Tag: Featured

-

WichitaLiberty.TV: Confusion about corruption in Wichita, regulation in Wichita, and the lowly pencil

Citizen activists were concerned about unleashing a corrupting influence in Wichita City Hall, but they didn’t know it’s already there. Then, the regulatory landscape in Wichita. Finally, what can a pencil teach us about how the world works?

-

Regulation in Wichita, a ‘labyrinth of city processes’

Wichita offers special regulatory treatment for special circumstances, widening the gulf between the haves and have-nots.

-

Sedgwick County Zoo

Since funding for and management of the Sedgwick County Zoo is in the news, here are some articles showing how generous the county has been with funding.

-

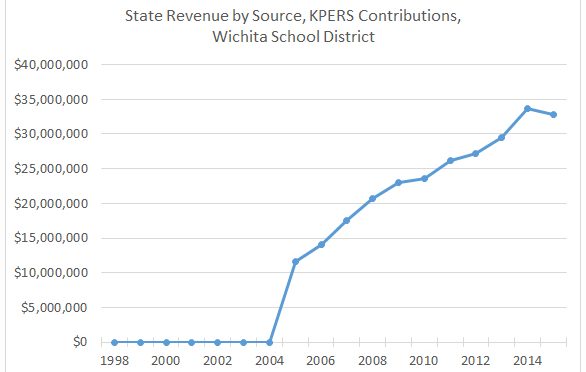

KPERS payments and Kansas schools

There is a claim that a recent change in the handling of KPERS payments falsely inflates school spending. The Kansas State Department of Education says otherwise.

-

WichitaLiberty.TV: Charter schools in Kansas, and a victory for speech and association

In this episode of WichitaLiberty.TV: Kansas has essentially no charter schools. Here’s why we need them. AFP Foundation scores a victory for free speech and association. Episode 120, broadcast June 5, 2016.

-

Kansas senate candidate forum

At the Wichita Pachyderm Club this week: A candidate forum for Republican Candidates for Kansas Senate, districts 27 and 31.

-

Wichita water statistics update

The Wichita ASR water project produced little water during the first four months of 2016. There were many days when river flow was adequate.

-

At Pachyderm: Legislative wrapup

Rep. Mark Kahrs, Rep. Marc Rhoades, and Sen. Ty Masterson briefed the Wichita Pachyderm Club on the 2016 session of the Kansas Legislature.

-

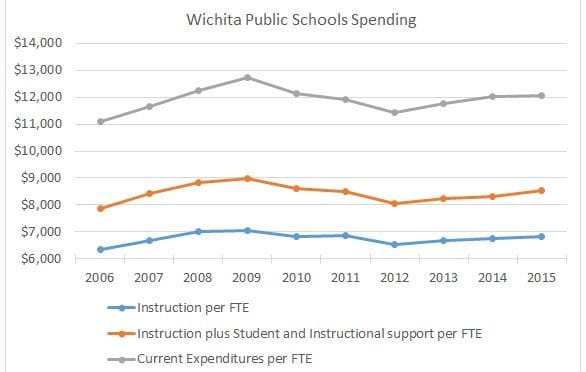

Wichita school spending

Spending by the Wichita public school district, adjusted for inflation and enrollment.

-

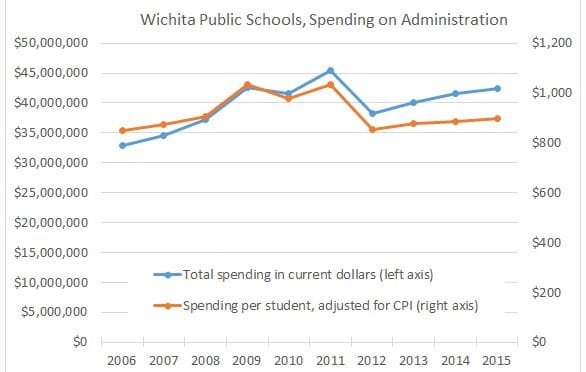

Wichita school district spending on administration

Could the Wichita public school district reduce spending on administration to previous levels?

-

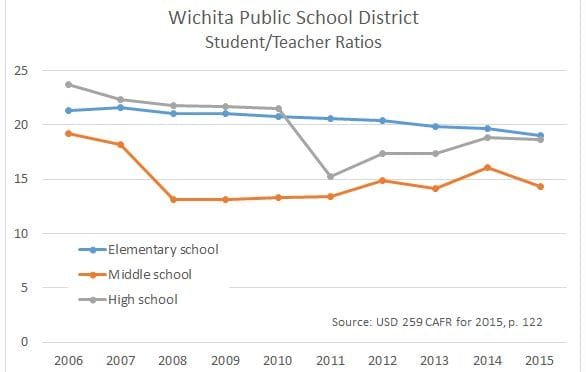

Wichita student/teacher ratios

Despite years of purported budget cuts, the Wichita public school district has been able to improve its student/teacher ratios.

-

At Pachyderm: Chapman Rackaway on the Kansas primary elections

Professor Chapman Rackaway of Fort Hays State University briefed members and guests of the Wichita Pachyderm Club on the August primary elections.