Tag: Featured

-

Kansas State Treasurer Ron Estes on KPERS

Kansas State Treasurer Ron Estes gave a presentation on the status of KPERS, the Kansas State Employees Pension System.

-

Introduction to Austrian Economics

“For Austrians, on the other hand, man is a purposeful being. … He has spirit and will.” The author of these remarks, Dr. Richard Ebeling, delivered a lecture on Austrian Economics to an audience in Wichita.

-

Wichita water statistics update

The Wichita ASR water project produced more water in August than in July, but continues to fail to produce water at the projected rate or design capacity.

-

Kansas schools shortchanged by accounting systems

Kansas schools could receive $21 million annually in federal funds if the state had adequate information systems in place.

-

Kansas teachers earn pension credit while working for union

An audit finds that a handful of Kansas teachers have accumulated KPERS service credits while working for teachers unions.

-

Having raised taxes, could you give us a little access?

The Wichita public school district has raised taxes substantially, but it’s still difficult to view the board meetings. Could we work out a deal?

-

Another week in Wichita, more CID sprawl

Shoppers in west Wichita should prepare to pay higher taxes, if the city approves a Community Improvement District at Kellogg and West Streets.

-

Austrian economics to be explained

A breakfast meeting in Wichita features Richard M. Ebeling, Ph.D. speaking on Austrian Economics.

-

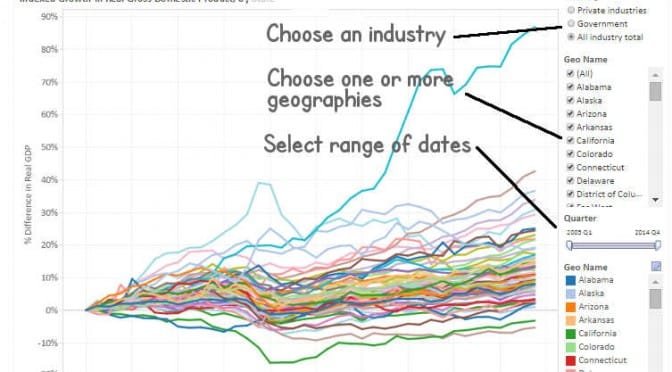

Quarterly gross domestic product by state

The U.S. Bureau of Economic Analysis (BEA) is releasing prototype quarterly gross domestic product (GDP) by state statistics for 2005–2014. Here is an interactive visualization.

-

Wichita CID illustrates pitfalls of government intervention

A proposed special tax district in Wichita holds the potential to harm consumers, the city’s reputation, and the business prospects of competitors. Besides, we shouldn’t let private parties use a government function for their exclusive benefit.

-

WichitaLiberty.TV: Congressman Mike Pompeo

Congressman Mike Pompeo talks about passing legislation like the Safe and Accurate Food Labeling Act, the Iran nuclear deal and his role in discovering the secret side deals, and other topics.

-

Randall Harris, Utility Manager of Chisholm Creek Utility Authority

Randall Harris, Utility Manager of Chisholm Creek Utility Authority, spoke on the topic “An Overview of the Chisholm Creek Utility Authority.”