Tag: Featured

-

Kansas is not an entrepreneurial state

The performance of Kansas in entrepreneurial activity is not high, compared to other states.

-

In Wichita, running government like a business

In Wichita and Sedgwick County, can we run government like a business? Should we even try? Do our leaders think there is a difference?

-

Economic development in Wichita: Looking beyond the immediate

Decisions on economic development initiatives in Wichita are made based on “stage one” thinking, failing to look beyond what is immediate and obvious.

-

WichitaLiberty.TV: The need for reform at Wichita City Hall

An episode this week at the Wichita city council meeting highlights the need for campaign finance reform in Wichita. We’ll examine a few incidents and see if there’s a way we can reform Wichita city government so that it is capitalism friendly instead of crony friendly.

-

In Wichita, not much notice of a public hearing

The City of Wichita gives little notice regarding a public hearing, which does not contribute to an open and transparent government that welcomes citizen involvement.

-

This week, Wichita has a chance to increase government transparency

The Wichita City Council can decide to disclose how taxpayer money is spent, or let it remain being spent in secret.

-

In Wichita, the need for campaign finance reform

Actions of the Wichita City Council have shown that campaign finance reform is needed. Citizen groups are investigating how to accomplish this needed reform, since the council has not shown interest in reforming itself.

-

Will the next Wichita mayor advocate enforcing our ethics laws?

Wichita has laws that seem clear. But the city attorney said they don’t mean what they seem to say. Will our next mayor stand up for ethics?

-

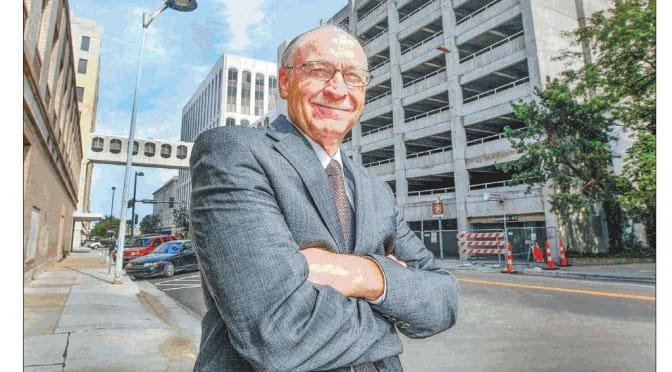

WichitaLiberty.TV: A downtown parking garage deal, academic freedom attacked at KU, and classical liberalism

In this episode of WichitaLiberty.TV: While chair of the Wichita Metro Chamber of Commerce, a Wichita business leader strikes a deal that’s costly for taxpayers. A Kansas University faculty member is under attack from groups that don’t like his politics. Then, how can classical liberalism help us all get along with each other?

-

Wichita Metro Chamber of Commerce: What is the attitude towards taxes?

Does the Wichita Metro Chamber of Commerce support free markets, capitalism, and economic freedom, or something else?

-

Art Hall: My decision to fight for academic freedom

If my private, personal communications are released, I will not be the only one whose academic freedom is jeopardized. The issue is much larger, and could ultimately jeopardize the academic freedom of any scholar at a public institution of higher education, writes Art Hall of the University of Kansas.

-

Why is this man smiling?

In Wichita, the chair of the Wichita Metro Chamber of Commerce crafts a sweetheart deal for his company to the detriment of Wichita taxpayers.