agenda packet: “The value of the abated taxes for the second five-years is approximately $253,000. The City Council could clawback the entire amount, or some portion, per the incentive agreement.”

But: The agreement that the council will consider is that the applicant company build an expansion to its facilities at a cost of $2,500,000, using no incentives. Also, the company will repay $100,000 of the abated taxes, in four annual payments of $25,000.

A few things to learn:

First, economic development incentives don’t always work. This reflects the uncertainty of business. When the city presents projections like benefit-cost ratios, it might want to remind us that these values will be achieved only if the project targets are reached. When businesses describe their plans, these are called forward-looking statements. They are accompanied by disclaimers like “subject to risks and uncertainties that could cause actual results to differ materially.” Investors and interested parties are “cautioned not to place undue reliance on these forward-looking statements.” The same cautions hold for citizens of Wichita, as they are the investors paying the cost of incentives and expecting to receive the benefits. That is, after all, the foundation of the benefit-cost analysis that accompanies requests for incentives: That by spending now or by giving up future tax collections, the city receives even more in benefits.

Second, cities often don’t have the fortitude to strictly enforce clawbacks. Here, the company is receiving credit of $153,000 for construction an expansion to its facility, something the company was contemplating anyway. In other words, receiving credit for something it was going to do anyway. This is the usual case. 4

Third, when the city and its officials say we no longer use cash as an incentive, here’s a case where the city canceled $153,000 of debt the city is entitled to, based on its agreement with the applicant company. That’s just like cash.

For more on this topic, see Clawbacks illustrate difficulty of economic development and In Wichita, a gentle clawback

—

Notes

- Wichita City Council Agenda Packet for January 8, 2019. Item V-1. ↩

- Wichita City Council Agenda Packet for February 12, 2008. Item No. 34 ↩

- See http://kansaseconomy.org/local-indices/wichita-current-index. ↩

- Bartik, Timothy J. 2018. “‘But For’ Percentages for Economic Development Incentives: What percentage estimates are plausible based on the research literature?” Upjohn Institute Working Paper 18-289. Kalamazoo, MI: W.E. Upjohn Institute for Employment Research. https://doi.org/10.17848/wp18-289. ↩