Tag: Featured

-

Kansas budgeting “off the tops” is bad policy

Direct transfers of taxpayer money sent to a specific business or industry is always a tough sell to politicians, let alone the voting public. But, that is why some corporations pay lots of money to lobbyists, writes Steve Anderson for Kansas Policy Institute.

-

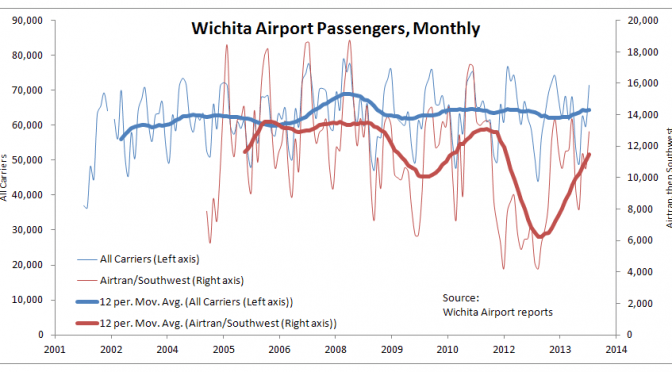

Wichita airport statistics updated

Why do Kansans pay taxes, including sales tax on food, to fund millions in subsidy to a company that is experiencing a sustained streak of record profits?

-

Susan Estes of AFP and the upcoming summt

On the Joseph Ashby Show, Susan Estes of Americans for Prosperity-Kansas appeared on August 7, 2014. Bob Weeks is the guest host. We discuss the the goals of AFP and the upcoming Defending the American Dream Summit in Dallas.

-

U.S. Rep. Mike Pompeo

On the Joseph Ashby Show, United States Representative Mike Pompeo appeared two days after election day. Bob Weeks is the guest host.

-

Voice for Liberty Radio: Hydraulic fracturing: A conjured-up controversy?

In this episode of Voice for Liberty Radio: Dwight D. Keen is former chairman of the Kansas Independent Oil and Gas Association. He spoke to the Wichita Pachyderm Club on the topic “Hydraulic Fracturing: A Conjured-up Controversy.”

-

What the Wichita city council could do

While the proposed Wichita city sales tax is a bad idea, the city could do a few things that would not only improve its chance of passage, but also improve local government.

-

WichitaLiberty.TV: Primary election results, and a look forward

A look at some of the primary elections results this week. What did voters say, and what should we look for in the November general election and the future past that?

-

Sedgwick County elections: Commissioners

In Sedgwick County, two fiscally conservative commission candidates prevailed.

-

Elections in Kansas: Federal offices

Kansas Republican primary voters made two good decisions this week.

-

Charles Koch: How to really turn the economy around

Charles Koch offers insight into why our economy is sluggish, and how to make a positive change.

-

Wichita city budget to have public hearing

This week the Wichita City Council holds the public hearing for the budget.

-

In Kansas fourth district, fundamental issues of governance arise

The contest in the Kansas fourth district is a choice between principle and political expediency, and between economic freedom and cronyism.