Tag: Featured

-

Quarterly state GDP data released

A new series of GDP data shows government growing faster in Kansas than in most states, with private sector growth near the middle of the states.

-

Public opinion on Wichita sales tax

As Wichita prepares to debate the desirability of a sales tax increase, a public opinion poll finds little support for the tax and the city’s plans.

-

Former Wichita mayor: Where is the water?

Former Wichita mayor Bob Knight explains that when he left office in 2003, we were assured we had water for 50 years. What has happened?

-

SEC orders Kansas to stop doing what it did under Sebelius and Parkinson

The Securities and Exchange Commission found that Kansas mislead bond investors. It ordered the state to implement reforms, which it has.

-

What is truth on education finance in Kansas?

One must wonder how much of Kansas’ and the nation’s student achievement woes are attributable to political self-interest and putting a higher priority on institutions than on the needs of individual students, writes Dave Trabert of Kansas Policy Institute.

-

Before asking for more taxes, Wichita should stop wasting what it has

Voters should ask that Wichita stop blatant and avoidable waste before approving additional taxes.

-

Kansas base state aid is only a part of spending

Using base state aid per pupil as the only measure of school funding leads to an incomplete understanding of school spending in Kansas.

-

What incentives can Wichita offer?

Wichita government leaders complain that Wichita can’t compete in economic development with other cities and states because the budget for incentives is too small. But when making this argument, these officials don’t include all incentives that are available.

-

WichitaLiberty.TV: Issues surrounding the Wichita sales tax and airport

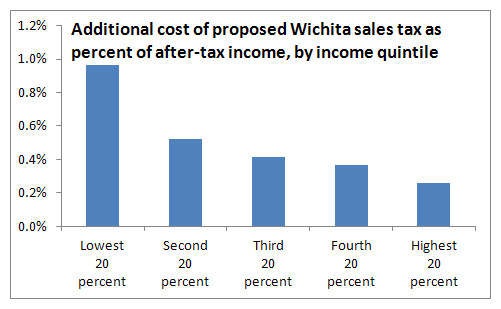

Who would be most harmed by the proposed Wichita sales tax? Also: A look at updated airport statistics, and what the city could do if it wants to pass the sales tax.

-

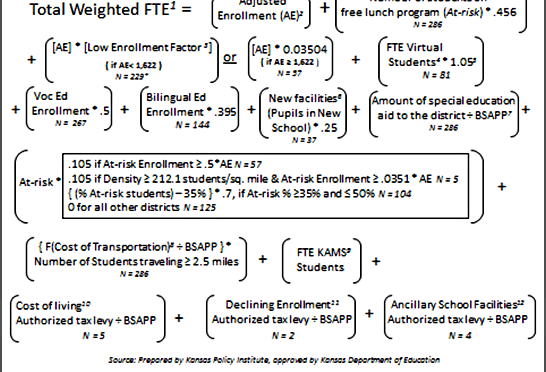

Kansas school finance formula explained

The updated version of the formula that will be used by the Kansas State Department of Education to determine student weighting in the coming school year is presented below.

-

Economic development in Wichita, one tale

In this excerpt from WichitaLiberty.TV: A look at a recent episode of economic development in Wichita, and what can we learn from that.

-

Wichita sales tax hike would hit low income families hardest

Analysis of household expenditure data shows that a proposed sales tax in Wichita affects low income families in greatest proportion, confirming the regressive nature of sales taxes.