Tag: Featured

-

Inspector General evaluates Obamacare website

The HHS Inspector General has released an evaluation of the Obamacare website HealthCare.gov, shedding light on the performance of former Kansas Governor Kathleen Sebelius.

-

Massage business regulations likely to be ineffective, but will be onerous

The Wichita City Council is likely to create a new regulatory regime for massage businesses in response to a problem that is already addressed by strict laws.

-

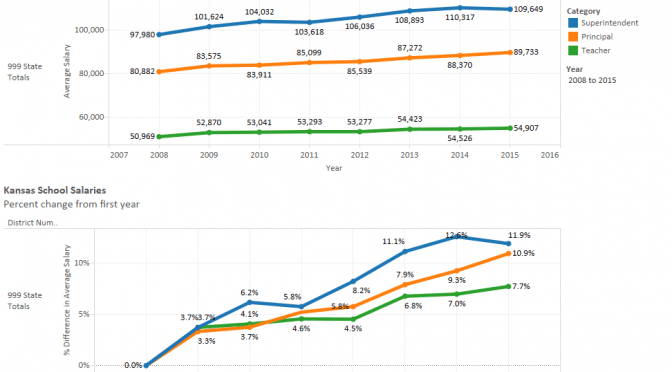

Kansas school salaries

Kansas school salaries for superintendents, principals, and teachers presented in an interactive visualization for each district.

-

David Bobb: Free speech and its importance

David Bobb, President of The Bill of Rights Institute, explains freedom of speech and its importance.

-

WichitaLiberty.TV: David Bobb, President of Bill of Rights Institute

In this episode of WichitaLiberty.TV: David Bobb, President of The Bill of Rights Institute, talks about civic education and the importance of humility.

-

Debate: The National Debt

This is an audio recording of a debate on the theme “Should the U.S. implement austerity measures due to the national debt?”

-

WichitaLiberty.TV: Radio talk show host Joseph Ashby

In this episode of WichitaLiberty.TV: Radio talk show host Joseph Ashby visits the KGPT studios to explain presidential politics.

-

Kansas transportation bonds economics worse than told

The economic details of a semi-secret sale of bonds by the State of Kansas are worse than what’s been reported.

-

This is why we must eliminate defined-benefit public pensions

Actions considered by the Kansas Legislature demonstrate — again — that governments are not capable of managing defined-benefit pension plans.

-

ACU rates the Kansas Legislature

The American Conservative Union has released its ratings for the 2015 Kansas Legislature.

-

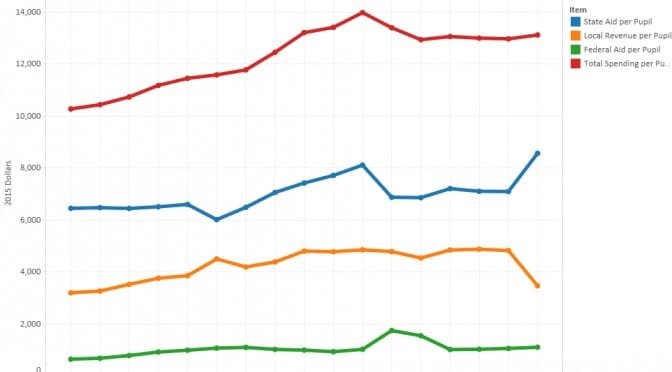

Kansas school spending: Visualization

An interactive visualization of revenue and spending data for Kansas school districts.

-

WichitaLiberty.TV: Journalist, novelist, and blogger Bud Norman on presidential politics

In this episode of WichitaLiberty.TV: Journalist, novelist, and blogger Bud Norman joins host Bob Weeks to discuss presidential election politics.