Tag: Featured

-

In Kansas, a lost legislative opportunity

Leaders in the Kansas legislature and executive branch tell us the only way to balance the Kansas budget this year is by raising more revenue through taxation. That may be true, as reforming spending and budgeting takes time to accomplish. We had the time. But our legislature and executive branch squandered that opportunity. Now, they…

-

WichitaLiberty.TV: Wichita economic development, Kansas schools and spending, minimum wage

Can we reform economic development in Wichita to give us the growth we need? Kansas school test scores, school spending, and how the Wichita district spends your money. Then, who is helped by raising the minimum wage?

-

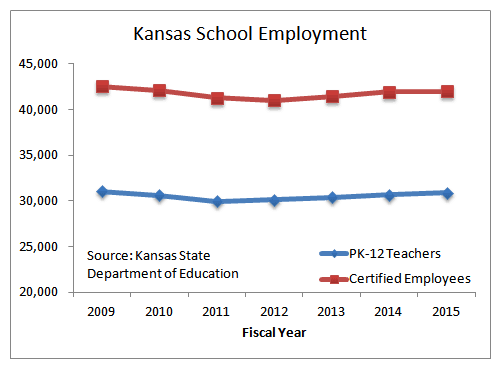

Kansas school employees, the trend

The trend in Kansas public school employment and teacher/pupil ratios may surprise you, given the narrative presented by public schools.

-

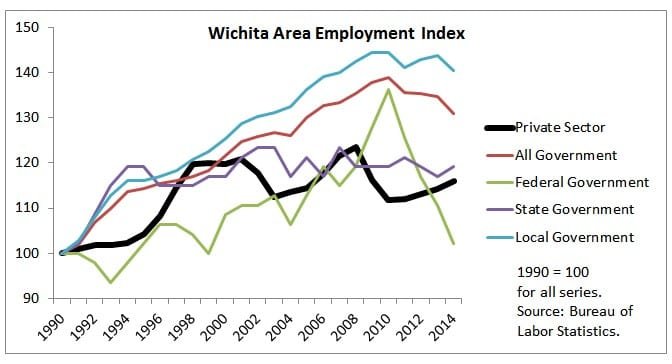

Wichita area job growth

Private sector job growth in the Wichita area is improving, but lags behind local government employment growth.

-

Wichita property tax rates up again

The City of Wichita says that it hasn’t raised its mill levy in many years. Data shows the mill levy has risen, and its use has shifted from debt service to current consumption.

-

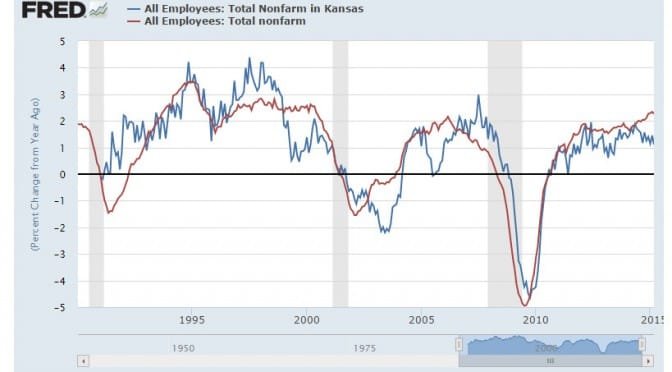

Kansas and U.S. economic dashboard

A collection of charts comparing aspects of Kansas and its economy to the United States.

-

Wichita economic development, the need for reform

An incentives deal for a Wichita company illustrates a capacity problem and the need for reform.

-

WichitaLiberty.TV: Kansas revenue and spending, initiative and referendum, and rebuliding liberty

The Kansas Legislature appears ready to raise taxes instead of reforming spending. Wichita voters have used initiative and referendum, but voters can’t use it at the state level. A look at a new book “By the People: Rebuilding Liberty Without Permission.”

-

Kansas school test scores, an untold story

If the Kansas public school establishment wants to present an accurate assessment of Kansas schools, it should start with its presentation of NAEP scores.

-

More government spending is not a source of prosperity

Kansas needs to trim state government spending so that its economy may grow by harnessing the benefits of the private sector over government.

-

The Kansas revenue problem in perspective

If we take the budgetary advice of a former Kansas state budget official, we need to be ready to accept the economic stagnation that accompanied his boss’s tenure.

-

Efficiency has not come to Kansas government

Kansas state government needs to cut spending, but finds itself in a difficult situation of its own making.